XPERTVOICE

89 subscribers

About XPERTVOICE

This channel is created only for the purpose of discussing various kinds of Investment products available in the market. Here we discuss financial and investment planning. #xpertvoice You can connect with me at Twitter :- bit.ly/3TXZhCj LinkedIn:- bit.ly/48AwaJk

Similar Channels

Swipe to see more

Posts

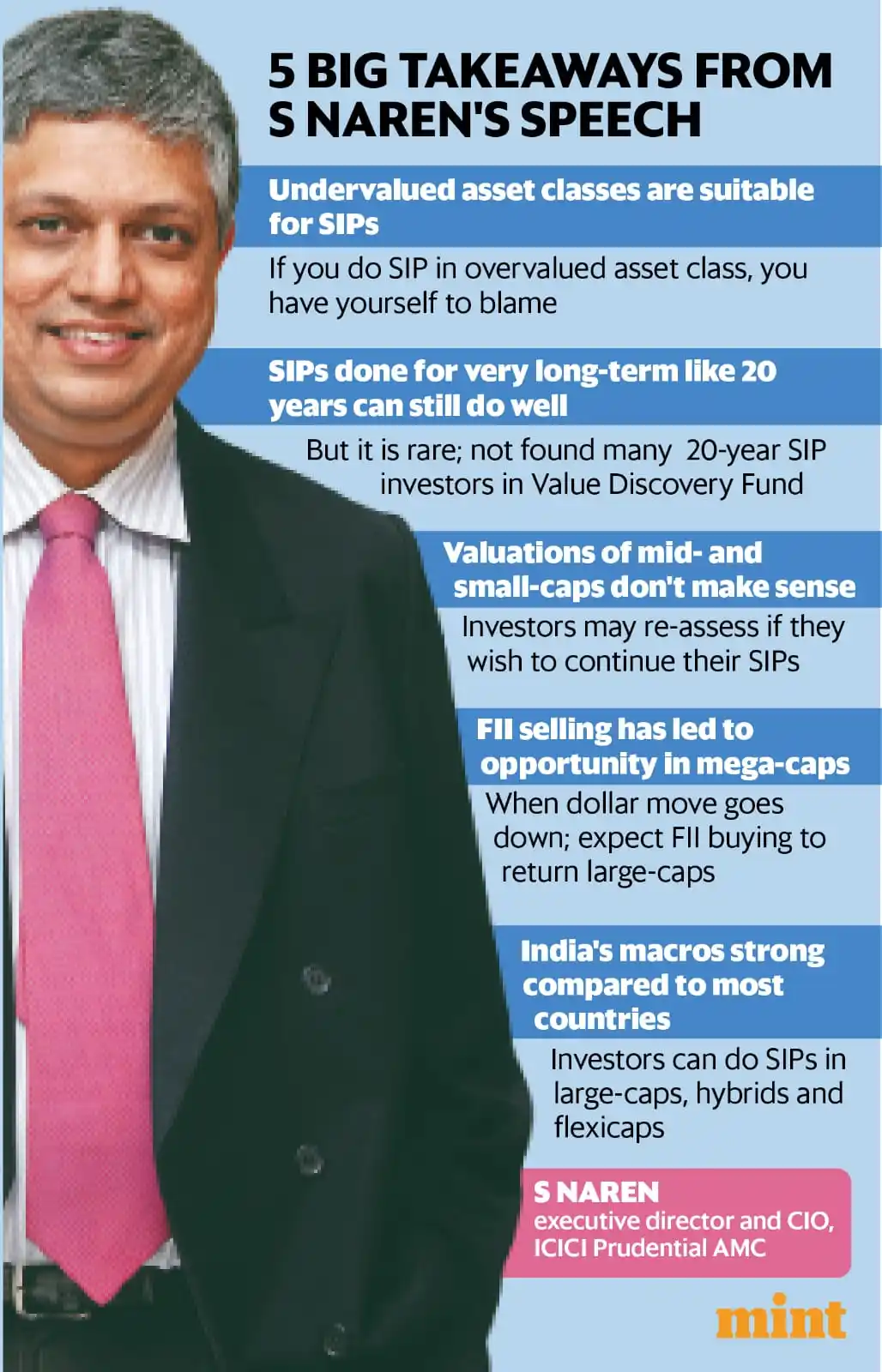

Many Investors are still in illusion that Smallcap and Midcap are made for 3-5 years. Long term investing is not 5 years. Long term investing of Small and Midcap starts from 10 years atleast.

