First Capital Trading Insights

June 12, 2025 at 11:55 AM

*First Capital Research | Daily Equity Watch | 12 Jun 2025*

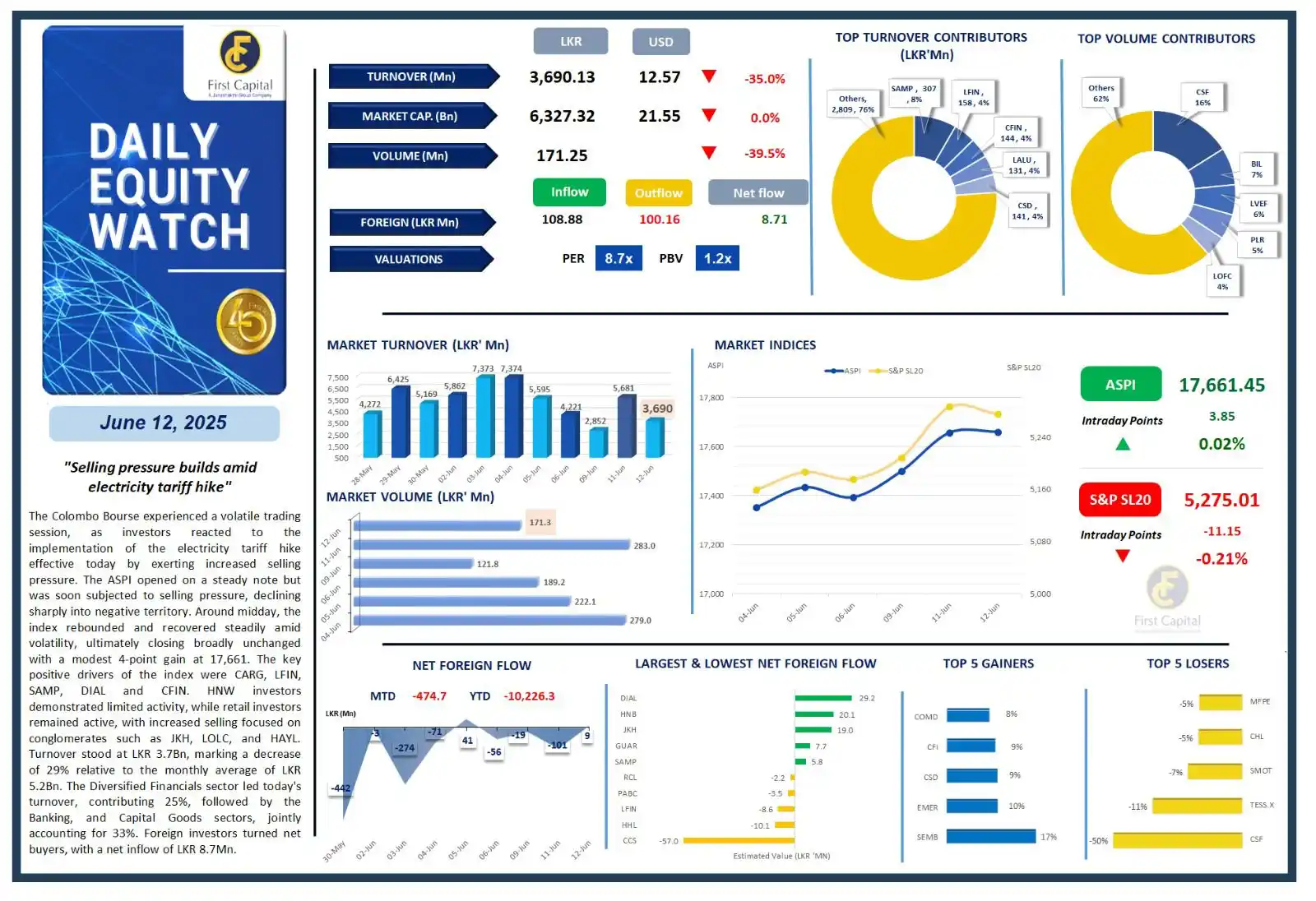

*"Selling pressure builds amid electricity tariff hike"*

The Colombo Bourse experienced a volatile trading session, as investors reacted to the implementation of the electricity tariff hike effective today by exerting increased selling pressure. The ASPI opened on a steady note but was soon subjected to selling pressure, declining sharply into negative territory. Around midday, the index rebounded and recovered steadily amid volatility, ultimately closing broadly unchanged with a modest 4-point gain at 17,661. The key positive drivers of the index were CARG, LFIN, SAMP, DIAL and CFIN. HNW investors demonstrated limited activity, while retail investors remained active, with increased selling focused on conglomerates such as JKH, LOLC, and HAYL. Turnover stood at LKR 3.7Bn, marking a decrease of 29% relative to the monthly average of LKR 5.2Bn. The Diversified Financials sector led today's turnover, contributing 25%, followed by the Banking, and Capital Goods sectors, jointly accounting for 33%. Foreign investors turned net buyers, with a net inflow of LKR 8.7Mn.

*-First Capital Research-*