Klath Consultancy Private Limited

June 8, 2025 at 11:27 AM

Changes in ITR-1 and ITR-4

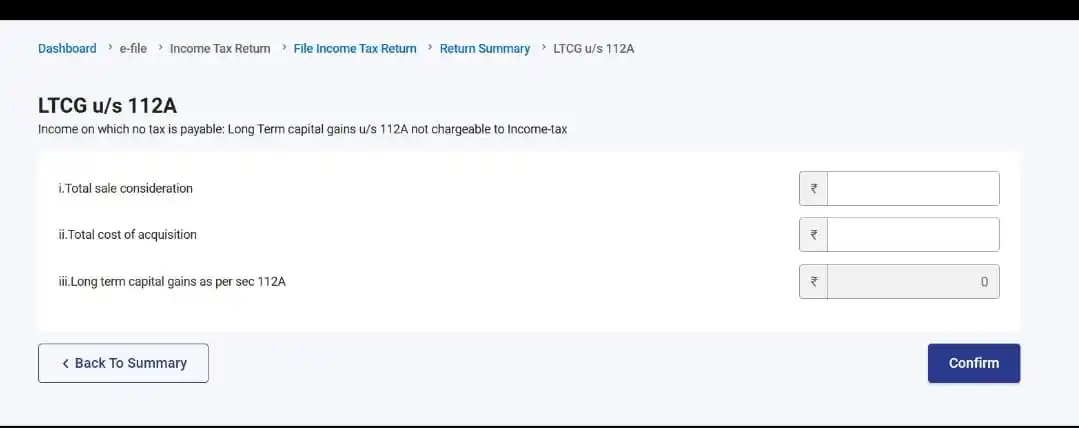

Long-term capital gain extent to exemption is now included in ITR-1 and ITR-4 from Assessment Year 2025-26 and onwards.

It means that long term capital gain more than 1.25 lakh is not included in ITR-1 and ITR-4 only up to 1.25 lakh long term capital gains included in ITR-1 and ITR-4.

#itr2025 #itrfiling2025 #longtermcapitalgains #itr1 #itr4 #klath05 #klath24 #dekhoaccountant #klathconsultancy #klathconsultancyprivatelimited