rethink P2P (English)

38 subscribers

About rethink P2P (English)

P2P Lending News by rethink P2P

Similar Channels

Swipe to see more

Posts

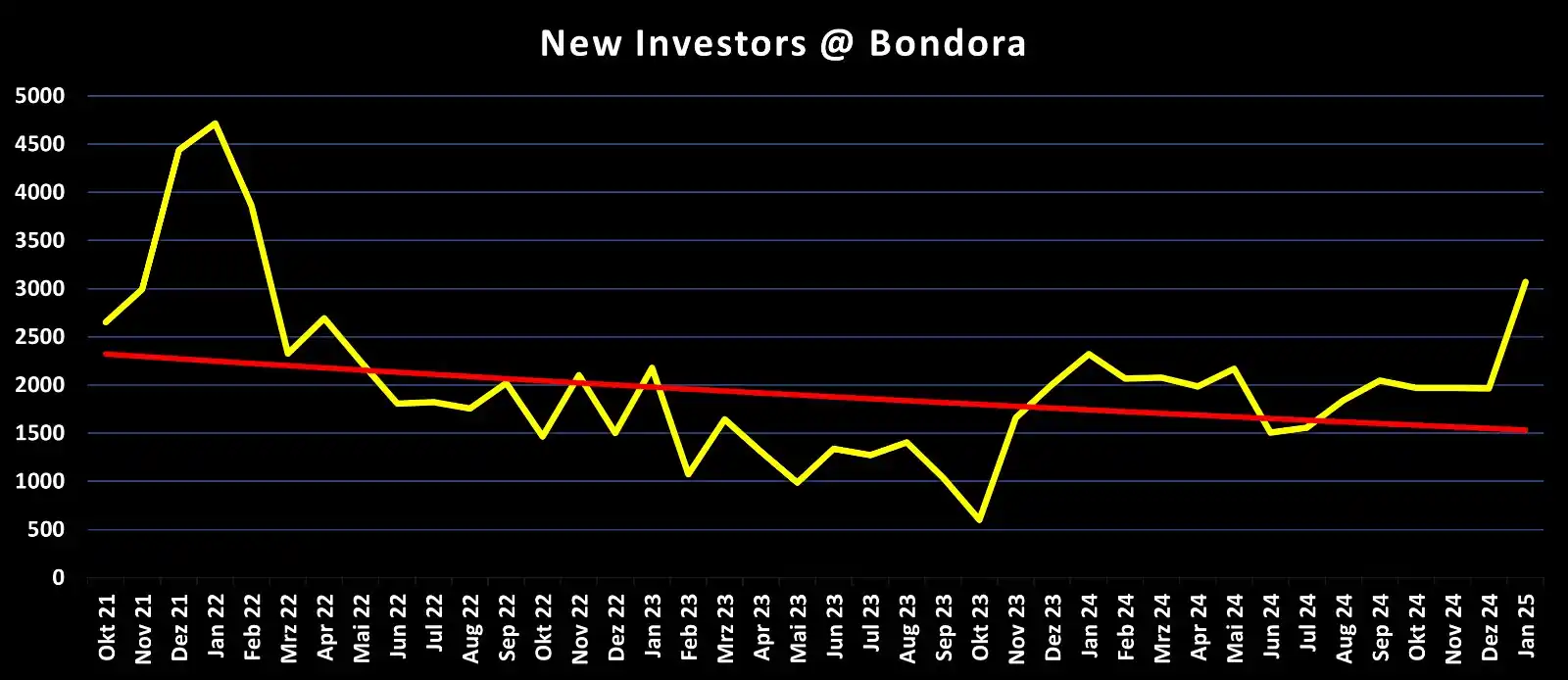

*Growing Demand @ Bondora Go & Grow!* Was it the New Year's resolutions in January? The decreasing interest rate environment? Or the fact that #Bondora has extended the removal of the deposit limit until at least the end of March? Whatever the reason may be, the popularity of Bondora Go & Grow is growing again. In January alone, 3,071 new investors have joined the Estonian P2P platform. The last time that more investors have registered on a monthly basis has been in February 2022, almost three years ago. *Bondora Go & Grow Review + 5 Euro Bonus:* https://rethink-p2p.de/en/bondora-go-and-grow-review/

