P Chhajed & Co LLP

133 subscribers

About P Chhajed & Co LLP

A Chartered Accountancy Firm with more than 14 years of expertise in various domains including Direct Taxation, GST, International Taxation, FEMA, Auditing, Accounts, Company Law, Project Finance, Subsidy, Bookkeeping for offshore clients etc. Professionally managed firm with qualified team. Assuring best in timely compliance, expert advisory and core litigation services. Assisting clients in different state of India including Gujarat, Maharashtra, Punjab, Haryana, Delhi, Karnataka, Rajasthan, Madhya Pradesh etc. and offshore clients of USA, Canada, Singapore. You may join us on our social media as below; - WhatsApp Community : https://shorturl.at/ajoOP - WhatsApp Channel : https://shorturl.at/hswN5 - Instagram : https://www.instagram.com/pchhajed_ca/ - LinkedIn : https://www.linkedin.com/company/capchhajed/ - Twitter / X : https://twitter.com/capchhajed - Facebook : https://www.facebook.com/cachhajed - Website : https://www.pchhajed.com/ Contact details: Mobile and Whats app - +91-9265885020 Landline - +91-79-48490128 Email - [email protected]

Similar Channels

Swipe to see more

Posts

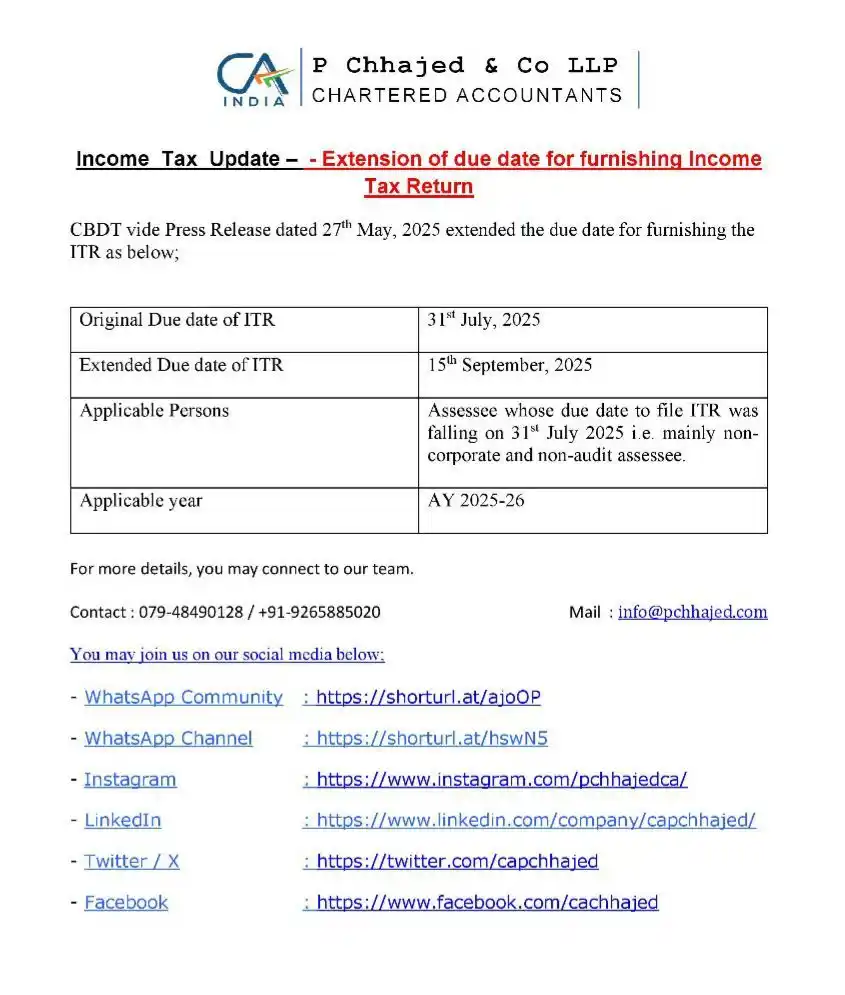

#IncomeTax_Update 📢 Important Update: ITR Filing Deadline Extended The Central Board of Direct Taxes (CBDT) has extended the due date for filing Income Tax Returns for FY 2024-25 (AY 2025-26) from July 31 to September 15, 2025. This extension accommodates significant revisions in ITR forms, system updates, and TDS credit reflections, ensuring a smoother filing experience for taxpayers. Brief Summary of the same is annexed herewith. Please utilize this additional time to gather necessary documents and file your returns accurately. For assistance or queries, feel free to reach out.

