*TATTVA Realty & Infra - Leading Real Estate Investment Destination*

June 16, 2025 at 08:17 PM

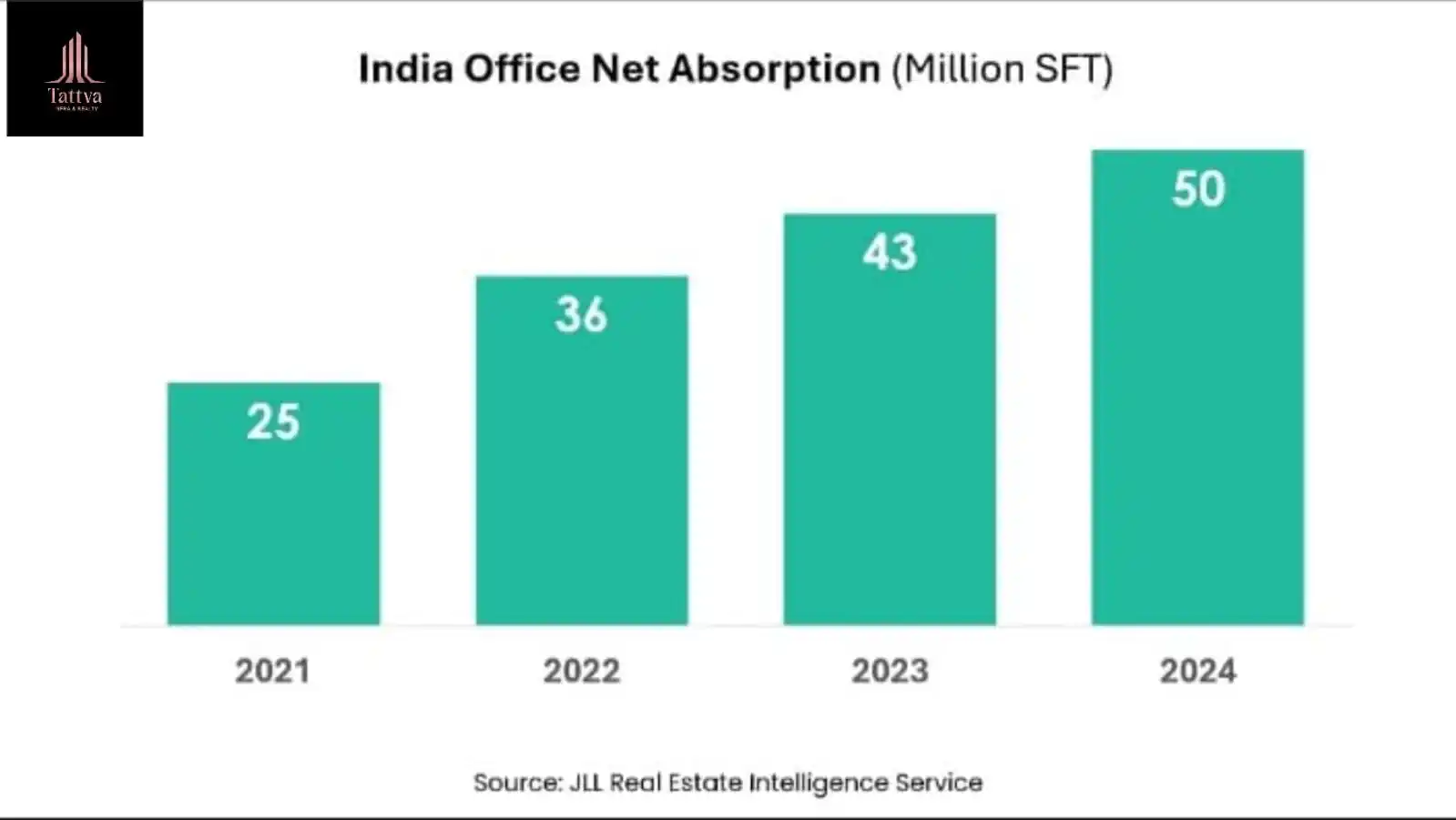

The chart shows a national trend of increasing office space absorption in India, and this certainly has significant implications for key metro markets like Hyderabad. Here's a focused analysis on how this trend likely impacts Hyderabad:

📍 Impact on Hyderabad Office Market

1. Riding the National Momentum

Hyderabad has consistently ranked among the top 3 cities in India for office absorption alongside Bengaluru and Pune.

The increase in national net absorption from 25M SFT in 2021 to 50M SFT in 2024 suggests Hyderabad is capturing a larger share of demand, especially from tech, pharma, BFSI, and GCCs (Global Capability Centers).

💼 Demand Drivers in Hyderabad

IT/ITeS Growth: Gachibowli, Hitec City, and Financial District continue to attract large tech occupiers.

Startups & GCCs: Hyderabad is a preferred destination for MNCs setting up capability centers due to lower costs and quality infrastructure.

Hybrid Work Readjustment: Firms are increasing office footprint post-pandemic, benefiting Hyderabad due to its affordable Grade A spaces.

🏗️ Supply and Vacancy Dynamics

New supply is coming up in West Hyderabad, particularly large campuses and SEZs.

Vacancy levels, while moderate, are expected to decline due to pre-commitments by large occupiers.

Rental values in micro-markets like Gachibowli and Nanakramguda are likely to see a moderate upward trend as demand strengthens.

📈 Forecasted Impact

🔍 Bottom Line

Hyderabad is well-positioned to benefit from India's office space absorption boom, particularly in the Grade A segment. The city will continue to be a key destination for both domestic and global occupiers looking for scalable, affordable, and high-quality office infrastructure.

👍

2