Target Sarl

May 23, 2025 at 04:30 PM

_*#african # Insurance*_

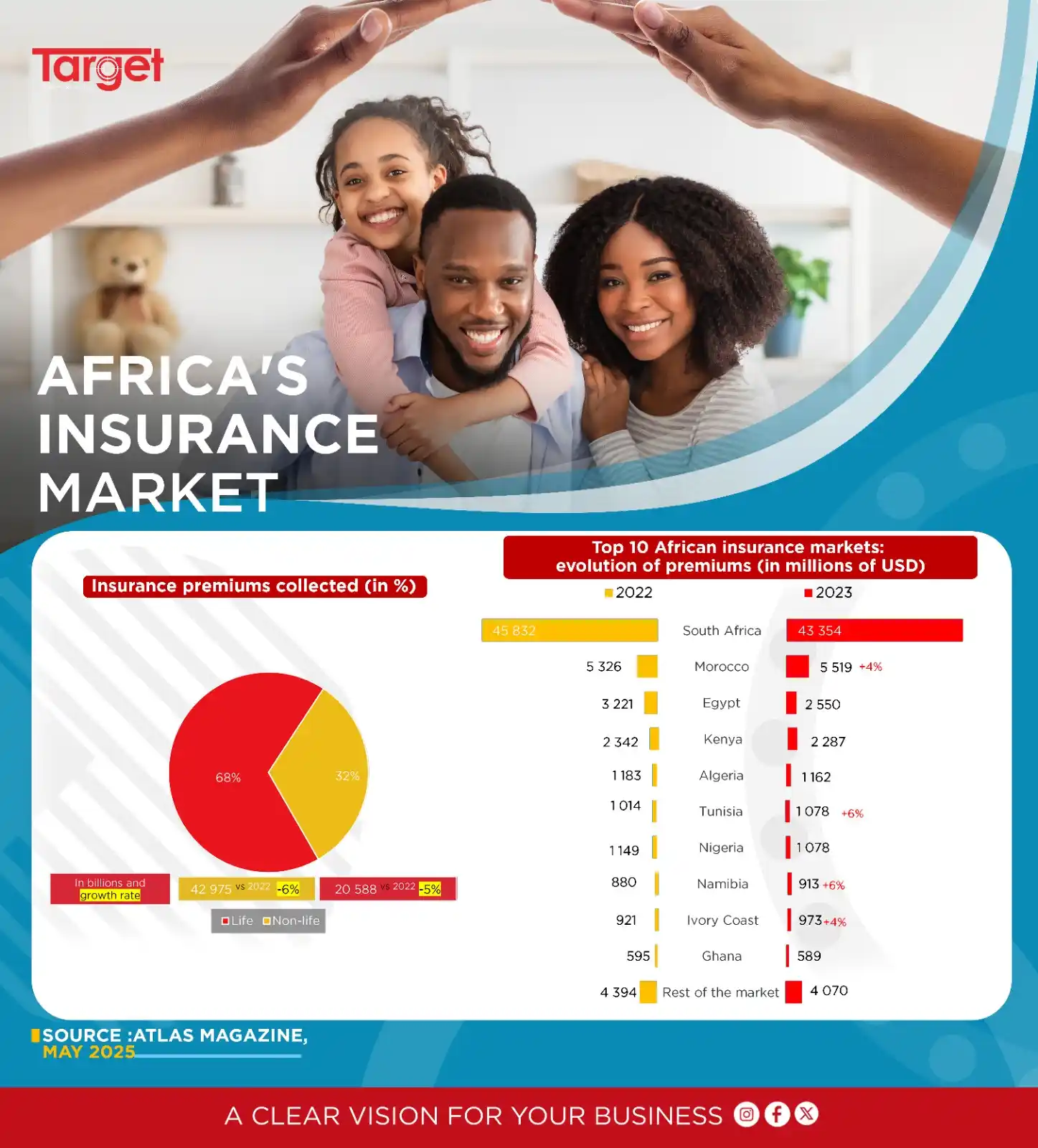

In 2023, the African insurance market experienced an overall decline in premiums collected, dropping from USD 67.3 billion in 2022 to USD 63.6 billion—a regression of 5.5%. This contraction is primarily attributed to a decrease in life insurance premiums, which fell by 6% year-on-year to USD 42.975 billion.

The distribution between life and non-life insurance continues to favor life insurance, which accounted for 68% of total premiums collected, compared to 32% for non-life insurance.

At the national level, South Africa remains the market leader, with premiums totaling USD 43.354 billion in 2023, despite a year-on-year decline of 5.4%. In contrast, countries such as Morocco, Tunisia, Namibia, and Côte d'Ivoire have shown positive momentum, posting growth rates ranging from +4% to +6%, reflecting the dynamic expansion of their insurance sectors. Conversely, markets like Egypt, Kenya, Algeria, Nigeria, and Ghana are witnessing stagnation or decline.

Lastly, the “rest of the market” segment—which includes countries outside the top 10—continues to contract, with premiums falling from USD 4.394 billion to USD 4.070 billion. This trend underscores the high concentration of the African insurance market around a limited number of dominant economies.

*_https://x.com/Target_SARL/status/1925944370982728148_*

❤️

1