Rajneesh Jha (Financial Wellness)

695 subscribers

About Rajneesh Jha (Financial Wellness)

CEO at Vitta Capital | Wealth Management for HNI and UHNI. I have a proven track record of delivering optimal solutions and investment strategies for my clients, based on their goals, risk profiles, and preferences. Hit the Bell 🔔 Icon and Save our No - 9560314594

Similar Channels

Swipe to see more

Posts

Praying for the family who were in flight AI 171 🙏🕉️💔 At least 170 people confirmed dead in Air India crash. Boeing share price plunges by over 6.5% in pre-market trading after 787 Dreamliner crashes in Gujarat, India. -242 Passengers were on Board.🥲💔

*📈🔺Oil prices soar over 12% after Israel strikes Iran, fuelling supply jitters* Geopolitical complexities have dramatically increased and will hurt the world economically. It's going to get a lot more messy, it seems.

*🚀 Every Wealth Journey Has 3 Stages:* 1️⃣ Struggle Phase → ₹0 to ₹1 CR 😓 2️⃣ Breakthrough Phase→₹1 to ₹10 CR 3️⃣ Compounding Magic → ₹10 to ₹100 CR+ ✨ Most people never cross Stage 1. Not because they lack income — but because they lack a strategy. We’re changing that. Starting NOW. 👇 *🎯 Mission: 500 Investors from 0 to ₹1 Crore+ in 5 Years* Your journey from ₹0 to ₹1 Cr starts with a simple decision — to stop guessing and start planning. ✅ Powered by Mutual Funds ✅ Goal-based + Risk-Managed ✅ Backed by the unstoppable India growth story 🇮🇳 💥 Go Equity. 💥 Go Aggressive. 💥 Go Safe. 💥 Go India. 📈 The longer you stay invested, the stronger the magic of compounding becomes. 💡 Investing isn’t a one-time action. It’s a mindset. A process. A second income. 📆 Regular reviews. Tactical entries. Focused goals. Real alpha. This is not a “one-tip” game. This is a lifetime wealth strategy. If you want to grow with India’s multi-decade bull run… If you want to treat investing like a real wealth-building engine… 📩 DM me “I’m In” to start your journey toward ₹1 Cr+ Let’s create wealth, not just returns. Let’s build freedom, not just portfolios. Message - 9560314594

*📈 Bull Run 2.0 Loading… 🐂* *It’s Time to Increase Your SIPs 💸 ❓* The Indian Stock Market is gearing up for a massive multi-year rally — and the signs are crystal clear. *Here’s why India is the ultimate bull case right now 👇 Read Detailed Thread 🧵* https://x.com/rajneesh__jha/status/1932465655049318768?s=46 🔵 1. Mutual Fund Mania – Retail Power Unleashed! 🇮🇳 India’s Mutual Fund AUM hit a record ₹72.2 lakh crore! 💰 SIP Inflows at ALL-TIME HIGH: ₹26,000+ crore/month 🚀 Retail investors are no longer spectators — they’re leading the game. 🟡 2. RBI Turns Dovish – Cheap Money Era Returns 🏦 Repo rates at multi-year lows ➕ Back-to-back cuts expected 🏗️ Easy credit = more capex + more jobs + higher consumption 💸 Liquidity is flowing → Fuel for economic and stock market expansion 🟣 3. Tax Relief = Higher Disposable Income 📉 0 tax on income up to ₹12 lakh (New Tax Regime) 👨👩👧👦 Middle class is saving more, investing more, spending more 💸 More SIPs, more retail activity, more demand! 🟢 4. GST Collection Breaking Records 📊 May 2025 GST: ₹2.01 lakh crore (3rd time crossing 2 lakh mark!) 📈 16.4% YoY growth — shows strong economic momentum 🧱 Indicates formalisation + rising consumption 🔴 5. India: The Fastest Growing Major Economy 🌏 While the world slows, India runs — IMF projects 6.8–7.2% GDP growth 🇺🇸 US facing possible recession, high interest rates 💡 Global capital is rotating to India — better risk-adjusted returns ⚫ 6. Global De-Risking = ‘China + 1’ = India Win 🏭 Companies are de-risking from China → Setting up in India 📦 Logistics, warehousing, EVs, semiconductors — huge inflows 🚢 Exports poised to hit record highs over next 3 years. 🟤 7. Crude Oil Correction = India’s Gain 🛢️ Brent crude below $80 = lower import bills 💸 India will save ₹2 lakh+ crore this year on oil alone 📉 Reduced CAD + stable rupee = Strong macro support. 🔶 8. Mega Infra Boom Underway 🛤️ ₹11 lakh crore+ allocation to infra in Union Budget 🏗️ Ports, railways, roads, airports — capex at record scale 🚚 Last-mile delivery costs falling → Boost to business margins ⚪ 9. Defence & Space = New Frontiers for Growth 🚀 India is doubling down on indigenization 🔫 Big orders flowing to Indian firms (HAL, BEL, etc.) 🌌 Space startups + tech defence = sunrise sectors for next decade. 💡 Other Bullish Triggers: ✅ Corporate Profits as % of GDP climbing again ✅ UPI dominance & digital banking penetration = financial inclusion ✅ Stable political regime = policy continuity ✅ FII confidence returning with heavy inflows in 2025 ✅ INR depreciating slowly = better returns in USD terms