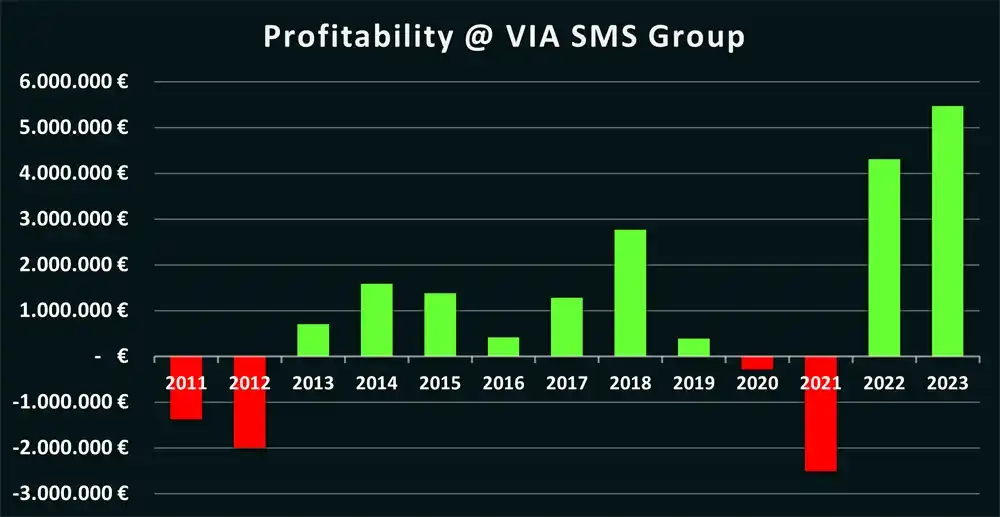

*Evaluation of VIA SMS Group Annual Report 2023* Nothing is older than yesterday’s newspaper. Except for the Viainvest annual report from the year before last (2023). After reviewing the numbers, here are the key takeaways: *Profitability* Viainvest achieved a record profit of EUR 5.4 million in 2023. With the exception of the COVID years (2020 and 2021), the company has been consistently profitable over the past decade. Hats off! *Balance Sheet* Viainvest regularly distributes dividends to its shareholders, which means that while the balance sheet figures are presentable, they are not outstanding either. For instance, EUR 6.7 million was distributed in 2023, leading to a EUR 1.6 million decrease in equity. Despite the record profit of EUR 5.4 million. • The equity ratio stands at a reasonable 10%. • The liquidity ratio is at 1.12, which is also acceptable. • The debt ratio has recently increased to 9.28, driven by a rise in short-term liabilities. *My Criticism* Despite these solid numbers, some issues bother me as well: 1. While other platforms have already presented provisional results for 2024 (such as Debitum), Viainvest takes more than a year to publish outdated figures. 2. The annual report contains multiple inaccuracies or errors. The reported short-term liabilities for 2022 don’t make sense, nor do the equity change timelines. 3. The notes explaining individual financial positions are missing from the report. If investors are forced to wait this long, then a complete and logically consistent annual report shouldn’t be too much to ask for. *Viainvest Review + Bonus:* https://rethink-p2p.de/en/viainvest-review/