Word of the Day *Alpha* 👇 It measures an investment’s ability to beat the market, representing excess returns over a benchmark. *Higher alpha ~ better performance!* Warm Regards, *Xpertvoice*

"Big institutions move like oil tankers—slow, cautious, and often reacting to waves rather than riding them. The individual investor, however, is like a speedboat. If equipped with the right knowledge, patience, and independence of thought, they can navigate the markets with agility, buying into opportunities before institutions catch on and exiting before they are forced to adjust. Over the long term, this ability to act independently and decisively can yield far greater rewards than following the herd." – Peter Lynch

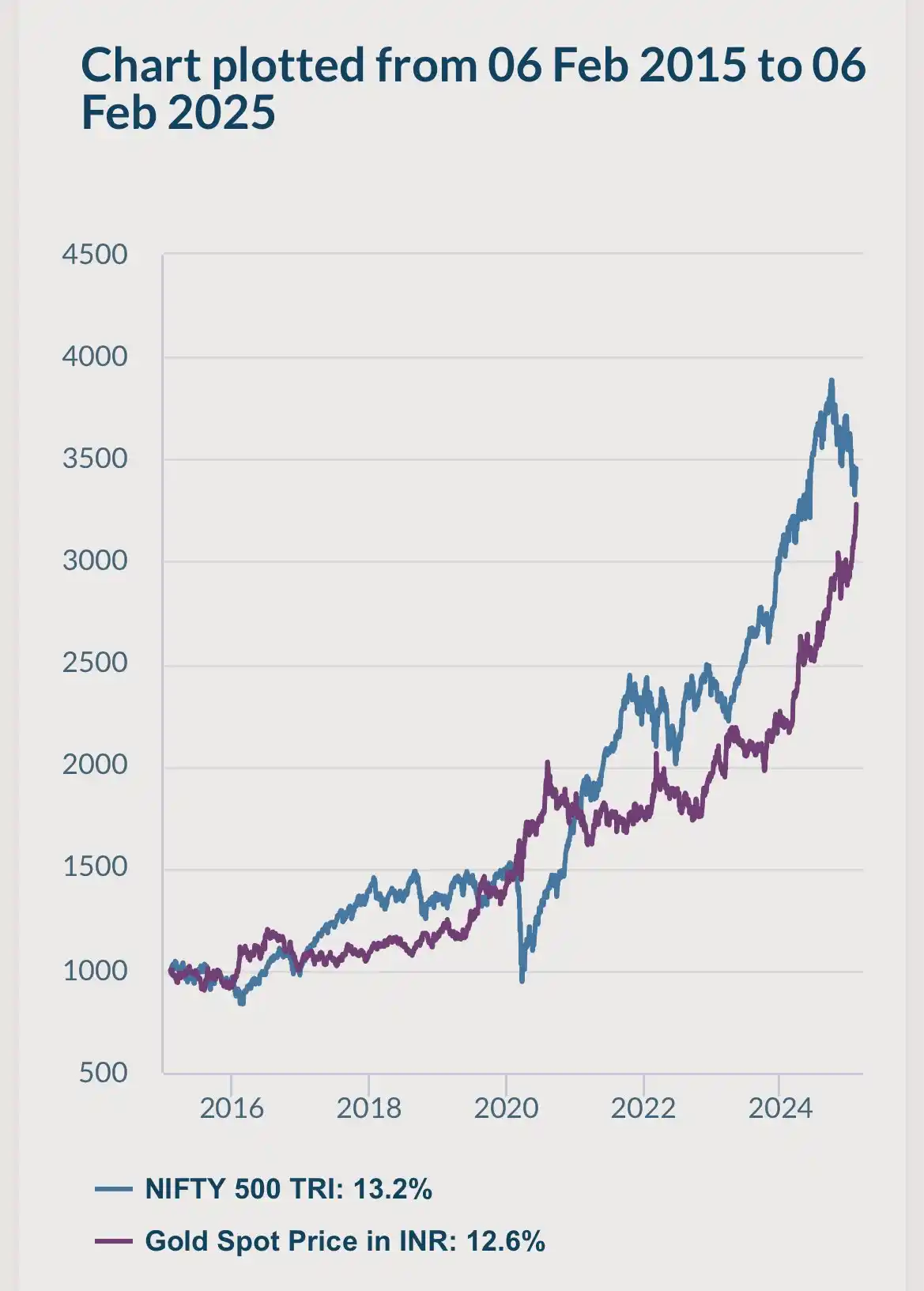

Gold can also do magic ✨.*Gold inching to beat Nifty50 returns in last 10 years*

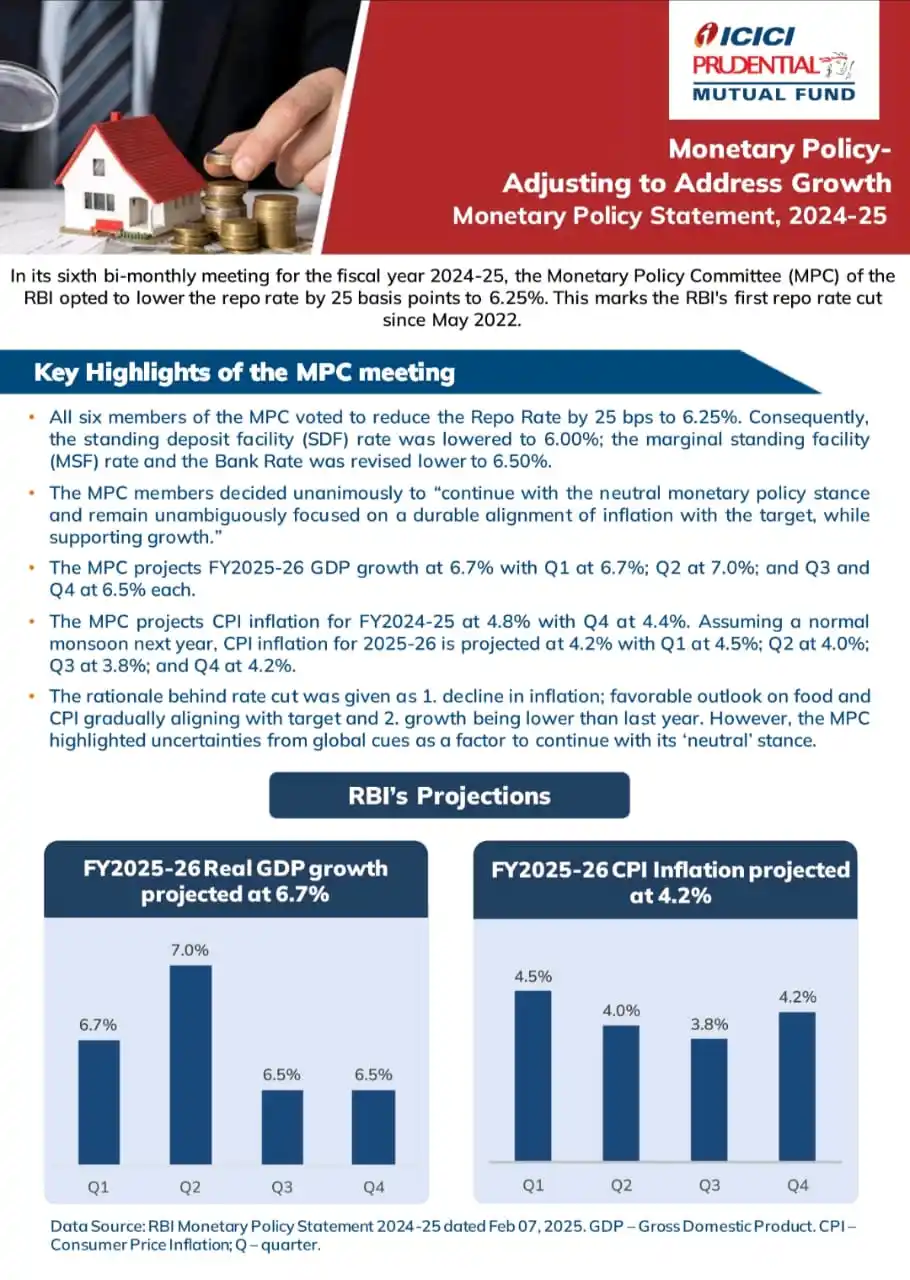

Breaking News ⚡⚡ RBI cuts rates by 25 bps - the first reduction in 5 years! 👉 There was no rate cut by RBI since May 2020 ✨ Sanjay Malhotra debuted with bang in his first policy meet as RBI Governer. #Xpertvoice

