Market Mania

301 subscribers

About Market Mania

Investing and Global Economy Knowledge SEBI SOCIAL MEDIA MANDATORY DISCLAIMER Equity Investment are subject to market risks. Refer your financial consultant advice before Investing. 👉This channel does not provide any tips/recommendations/advice 👉All updates/posts/discussions are only for education and learning purpose. 👉Do Consult your financial advisor before taking trades or investment decisions 👉Channel Owners or Members are not responsible for any financial decision taken independently and caused losses

Similar Channels

Swipe to see more

Posts

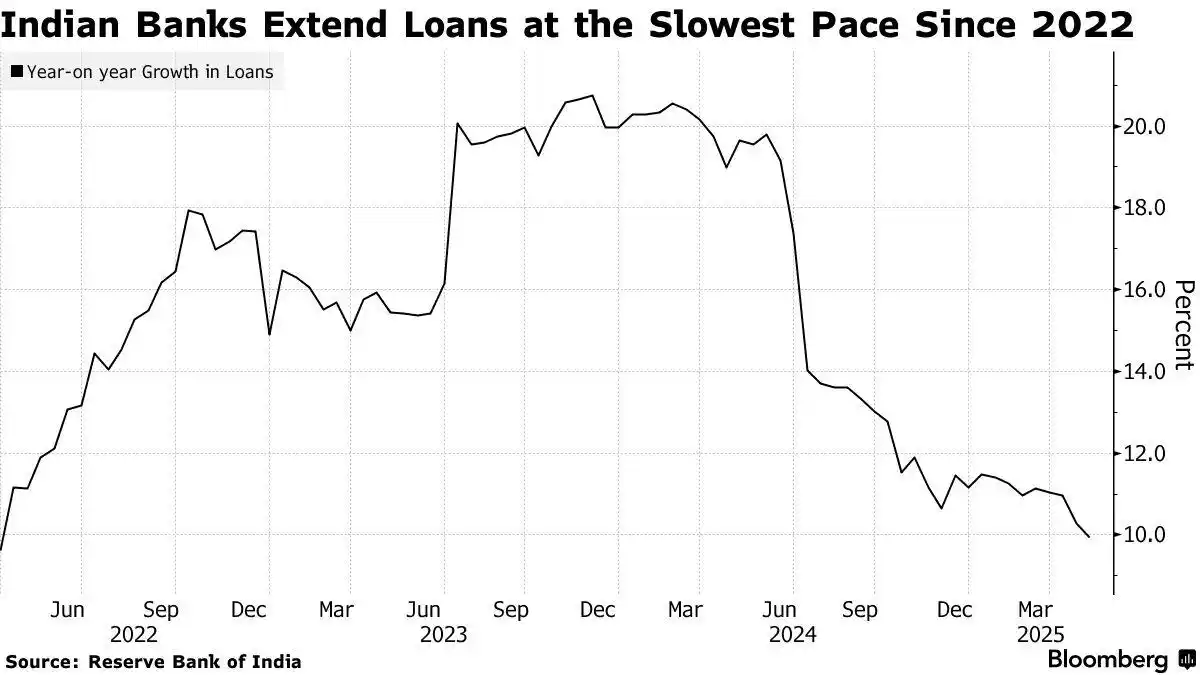

Billionaire Kumar Mangalam Birla’s Grasim Industries just snagged its cheapest local-currency bond in years. The company is raising up to 10 billion rupees ($117 million) with a five-year bond, thanks to the RBI’s recent rate cuts and cash injections. It’s a win-win for Grasim and the economy, showing the central bank’s efforts are paying off. Looks like other corporates are also making the most of the low-rate environment, with Jio Credit Ltd., a shadow lender owned by Mukesh Ambani, set to seek bids next week to raise three-year money at 7.08% coupon. That’s 11 basis points lower than a similar tenor deal last week. India’s loan growth has hit a snag, slipping below 10% for the first time in over three years. With a uncertain economic outlook and cheaper bond options, companies are holding back on borrowing. Bank loans grew just 9.95% to 182.9 trillion rupees ($2.1 trillion) as of May 2, marking the slowest pace since March 2022.

