Rajneesh Jha (Financial Wellness)

May 15, 2025 at 06:05 AM

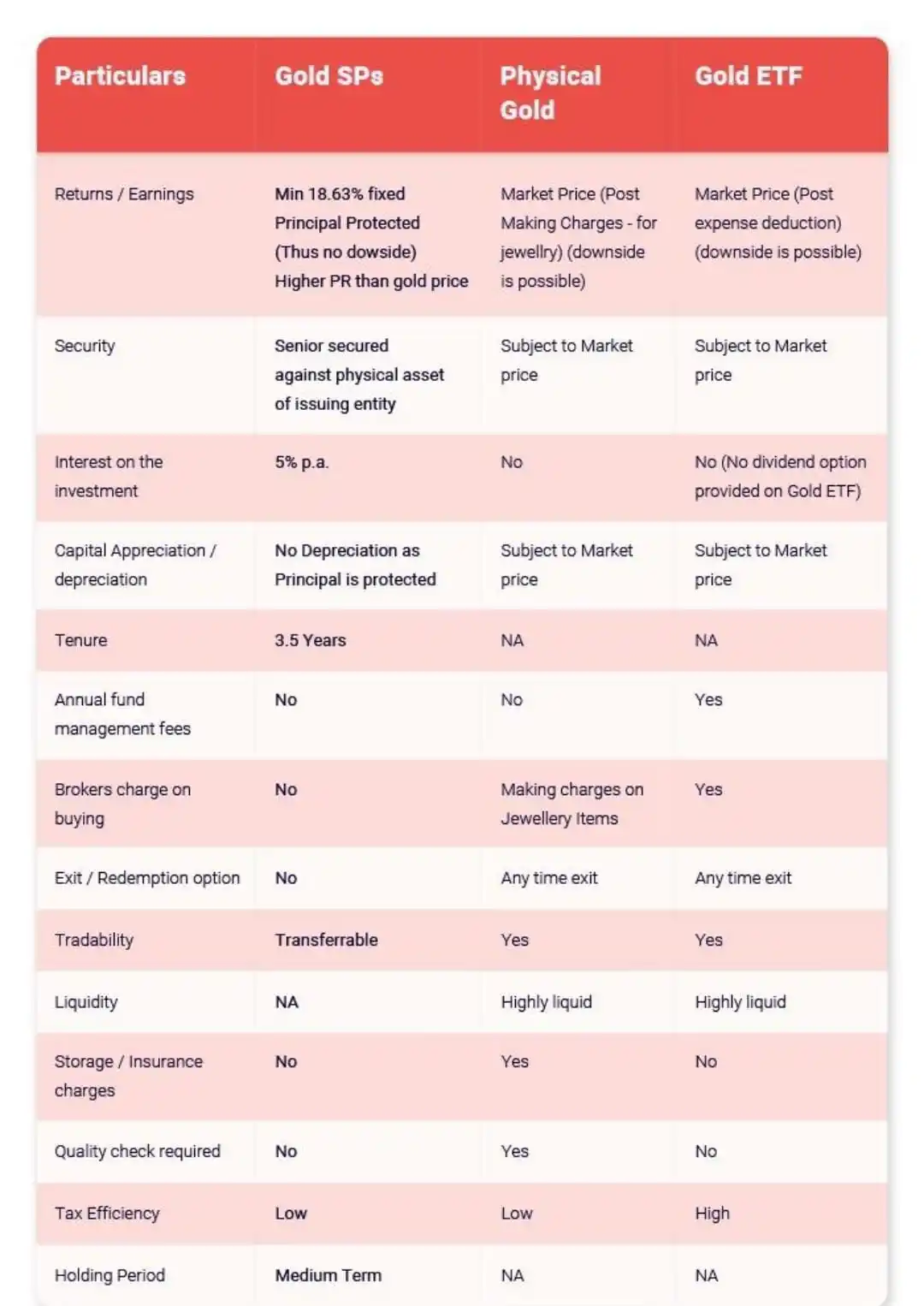

*Which Gold Investment is Better? Let’s Simplify!* ⚱️💛

*1. Gold SPs (Structured Products)*

✅ 18.63% Fixed Return and other options available like 1.27x of gold return if gold gives 100 this will make 127.

✅ Principal Protected Safety

✅ And 5% Interest p.a. minimum

✅ No making/storage/management fees

❌ No early exit

➡️ Best for medium-term fixed-income seekers

*2. Physical Gold*

⚠️ Market-linked returns

❌ No interest

❌ Depreciation + Making Charges

✅ Anytime exit & liquidity

➡️ Good for traditional buyers, but costly!

*3. Gold ETF*

⚠️ Market-linked returns

❌ No interest/dividends

✅ Highly liquid & tax efficient

⚠️ Expense ratio & brokerage apply

➡️ Best for short-term liquid investors

*Verdict:*

Growth with capital safety–go for Gold SPs

For liquidity – Gold ETF wins

For gifting or emotional value – Physical Gold stays!

You can connect us for Gold Structured product and Gold ETF or Gold MF :- 9560314594