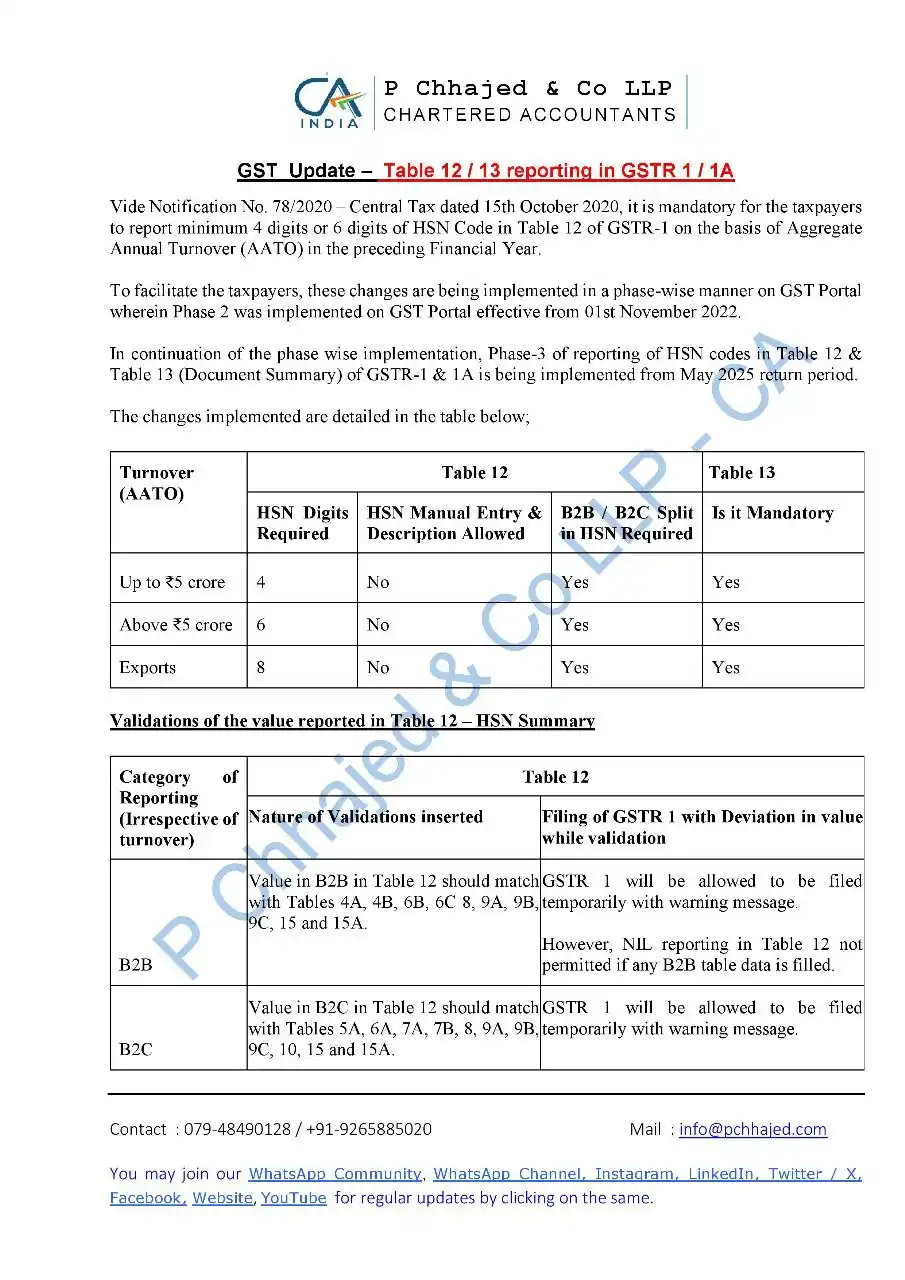

#GST_Update *Mandatory HSN and Document Summary Reporting in GSTR-1 / 1A from May 2025* We have prepared a comprehensive summary outlining the latest rules and requirements for HSN code and Document Summary reporting in GSTR-1 / 1A, effective from the May 2025 return period. Key Highlights: 🔹 HSN code reporting is now mandatory for both B2B and B2C supplies based on turnover thresholds. 🔹 Manual entry of HSN codes is no longer permitted; selection from the GST portal dropdown is required. 🔹 Table 13 reporting is now compulsory alongside Table 12 in GSTR-1. 🔹 Non-compliance may attract consequences.