*🚨 US Plans 5% Tax on Remittances by Immigrants – Big Blow to Indian NRIs ❓* A new bill proposed by US House Republicans could levy a 5% excise tax on all remittances sent by non-citizens — including: 🧑💻 H-1B holders 🎓 F-1 visa students 🟩 Green card holders *Why ❓* To plug US fiscal deficits, fund Trump-era tax cuts & curb immigration flows. *💸 Why This Is a Big Deal for Indian-Americans & NRIs* *🇮🇳 India = World's #1 Remittance Receiver* $125 Billion in 2023 $33.2 Billion came just from the US (27%) That’s ~1% of India’s GDP! Now imagine — 🧾 5% tax = $1.66 Billion (~₹14,175 Cr) Just for sending money home! *📉 How It Impacts NRIs & Indian Economy* 🏡 NRI Families: Lower monthly income for parents, education, medical bills Less money to invest in Indian real estate, mutual funds, startups *🌍 Indian Economy:* States like Kerala, Punjab, Maharashtra could see a dip in consumption Real estate and capital markets may lose a key inflow Multiplier effect = ₹20,000–₹25,000 Cr economic hit *📢 NRI Investors: Time to Act Smart!* If you’re planning: ✔️ To invest in property ✔️ To send money for family ✔️ Or to park funds in Indian markets This may be your last tax-free window! 👉 Use NRI-compliant investment routes 👉 Make sure all remittances follow RBI & FEMA guidelines 👉 Stay tuned — this is still a proposal but gaining traction *📌 You can reach out to us on WhatsApp:- +919560314594* We will help you to explore the best Investment options to Growth your wealth. The US wants to tax your connection to home. Are you prepared ❓ 📍Read Here :- https://www.linkedin.com/posts/rajneeshjha-_nritaxalert-usindiapolicy-remittancetax-activity-7328720459263369216-LmEc?utm_medium=ios_app&rcm=ACoAAB9VxpMBzJ92bL33q8yfMNCBZzouBCdN3Ug&utm_source=social_share_send&utm_campaign=copy_link

