GJ's Techno Funda ™

May 16, 2025 at 03:26 AM

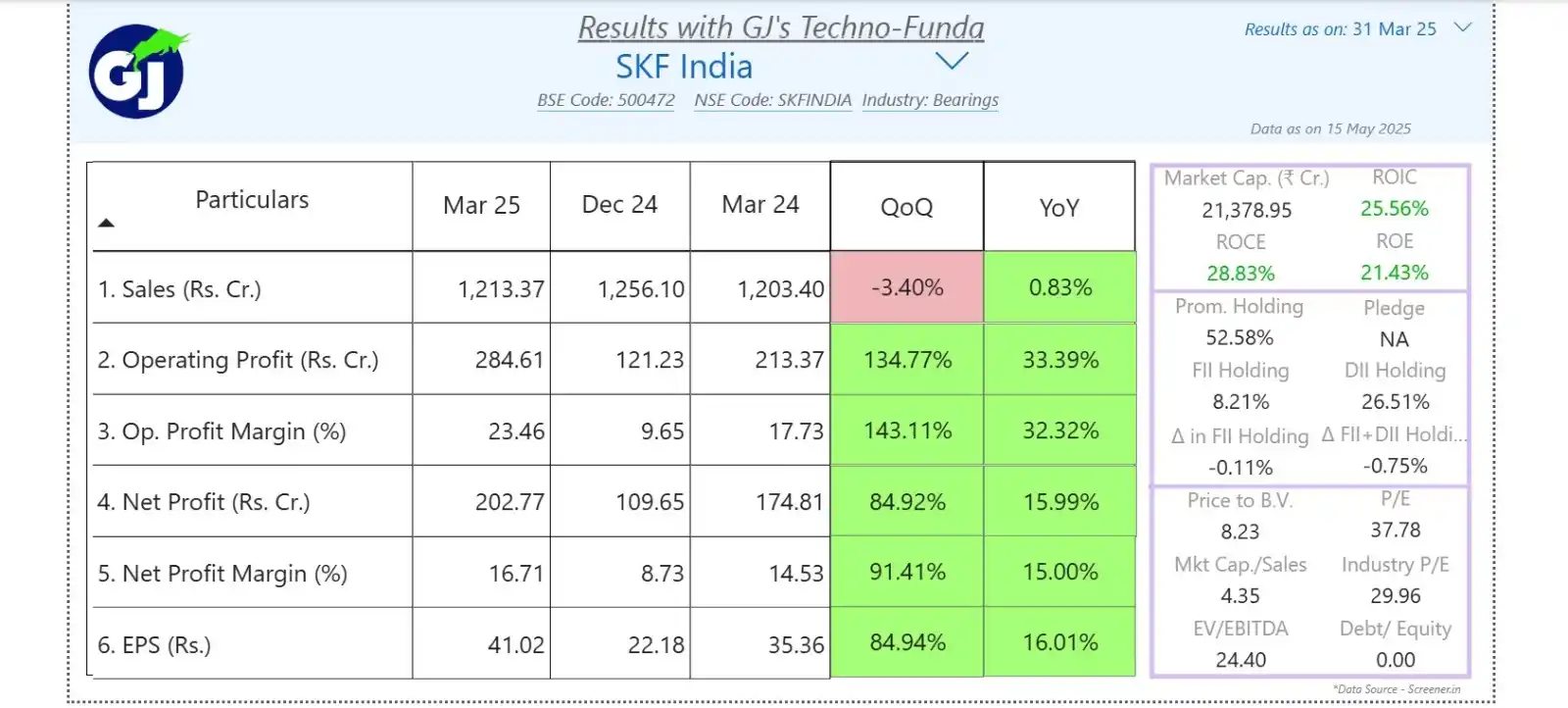

⚙️ SKF India Q4 FY25 Results Breakdown

📅 As of 31 Mar 2025 | Bearings Industry | BSE: 500472 | NSE: SKFINDIA

🔹 Strong Positives 🔹

🚀 Operating Profit up 134.77% QoQ – Major jump in efficiency

📈 Op. Profit Margin soars to 23.46% (vs. 9.65% last quarter) – Up 143.11% QoQ

💰 Net Profit up 84.92% QoQ and 16% YoY – Strong bottom-line growth

🧮 EPS jumps 84.94% QoQ to ₹41.02 – Strong earnings momentum

🔸 Positives 🔸

✅ YoY Operating Profit up 33.39% – Sustainable improvement

✅ ROCE: 28.83% | ROE: 21.43% – Healthy capital efficiency

✅ Debt-Free Company (D/E = 0.00) – Financially sound

✅ Net Profit Margin at 16.71% – Up 91.41% QoQ

✅ Promoter holding at 52.58% – Solid ownership structure

🔻 Negatives 🔻

📉 QoQ Revenue down 3.40% – Slight decline in top-line

📉 FII Holding dropped by 0.11% | Combined FII+DII down 0.75% – Weak institutional sentiment

⚠️ High EV/EBITDA (24.40) and P/E (37.78) – Premium valuation compared to industry (P/E 29.96)

📊 Investor Takeaway:

SKF India delivers exceptional profitability and margin expansion, though revenue softness and high valuation metrics suggest cautious optimism. Strong fundamentals, but watch the pricing.