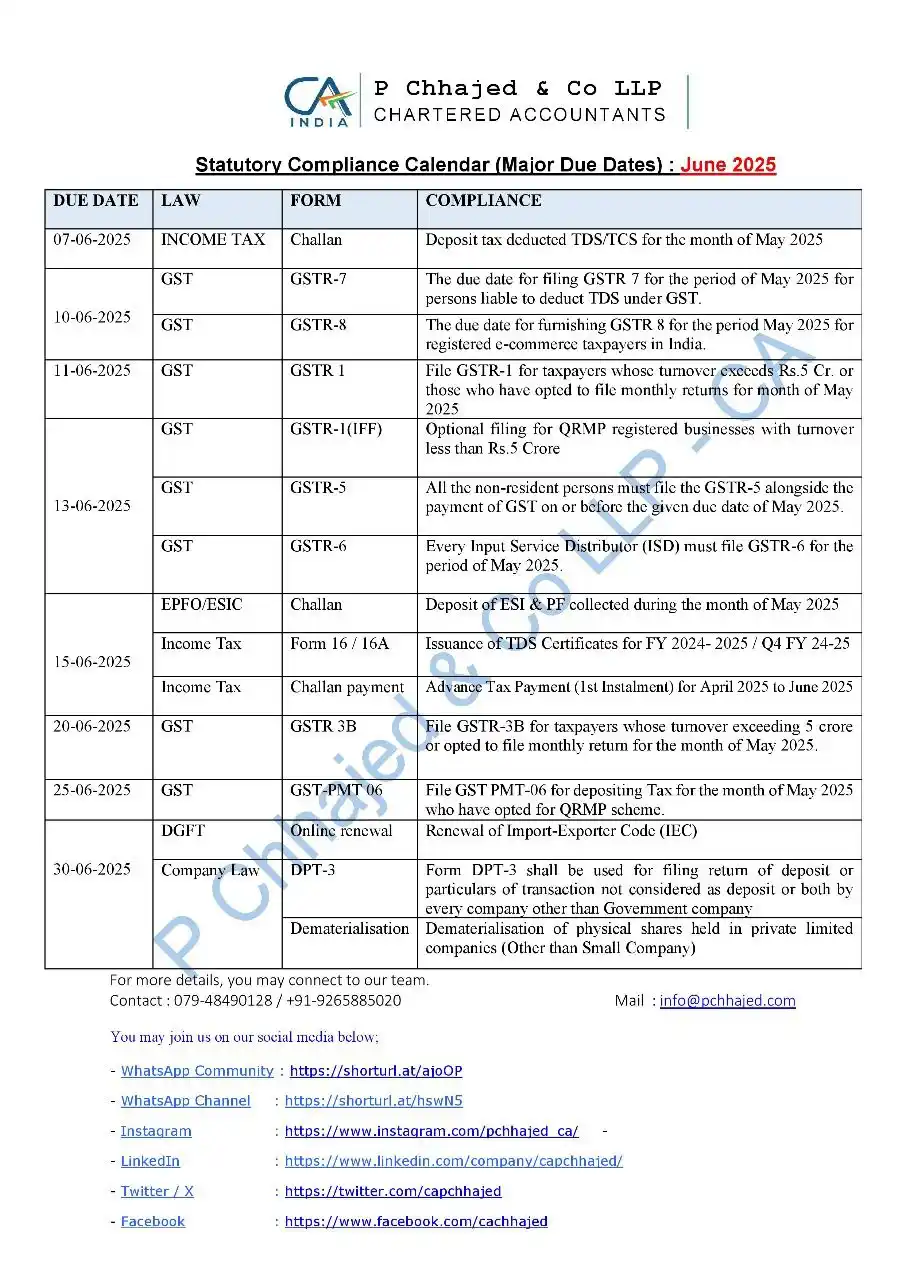

Dear Readers, Kindly find the attached compliance calendar for the month of June 2025. It contains the major statutory due dates as applicable. Hope you will find it useful and it may save you from unnecessary interest / late fees and penalty. You may join us on social media with the links in the attachment.

