What'sFin? with KhushJ✨

February 16, 2025 at 04:40 PM

*Key Budget Highlights, that matters.*

Heyy Folks, 1st of All, I would like to apologise for not lately.

But here we go once again,

I tried understanding & explaining the key elements of recent budget, do go through it once.

*Read it till the End to find "What is Rebate & MR" too.*

*DT Updates*

* Kisan Cr Card (KCC) limit increased from 3L to 5L. [Farmers to hv more money to spend on Agro].

* Increased classification criteria for MSMEs.

* India Post in Focus [Direct competition to Delhivery and others].

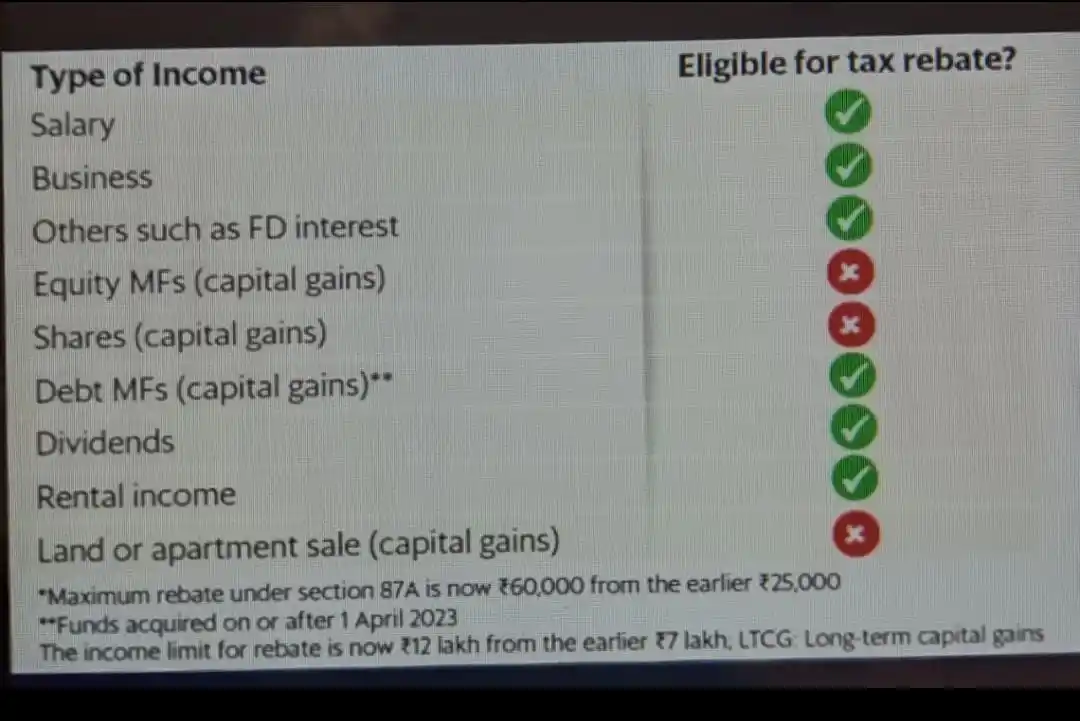

* No income tax up to 12L via rebate¹ (additional 75K for salaried individuals).

* Marginal Relief (MR¹) for income up to 12.75L.

* Up to 10L can be remitted under the Liberalised Remittance Scheme (LRS) without RBI approval (primarily used for foreign travel & similar purposes).

* No TCS on foreign remittances for education (good for foreign going students).

* No TDS for Sr citizens earning Interest (other than on securities, since dealt seperately) upto 1L.

* Startups reg'd w/i the next 5 years (uptill 2030) can pay "zero tax" on profits for any 3 consecutive years within the initial 10 years of incorporation.

*IDT Updates*

* No GST reg'n req'd up to a threshold of 50L for goods and 25L for services unless compulsory. [ Earlier it was 40L & 20L respectively].

* Reduced import costs for essential medicines.

¹Rebate:- No IT uptill 12L or 12.75L (if salaried) but it shall be calculated from the scratch (of course past the Basic Exemption Limit of 4L) if the Income exceeds the previously prescribed threshold.

²MR:- Marginal Relief is the Tax relief from the additionally earned Income, which is just slightly beyond 12L only uptill 12.75L. [ Here the Additionally earned Income will be treated as Tax & the Tax won't be calculated from the scratch.]

Example:- If the Income is 12.10L, the Additionally earned 10K would be fully be termed as "Tax to be paid" unlike 61,500 which would have been paid, had there been no MR.

That was all for Today.

Thank you for Reading.✨

Found insightful? Share it with some1 who may need it.

This is KhushJ & I'm on leave until the next post.