GST & Tax Alerts

May 28, 2025 at 11:53 AM

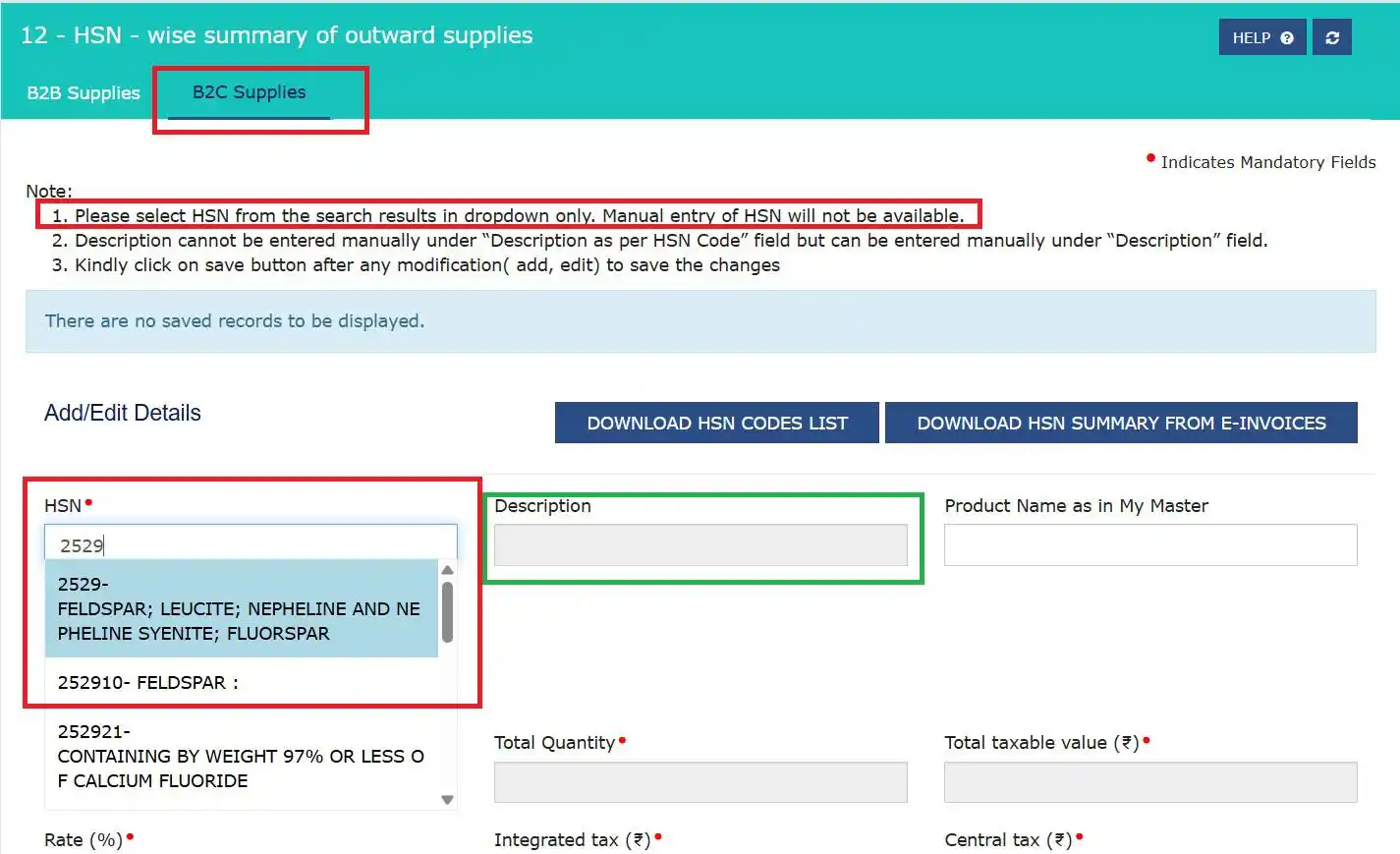

🔔 GSTN Update | HSN Table – Phase 3 Begins from May GSTR-1 - All you need to know!!

📌 Separate HSN reporting for B2B & B2C is now available and mandatory

📌 No Manual HSN entry – dropdown only

📌 Description as per HSN Code (New Field) Auto-Populated from HSN master-Un-editable

➡️Description (already existing field) can be entered Manually

🔖New Validation- B2B values will be validated against B2B HSN & B2C values against B2C HSN-System will issue a warning in case of Mismatch

🔖If value is entered in any B2B Table , then B2B Tab of Table 12 cannot be left empty

Note: Since mentioning HSN in invoices for B2C supplies is not mandatory for taxpayers with ATTO up to ₹5 Cr, reporting same in the HSN table is also not mandatory

👍

❤️

🙏

❤

33