🚀 Union Budget 2025 – Key Taxation Insights: The Union Budget 2025 brings significant Income Tax & GST reforms, impacting individuals, businesses, and the economy. Some of the major highlights include: 🔹 Revision in the limits for MSMEs. 🔹 New Income Tax bill to be proposed in this week on the table of the House. 🔹 Income Tax Updates ✅ Changes in tax slabs & rebates under the new tax regime - Relief to Middle Class persons ✅ Extended time limits for filing updated returns ✅ Revised TDS/TCS provisions for better compliance ✅ Change in set off and carry forward provisions in case of Amalgamations / Merger ✅ Proposal aiming at Charitable Institutions and Trust ✅ Introduction of Block Concept in case of Transfer Pricing Provisions ✅ Proposals aiming at reducing the litigations ✅ Proposals aiming at Start Up and IFSC ✅ Many more.. 🔹 GST ✅ ITC distribution updates for ISDs ✅ Introduction of track & trace mechanisms for supply chains ✅ "Plant or Machinery vs. "Plant and Machinery ✅ Additional Burden in case of issuance of credit note for reduction of outward supply tax liability. ✅ Change in Pre-Deposit criteria for order levying Penalty without levying tax. ✅ Change in Schedule III of the GST law. ✅ Many more.. This budget sets the stage for growth, compliance simplification, and digital transformation in taxation. 📌 Stay informed—download the full report or connect with us to discuss the key takeaways. The complete presentation can be accessed at https://shorturl.at/g8fKx

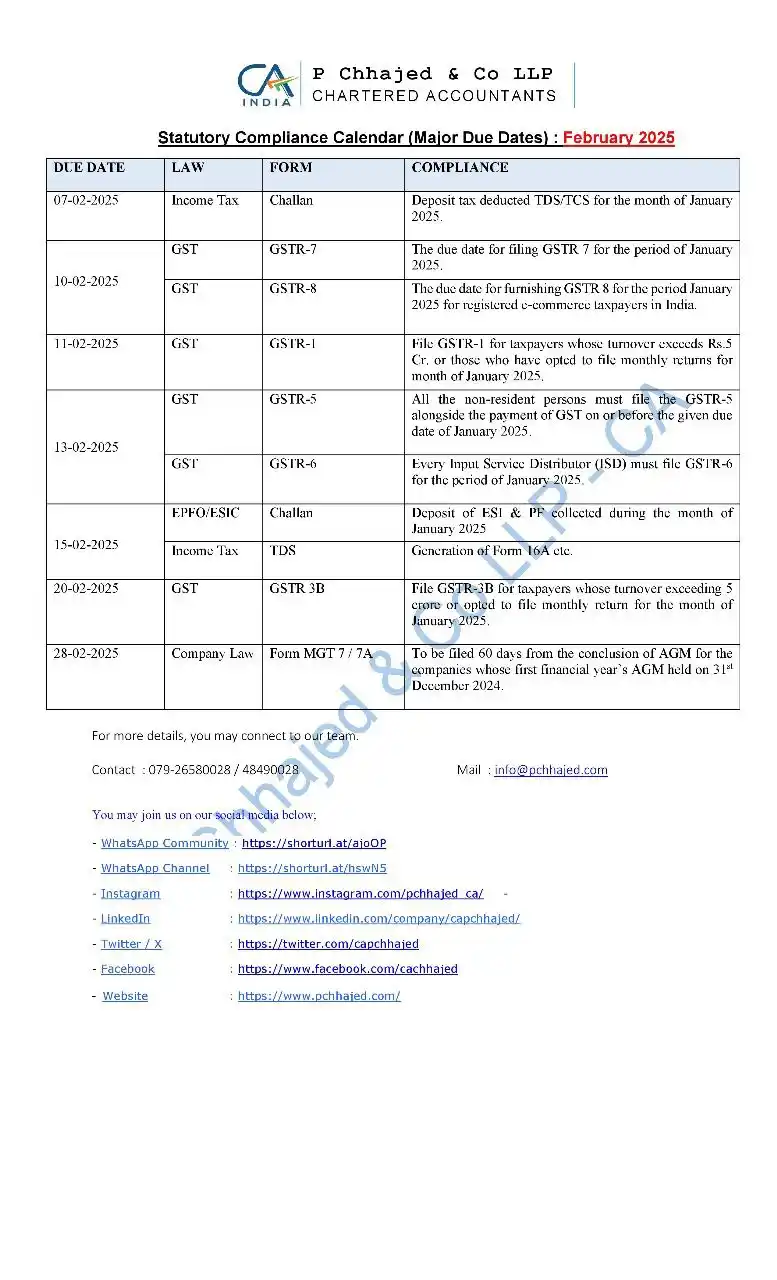

Dear Readers, Kindly find the attached compliance calendar for the month of February 2025. It contains the major statutory due dates as applicable. Hope you will find it useful and it may save you from unnecessary interest / late fees and penalty.

