What'sFin? with KhushJ✨

235 subscribers

About What'sFin? with KhushJ✨

Heyy Everybody 🙋🏻♂️, This is CS KhushJ and by this channel, I won't be posting the reaction or review kind of videos revolving around the CS 😄😀 Here we will talk about Finance, Taxation and Law and much more. So why not connect? Connect with me to learn about the Finance in a easy peasy way direct on your WhatsApp Messenger with one fresh post every Tuesday and Friday💫. Query? Drop a mail @ [email protected] #i'm nt a SEBI Reg'd RA & Anything & Everything posted here, is only for Educational purpose only.

Similar Channels

Swipe to see more

Posts

Heyy Team, We'll resume back shortly, Stay connected. Thanks, KhushJ.

*When to exactly Buy & Sell the Shares?* Some1 asked. Simply saying, When a particular Share rises rapidly & solely, owing to some news. It's an *indication* of "Overbought". One should avoid such Stocks/Companies, in this case. Vice-versa when a particular stock falls basis those news, it *can be said to be* "oversold" and could be regarded as a great buy. *Nt an Invstmnt Advice* *Appropriate analysis always suggested.* That was all for Today. Thank you for Reading.✨ Found insightful? Share it with some1 who may need it. This is KhushJ & I'm on leave until the next post.

The Answer will be Neutral saving. (I forgot to Add the 3rd option). * Since no IT uptill 12L, * Mr X shall save the whole of it, by way of a Rebate. * Now Mr Y should ideally be paying 67.5K in Tax, since his Income exceeds the spf'd threshold & be end up saving only 11,82,500. * But here comes MR to his rescue. So What is Rebate¹ & MR² exactly?

Finally CS, it is. Grateful to every1 around. Dhanyawaad ✨

¹Rebate:- No IT uptill 12L or 12.75L (if salaried) but it shall be calculated from the scratch (of course past the Basic Exemption Limit of 4L) if the Income exceeds the previously prescribed threshold. ²MR:- Marginal Relief is the Tax relief from the additionally earned Income, which is just slightly beyond 12L only uptill 12.75L. [ Here the Additionally earned Income will be treated as Tax & the Tax won't be calculated from the scratch.] Example:- If the Income is 12.50L, the Additionally earned 50K would be fully be termed as "Tax to be paid" unlike 67,500 which would have been paid, had there been no MR. (Forgot to add the 3rd option, it'll be equal saving). That was all for Today. Thank you for Reading.✨ Found insightful? Share it with some1 who may need it. This is KhushJ & I'm on leave until the next post.

* The Union Budget 2k25 shall be presented tomorrow. * The Stk Mkt shall remain open tomorrow unlike closed on normal weekends. * Will try sharing insights on the Budget.