https://www.linkedin.com/posts/hitesh-verma-79aab610_rising-risk-free-rates-a-reflection-of-fiscal-activity-7331878831609270272-6stg?utm_source=share&utm_medium=member_ios&rcm=ACoAAAJMX-YBRt56iUz4XOe4JbErdNhQWwQChz8

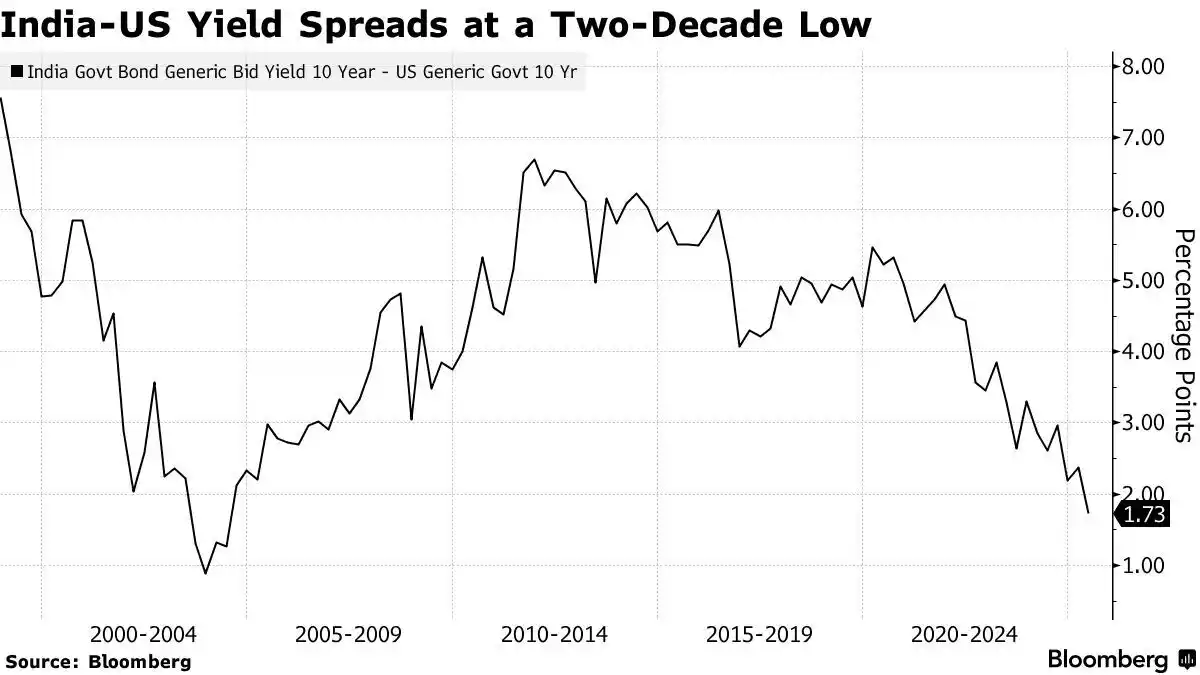

India's bond yield premium over the US has narrowed to its smallest in two decades, likely risking fund outflows from local debt. The spread between the benchmark 10-year India debt and the US has shrunk to about 173 basis points, driven by India's strong fiscal position, easing inflation, and expectations of lower interest rates. Despite the shrinking yield advantage, India's strong macros may still ensure some inflows, and foreign funds have poured a net $2.3 billion in rupee debt so far this year.

The UK has leap-frogged China to become the #2 largest foreign holder of US Treasuries. The Bank of England isn't on a buying binge. Rather it's global banks, insurers, custodians and hedge-fund “basis traders” booking positions through the City. China’s been drip-selling Treasuries for a decade, rotating into agencies, gold and crucially, shorter-dated bills to keep its options open. -The foreign share of the $27 trillion US Treasury market keeps shrinking, raising Washington’s sensitivity to ratings downgrades and home-grown demand shocks. -A thinner Chinese bid can nudge yields higher just as the Fed flirts with cuts. -For the City, it’s a post-Brexit branding win: London remains the balance sheet for global dollar flow. James Eagle, Founder of Eeagli @LinkedIn