🚀 *Thinking of Starting a Business? January to March is the BEST time to register!* ✨ Why? 1️⃣ 15+ Months to file your first financials! 2️⃣ Longer First Financial Year to plan & grow. 3️⃣ First AGM? No rush! Deadline: Dec 31, 2026 if incorporated during Jan-March 2025. ⚠ Note: These benefits are under Company Law. Income Tax? Same timeline—April 1 to March 31! 💡 Start smart. Stay compliant. For a short and instant WA conversation, click on https://shorturl.at/KEWrp

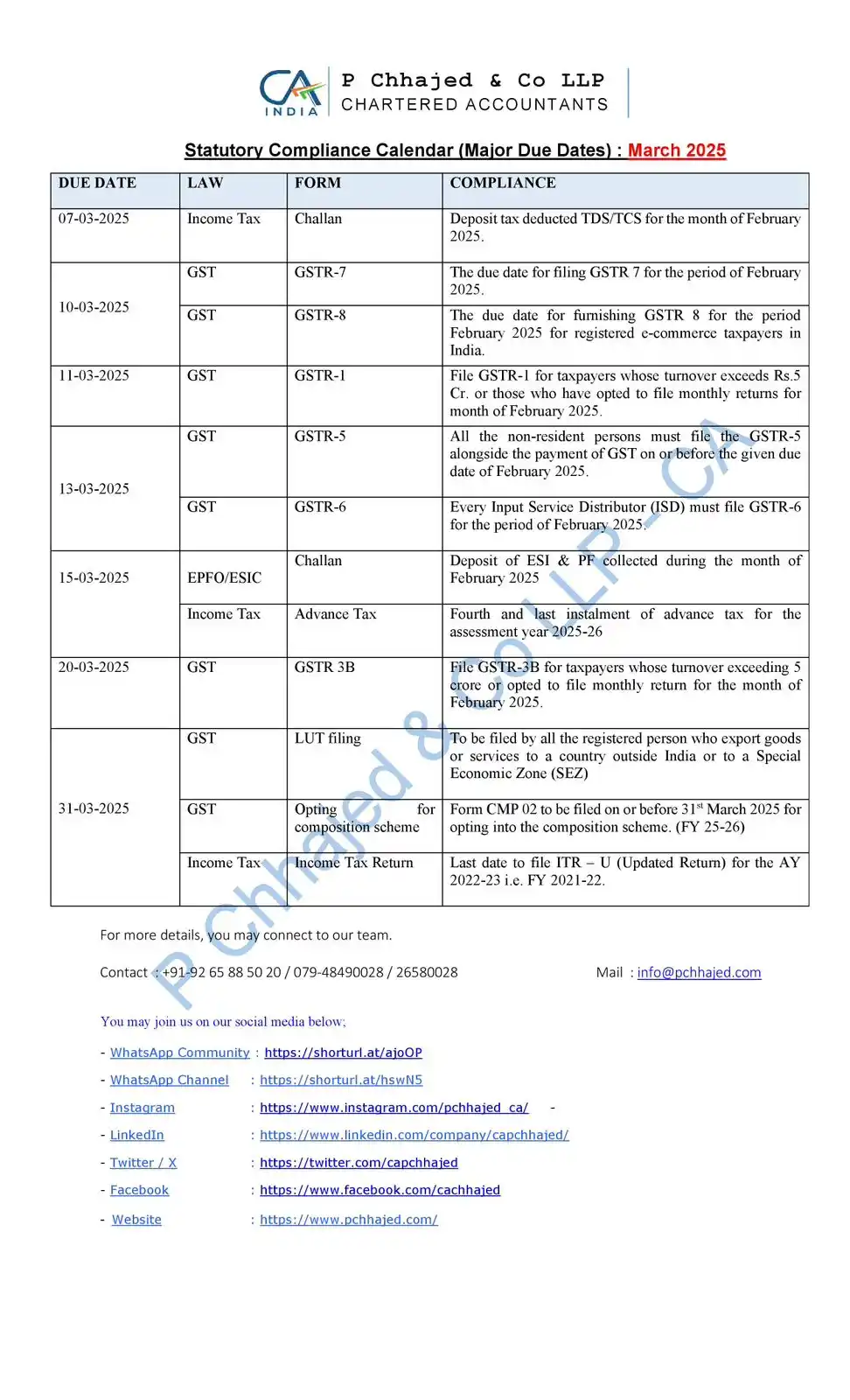

Dear Readers, Kindly find the attached compliance calendar for the month of March 2025. Our team P Chhajed & Co LLP - Chartered Accountants summarized the major statutory due dates as applicable. This month will be very crucial in terms of various due dates viz. Last installment of Advance Tax under GST, Filing of declaration by the persons who are supplying services as GTA under GST etc. Hope you will find it useful and it may save you from unnecessary interest / late fees and penalty. You may join us on social media with the links in the attachment.