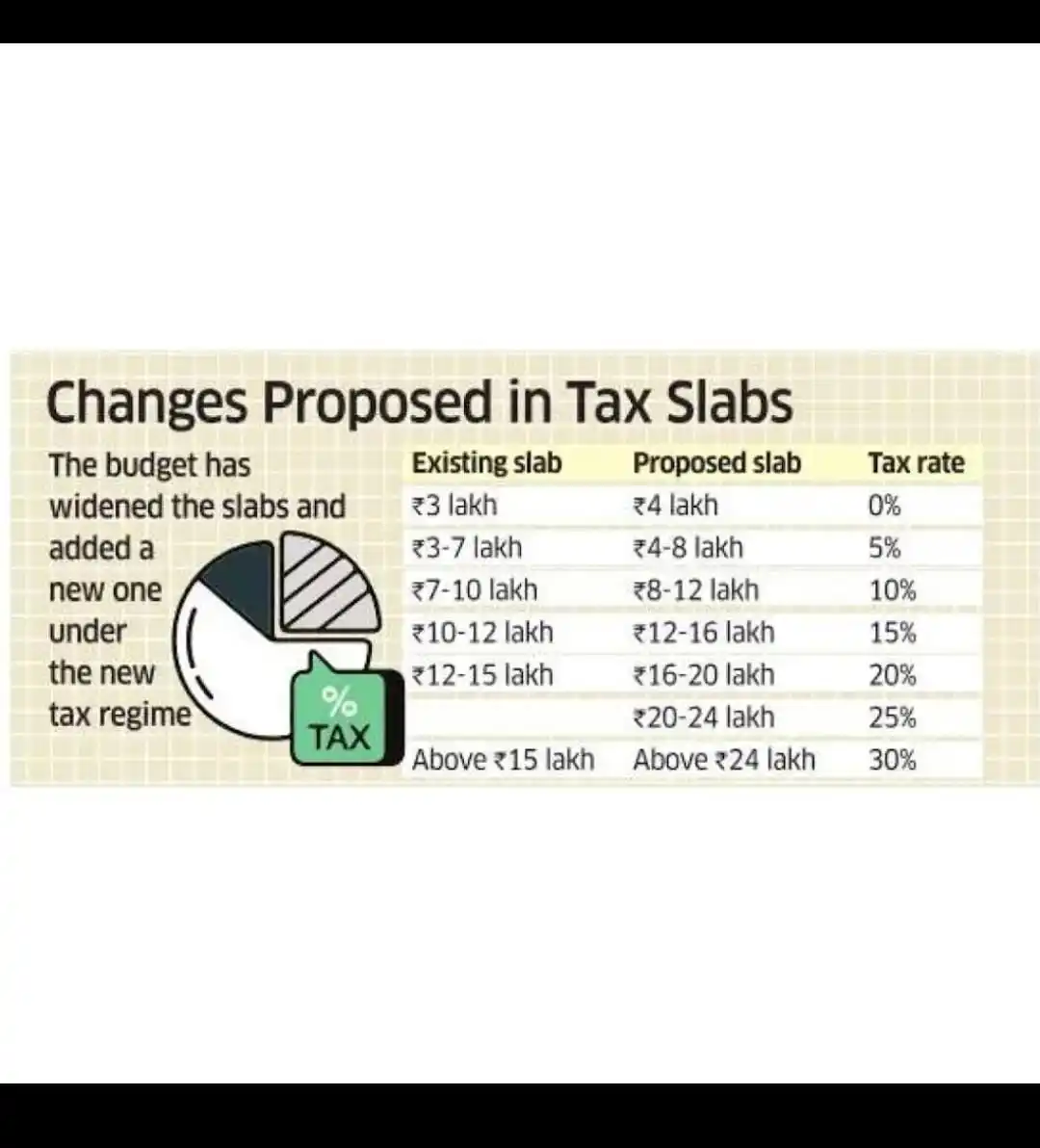

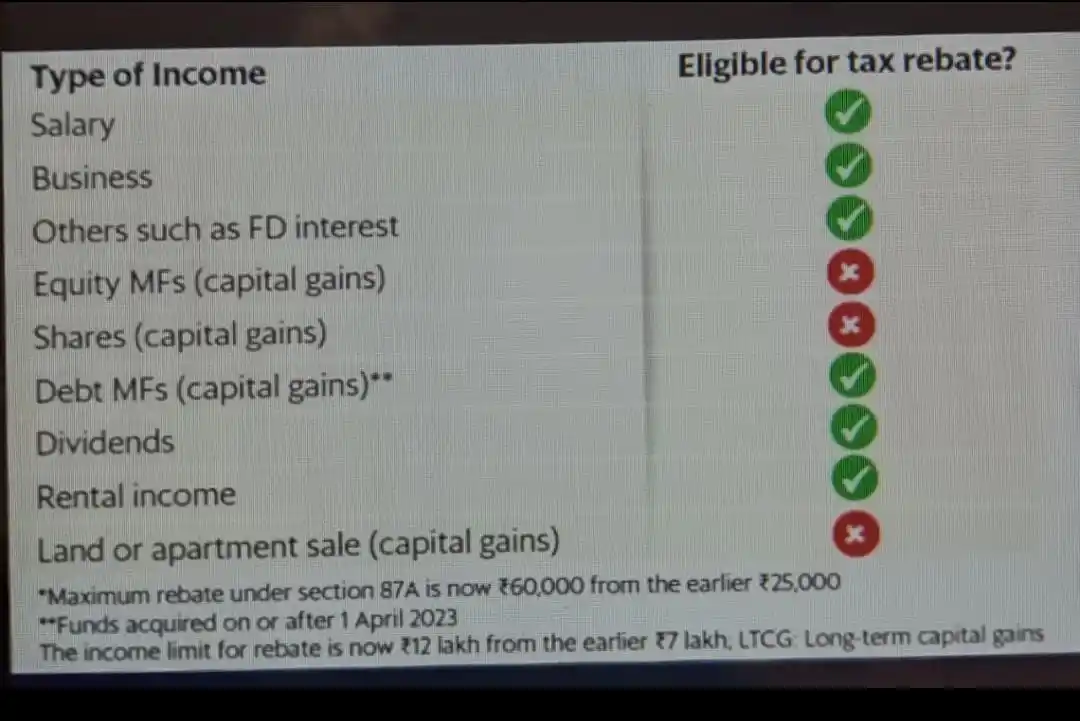

*Key Budget Highlights, that matters.* Heyy Folks, 1st of All, I would like to apologise for not lately. But here we go once again, I tried understanding & explaining the key elements of recent budget, do go through it once. *Read it till the End to find "What is Rebate & MR" too.* *DT Updates* * Kisan Cr Card (KCC) limit increased from 3L to 5L. [Farmers to hv more money to spend on Agro]. * Increased classification criteria for MSMEs. * India Post in Focus [Direct competition to Delhivery and others]. * No income tax up to 12L via rebate¹ (additional 75K for salaried individuals). * Marginal Relief (MR¹) for income up to 12.75L. * Up to 10L can be remitted under the Liberalised Remittance Scheme (LRS) without RBI approval (primarily used for foreign travel & similar purposes). * No TCS on foreign remittances for education (good for foreign going students). * No TDS for Sr citizens earning Interest (other than on securities, since dealt seperately) upto 1L. * Startups reg'd w/i the next 5 years (uptill 2030) can pay "zero tax" on profits for any 3 consecutive years within the initial 10 years of incorporation. *IDT Updates* * No GST reg'n req'd up to a threshold of 50L for goods and 25L for services unless compulsory. [ Earlier it was 40L & 20L respectively]. * Reduced import costs for essential medicines. ¹Rebate:- No IT uptill 12L or 12.75L (if salaried) but it shall be calculated from the scratch (of course past the Basic Exemption Limit of 4L) if the Income exceeds the previously prescribed threshold. ²MR:- Marginal Relief is the Tax relief from the additionally earned Income, which is just slightly beyond 12L only uptill 12.75L. [ Here the Additionally earned Income will be treated as Tax & the Tax won't be calculated from the scratch.] Example:- If the Income is 12.10L, the Additionally earned 10K would be fully be termed as "Tax to be paid" unlike 61,500 which would have been paid, had there been no MR. That was all for Today. Thank you for Reading.✨ Found insightful? Share it with some1 who may need it. This is KhushJ & I'm on leave until the next post.