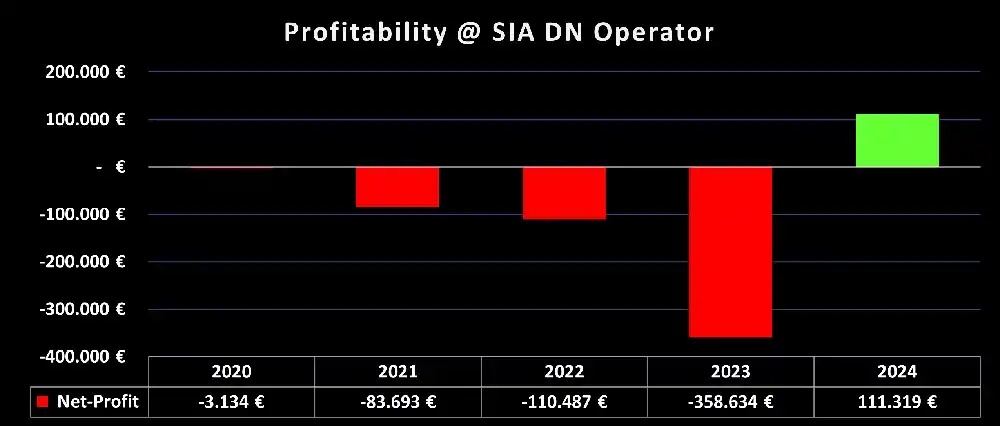

*Debitum Annual Report 2024* A few days ago, #Debitum published its business figures for 2024. According to the report, the Latvian P2P lending platform managed to reach profitability for the first time on an annualised basis with a profit of EUR 111,000. While revenue has almost quadrupled to EUR 1.3 million, the level of expenses has only increased moderately – despite rising expansion costs. SIA DN Operator's balance sheet has also improved significantly compared to the previous year. The equity ratio stands at a solid 53%, the liquidity ratio at 1.79, and the debt-to-equity ratio has decreased for the third consecutive year (0.88). Subject to an audited financial report, which is expected to follow in Q2/2025 from Grant Thornton, these are strong and healthy figures that pave the way for financially sustainable growth. *Debitum Review + Bonus:* https://rethink-p2p.de/en/debitum-review/

*Sandbox Funding: The Secret behind Debitum's biggest Lender!* Sandbox Funding, in some cases known as ‘Blackbox Funding’, makes up for 75% of the outstanding portfolio on #Debitum Investments, which is why the lender is currently the biggest and the most important pillar on the Latvian marketplace. For this reason, the background story of Sandbox Funding deserves a closer look. Hence, my latest article deals with Sandbox’ origin story, how it operates, its financial performance and the question how much of a “Black Box” the lender really is. *Blog Article:* https://rethink-p2p.de/en/debitum-sandbox-funding/

*Income Insights #14: What happens in 2025?* Today, a new episode of the #Income Insights podcast came online. In episode #14, I spoke with Income CEO Lavrenti Tsudakov about the targets and the outlook for 2025. A few interesting statements emerged during our discussion: 1) By the end of 2025, Income aims to manage a portfolio of 35 to 40 million euros. This would not only double their portfolio but also achieve profitability on a monthly basis. 2) To reach their AUM target, six (!) new lenders are expected to join the marketplace this year alone. Currently, the marketplace is in the final stages of onboarding two car-leasing companies from Lithuania and Kosovo. 3) Income will launch a crowdfunding campaign in the coming months, aiming to raise 250,000 euros. The funds will be used to hire new employees and introduce a secondary market. We also discussed other topics such as the ClickCash repayments, platform regulation, and the growth of institutional investors. *Tune in on YouTube:* https://www.youtube.com/watch?v=kehsg9VwOk8

*Danarupiah Numbers for 2024!* Last week, the Indonesian lender Danarupiah published its consolidated, but not yet audited, business figures for 2024. At first glance, the numbers look extremely strong! According to the report, a profit of EUR 14.1 million was achieved, while the revenue increased to EUR 25.5 million and the equity position stands at EUR 36.2 million (equity ratio: 68%). Hence, all important KPIs have improved compared to the previous year. I will therefore maintain my high exposure level in Danarupiah assets (EUR 7,800). *Income Review + Bonus:* https://rethink-p2p.de/en/income-marketplace-review/