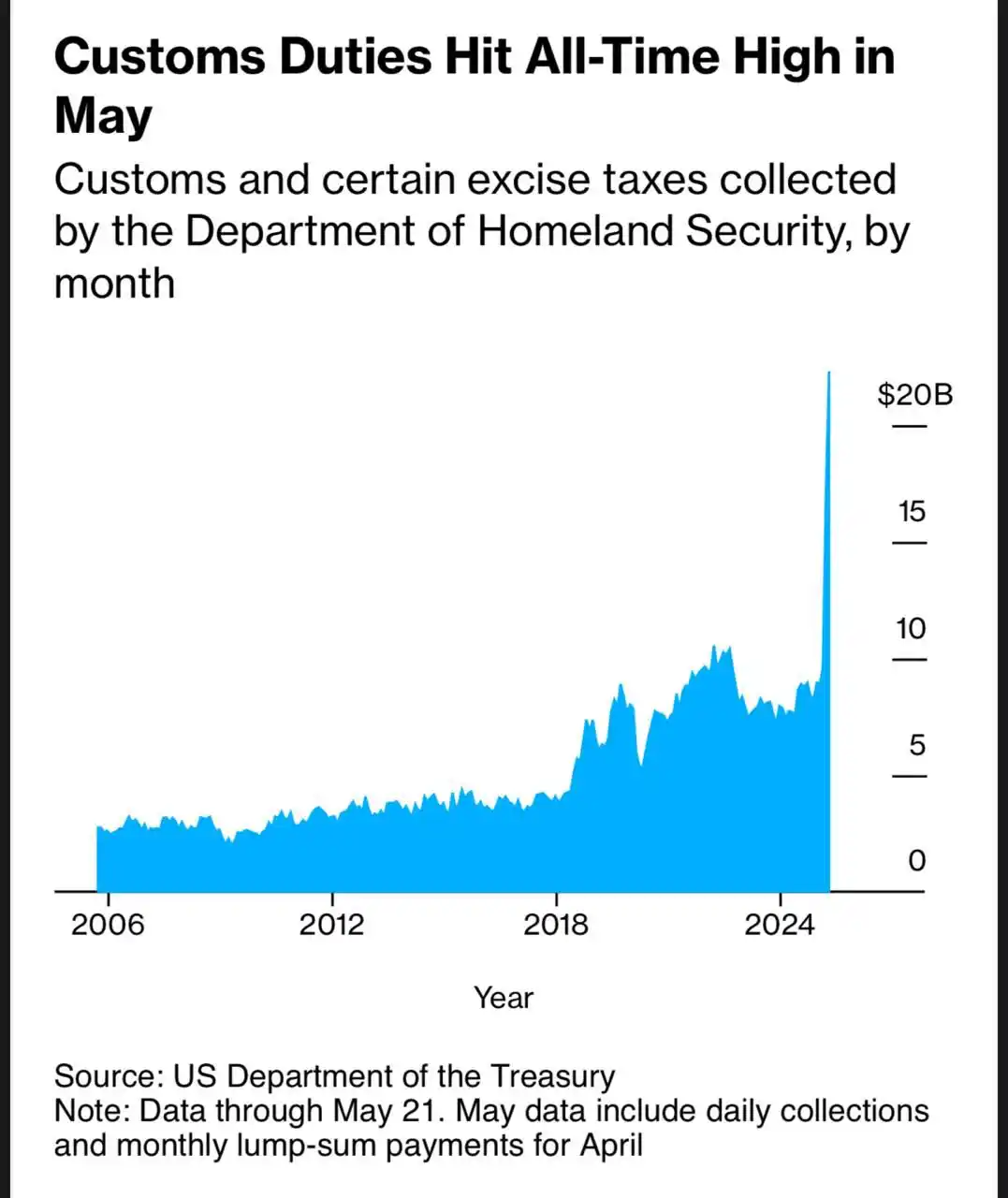

Daily revenue from US customs duties reached a record $16.5 billion, reflecting the full impact of President Donald Trump's new universal tariffs. The data suggest that Trump will fall short of his goal of $2 billion a day in tariff revenue to help pay for record tax cuts. The Treasury will bring in at least $22.3 billion in customs duties and other excise taxes this month, a monthly record in dollar terms. The new levies being collected consist mostly of a 10% baseline tariff for most of the world, a 25% duty on steel and aluminum, and 25% on autos. The tariff rate on China was about 20% when Trump took office, hit a high of 145% and is now 51%.