*UPI & Overspending: Is Cashless making us Careless?* Have you noticed your spending increasing especially since the demonetization in 2016? You’re not alone. The Unified Payment Interface (UPI) has made it so easy to spend money that we often don’t realize how quickly it’s leaving our pocket. *Why Are We Overspending?* The very obvious reason is, UPI which allows instant payments, making transactions feel effortless. Add to that is, The new Rupay Card UPI which lets us use credit cards, allowing us to spend money we don’t even have. This convenience can & is leading us to overspend and sometimes fall into debt. *Impulse Buying: A New Norm:* The phenomenon of impulse buying has also become more prevalent. With the fear of missing out (FOMO) driving many purchases, we often find ourselves buying things on a whim rather than sticking to a budget. *So, How can we have an Anchor over our spending?* Here are some simple ways to manage your finances better: * *Open Multiple Accounts*: Use separate A/cs' for salary, savings, Emergency Funds¹ & everyday spending. * *Unlink Your Main Account*: Disconnect your primary A/c from UPI to limit easy access to funds. * *Keep Low Balances*: Maintain a low balance (1-2k) in your UPI-linked A/c to control spending. * *Disable Auto-Pays*: Turn off unnecessary Auto-pays. * *Set a Weekly Budget*: Have a weekly budget, to not overspend. * *Track Your Spendings*: atleast once a month, to improve. * *Plan Purchases*: Avoid impulse buying by planning your purchases in Advance. * *Use Cash for Small Purchases*: Pay with cash for minor expenses like Tea & Snacks to become more aware of your spending. By implementing these tips, we can take charge of our finances in a world where spending is all too easy. ¹ You can read our earlier post, to know more about What are the Emergency Funds & why do they matter. That was all for Today. Thank you for Reading.✨ Do share, if found insightful. This is KhushJ & I'm on leave until the next post.