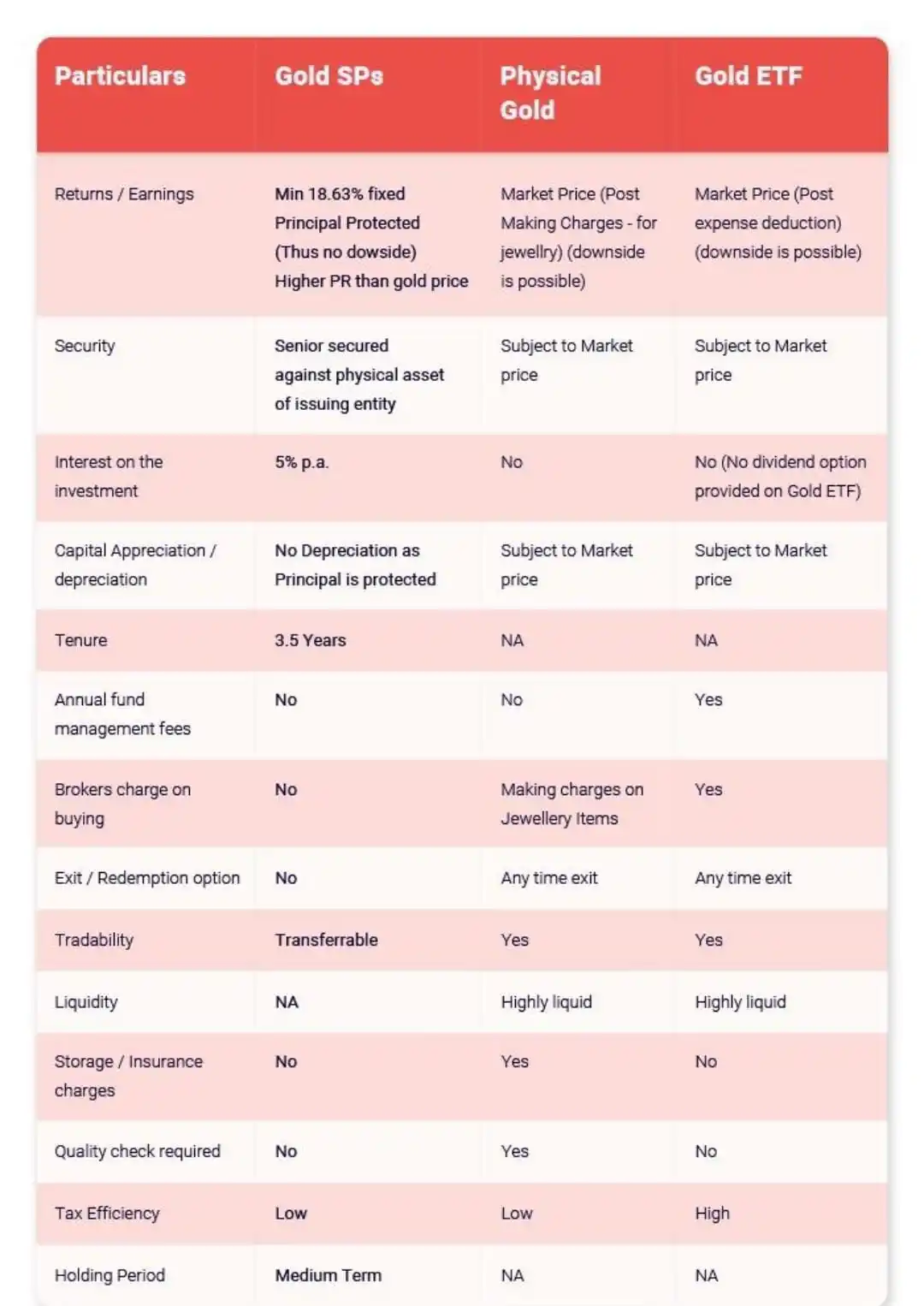

*Which Gold Investment is Better? Let’s Simplify!* ⚱️💛 *1. Gold SPs (Structured Products)* ✅ 18.63% Fixed Return and other options available like 1.27x of gold return if gold gives 100 this will make 127. ✅ Principal Protected Safety ✅ And 5% Interest p.a. minimum ✅ No making/storage/management fees ❌ No early exit ➡️ Best for medium-term fixed-income seekers *2. Physical Gold* ⚠️ Market-linked returns ❌ No interest ❌ Depreciation + Making Charges ✅ Anytime exit & liquidity ➡️ Good for traditional buyers, but costly! *3. Gold ETF* ⚠️ Market-linked returns ❌ No interest/dividends ✅ Highly liquid & tax efficient ⚠️ Expense ratio & brokerage apply ➡️ Best for short-term liquid investors *Verdict:* Growth with capital safety–go for Gold SPs For liquidity – Gold ETF wins For gifting or emotional value – Physical Gold stays! You can connect us for Gold Structured product and Gold ETF or Gold MF :- 9560314594

*Welcome to Monday Investor Q&A Week ❓ I receive few questions this week from investors I will answer important once.* You can also ask your Queries I will try to answer that too. Like 👍 Share and Retweet 🧵 All Question and answer in thread 🧵 Link :- https://x.com/rajneesh__jha/status/1921864478464831888?s=46

*Hello Everyone❤️* First of all, *a heartfelt THANK YOU* to each one of you for trusting me and being part of our growing financial community. *Your support has always been my biggest strength* – Now, I’m taking the next big step- I’m launching my *own YouTube channel* https://www.youtube.com/@Rajneesh_jha to create *video content, reels & podcasts* so we can: ✔️ Educate more people about investing & finance ✔️ Reach NRIs, HNIs & young investors like YOU ✔️ Feature real investor journeys & expert conversations ✔️ Build India’s most trusted wealth & financial literacy community *I truly need your support once again!* If I’ve ever added value to your investing journey — Please *subscribe* to my channel, watch a few videos, and share it with your friends & family. *Here’s my channel link:* 👇 https://www.youtube.com/@Rajneesh_jha Let’s grow this *not just as a channel, but as a mission* to make every Indian financially confident. With gratitude & respect, *Rajneesh Jha* *(Your Growth Partner)*