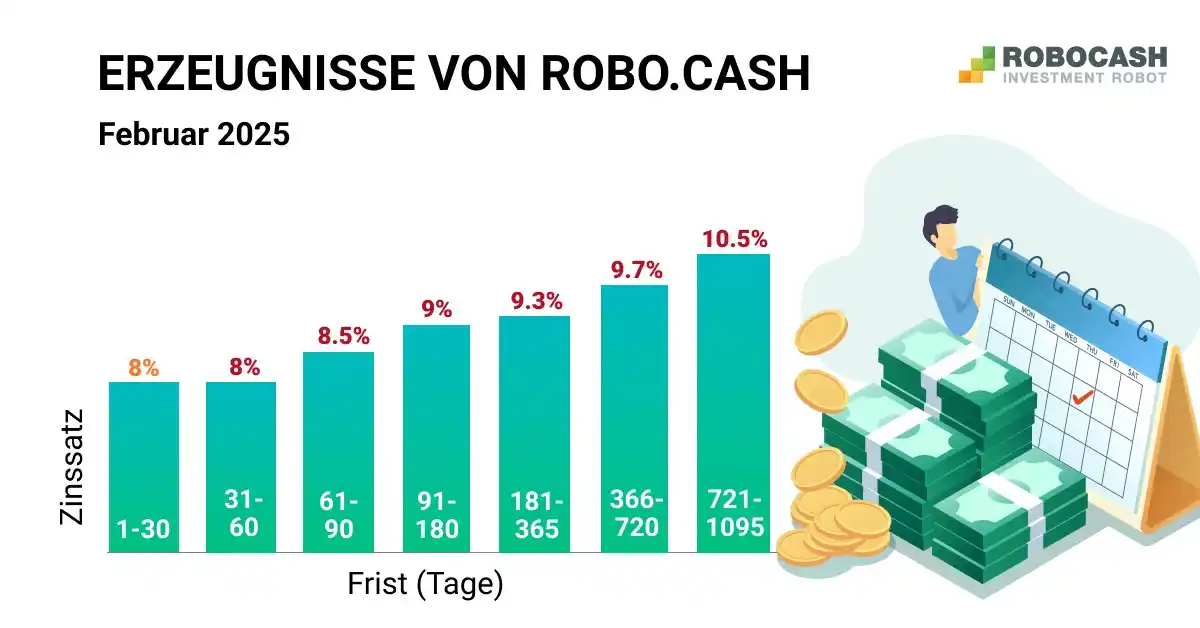

*Robocash Lowers Interest Rates!* After PeerBerry, Crowdpear and Esketit, also #Robocash is now adjusting its interest rates downwards. The new range, which will come into effect on 10 February, will be between 8% and 10.5%. The reason given for this is the growing demand from investors, which significantly exceeds the supply of loans on the platform. Looking at the numbers though, also the lender profitability will have been an important factor. Since Q2/2024, the portfolio under management has fallen from EUR 85 million to now EUR 78 million. *Robocash Review + Bonus:* https://rethink-p2p.de/en/robocash-review/

*LFDF: New lender on Debitum!* With the „Latvian Forest Development Fund“ (LFDF), #Debitum has onboarded the first new lender of the year. *What is Behind the LFDF?* The LFDF connects small landowners with institutional buyers such as SODRA and IKEA. The fund acquires forest land (typically between 10 and 50 hectares), manages the timber harvest, undertakes land management, export, legal structuring and then sells it in large-scale transactions. The LFDF has already acquired 2,600 hectares of forest land and successfully sold 800 hectares. The average margin is said to have been 35% per transaction. *What are the Conditions?* The first EUR 400,000 from LFDF have already been uploaded to the platform. The interest rates were between 10% and 12%, while the terms were between 6 and 18 months. In the coming days and weeks, I will be familiarising myself a little more with the topic and will be happy to carry out a sandbox funding-style analysis if you are interested. *Website of LFDF:* https://www.lfdf.eu/ *Debitum Review + Bonus:* https://rethink-p2p.de/en/debitum-review/