P Chhajed & Co LLP

May 29, 2025 at 08:40 AM

#gst_update

*Mandatory HSN and Document Summary Reporting in GSTR-1 / 1A from May 2025*

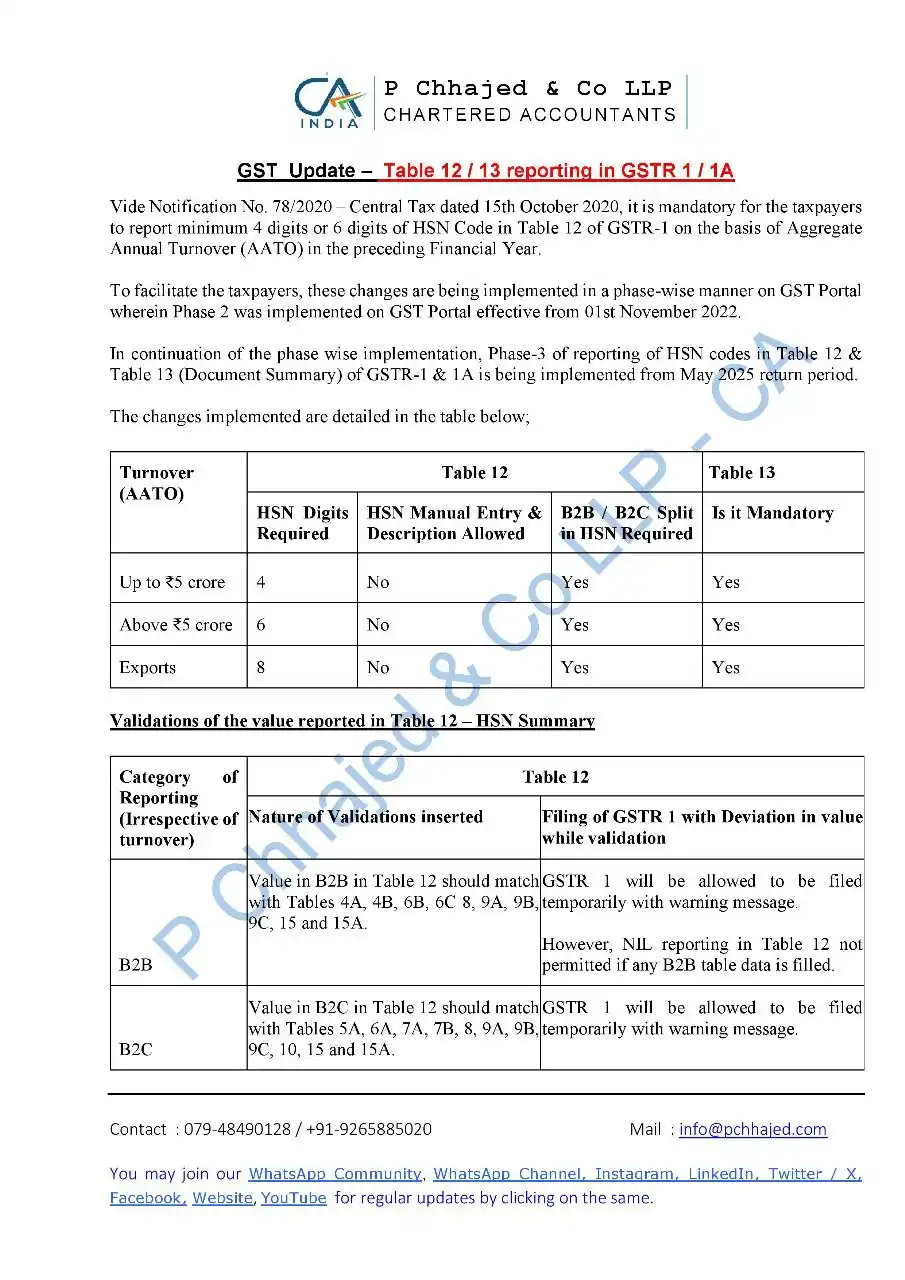

We have prepared a comprehensive summary outlining the latest rules and requirements for HSN code and Document Summary reporting in GSTR-1 / 1A, effective from the May 2025 return period.

Key Highlights:

🔹 HSN code reporting is now mandatory for both B2B and B2C supplies based on turnover thresholds.

🔹 Manual entry of HSN codes is no longer permitted; selection from the GST portal dropdown is required.

🔹 Table 13 reporting is now compulsory alongside Table 12 in GSTR-1.

🔹 Non-compliance may attract consequences.