*Just Read an Amazing ET Wealth Article🏠 Old Tax Regime vs New: Should Your Home Loan Decide the Switch ❓💡Thought to share you.* With Budget 2025 raising the tax-free income limit to ₹12 lakh, the New Tax Regime is looking more attractive — but is it really the best for you, especially if you have a home loan? Here’s a quick breakdown: 🔻 Old Tax Regime ✔️ Offers deductions like: ₹2 lakh on home loan interest (Section 24b) ₹1.5 lakh under Section 80C (for PPF, ELSS, etc.) ✔️ Good if you claim high deductions ✔️ Still preferred by many home loan borrowers BUT many of these tax-saving tools are now not useful for everyone — especially those with fewer deductions or simple tax profiles. 🆕 New Tax Regime ✔️ Lower tax rates ✔️ No deductions needed ✔️ Clean, simple, and now more rewarding if your taxable income is up to ₹12.5L ✔️ Works great for salaried individuals with fewer deductions 🔍 Key Insight: If your deductions are: ✅ High → Old regime may still work better ✅ Low or nil → New regime is likely your best bet 📊 For example, if your income is ₹20L, and deductions are under ₹7.5L, new regime might save you more (see chart ➡️) 🏦 Bonus: Interest on home loans is still allowed under certain conditions in the new regime — especially for let-out property. 🎯It’s not about which regime is “better” — it’s about what suits your tax situation best. If you’re unsure, consult a tax expert or run a quick comparison. *👇 Let me know in the comments:* Which one are you opting for in FY25 ❓ https://www.linkedin.com/posts/rajneeshjha-_taxplanning-financesimplified-budget2025-activity-7327620522463186947--nRG?utm_medium=ios_app&rcm=ACoAAB9VxpMBzJ92bL33q8yfMNCBZzouBCdN3Ug&utm_source=social_share_send&utm_campaign=copy_link

*If your Portfolio is not up by minimum 4% today then you must think to take Retirement from Stock Market today 😅*