🚨No One will tell You about this🚨 A whoopee 41% return 🤯 ✨ Gold hit a fresh high of $2901 per ounce. *99 Carat Gold is being sold at ₹87100 in Mumbai today.* [Gold Future Chart: @Investingcom] Apart from physical gold one can invest in gold through: 1. Gold ETF: Gold Bees and Gold ETFs can be purchased though demat account. 2. Gold FoF: Mutual funds provide easy and fractional investment in Gold with the help of Gold FOF. One can even invest as low as ₹100 per month. 3. Digital Gold: Various online platforms are giving facilities to acquire Gold units digitally. 4. Sovereign Gold Bond: However the government is not issuing any fresh tranches of SGB, but one can buy existing schemes through Demat. *Comment for details procedure* 📍Asset Allocation: Gold has delivered almost 41% mark to mark return in last one year. One should always have gold in his portfolio. 💡 *Otherwise invest in Multi asset Funds. They put at least 10-15% in Gold and Silver.*

🏛 *NSE’s Contribution to the Economy*👇 (9MFY25): 💰 Total Contribution to Exchequer: ₹45,499 Cr 🔸 STT/CTT: ₹37,271 Cr (61% from cash market, 39% from derivatives) 🔸 Stamp Duty: ₹2,976 Cr 🔸 SEBI Fees: ₹1,613 Cr 🔸 Income Tax: ₹2,173 Cr 🔸 GST: ₹1,466 Cr

![Un Loco Más [(Yo) (Intento 2)] WhatsApp Channel](https://cdn1.wapeek.io/whatsapp/2025/02/28/17/un-loco-mas-yo-intento-2-cover_b7e8180ebbffae571b6bfb730ae7c7af.webp)