APPSC/ UPSC

June 10, 2025 at 02:57 PM

Virtual digital assets

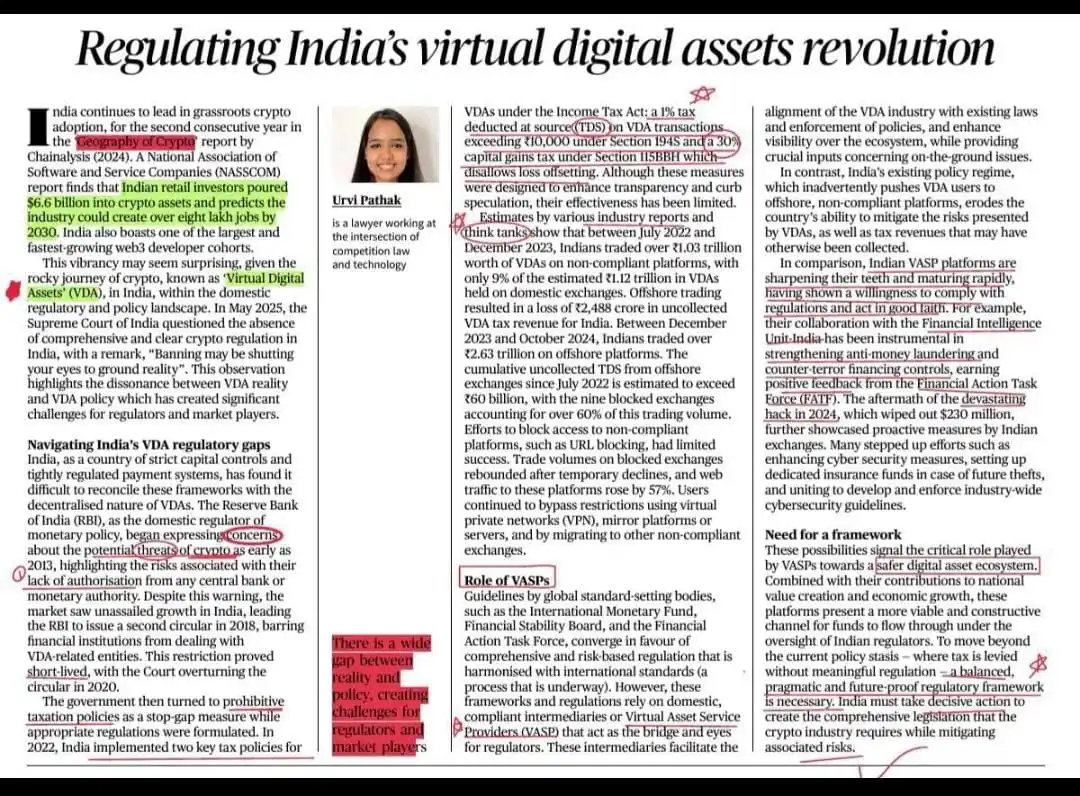

🔆 Key Takeaways: Regulating India’s Virtual Digital Assets (VDA)

✅ India leads in crypto adoption, with retail investors pouring $6.6 billion and predicting 8 lakh jobs by 2030.

✅ Regulatory challenges persist due to gaps between VDA reality and policy.

✅ Two key tax measures introduced: 1% TDS on transactions above ₹10,000 and 30% capital gains tax, with limited offsetting allowed.

✅ Industry reports show Indians traded over ₹1.03 trillion on non-compliant platforms, causing ₹2,488 crore in lost tax revenue.

✅ Virtual Asset Service Providers (VASPs) are crucial for bridging regulators and market players, showing readiness to comply with regulations.

✅ FATF praised India’s anti-money laundering and counter-terror financing efforts post a $230 million crypto hack in 2024.

✅ Calls for a balanced, pragmatic, and future-proof regulatory framework to support a safer digital asset ecosystem and mitigate risks.

#cryptoregulation #digitalassets #vasps #indiacrypto

😢

1