According to the United Nations, a total of 17 “non-self-governing territories” remain worldwide, the majority of which are islands in the Caribbean and Pacific. This figure has dropped significantly from the 72 stated by the UN in 1946, when the international organization formalized the list.

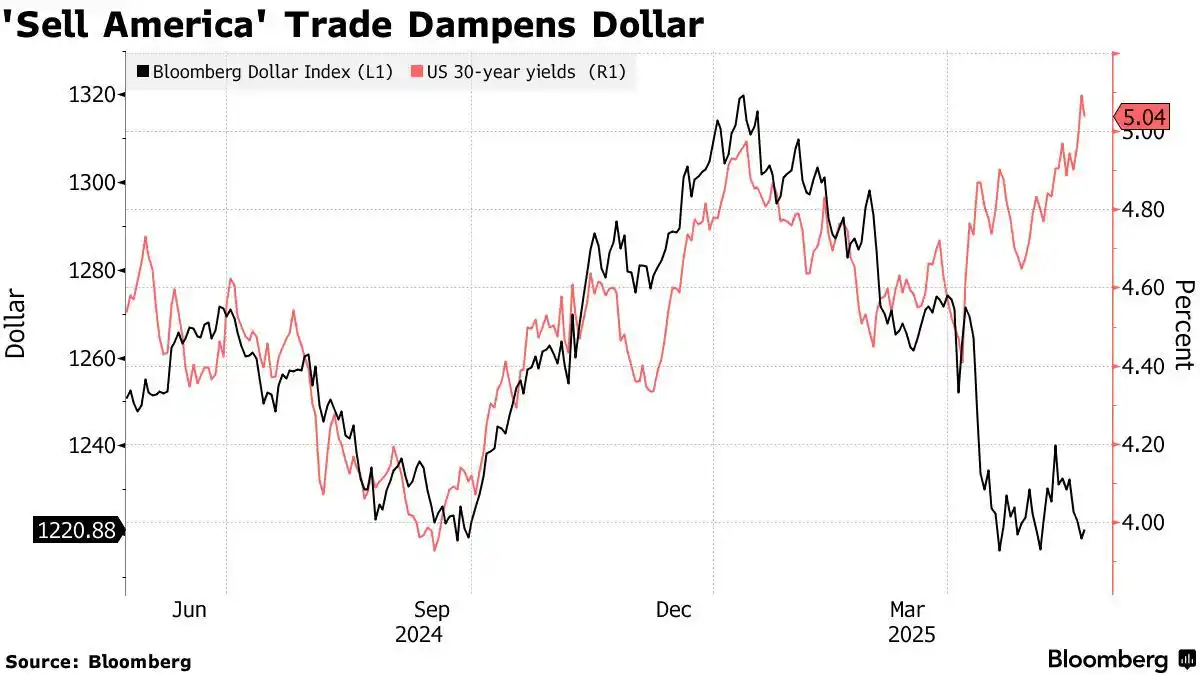

Bond markets this week have reflected investors’ concerns about the fiscal health of the US economy, which was amplified after Moody’s Ratings downgraded the nation’s top credit rating last week. That broke a relative calm in financial markets after a month of turmoil from US President Donald Trump’s tariff blitz. US stocks had even rallied to within striking distance of a bull market. “The bond market is speaking, equity markets aren’t really listening at this point,” Thomas Taw, head of Asia Pacific investment strategy at BlackRock Asset Management, said in a Bloomberg Television interview. “All these measures that are coming through, whether it’s tax bill, tariffs, et cetera, these are all inflationary type of measures. Thursday’s rebound in Treasuries came after the bond market sold off recently to reflect worries about the US’ surging debt load. Investors are concerned that Trump’s signature tax bill, which narrowly passed the House, would boost the nation’s already swelling deficit. With the yield on 30-year Treasury bonds again passing the 5% mark on Wednesday, the nation’s creditors injected a dose of harsh economic reality into Trump’s fiscal policy. Meanwhile, Federal Reserve Governor Christopher Waller said the central bank could cut interest rates in the second half of 2025 if the Trump administration’s tariffs on US trading partners settle around 10%.

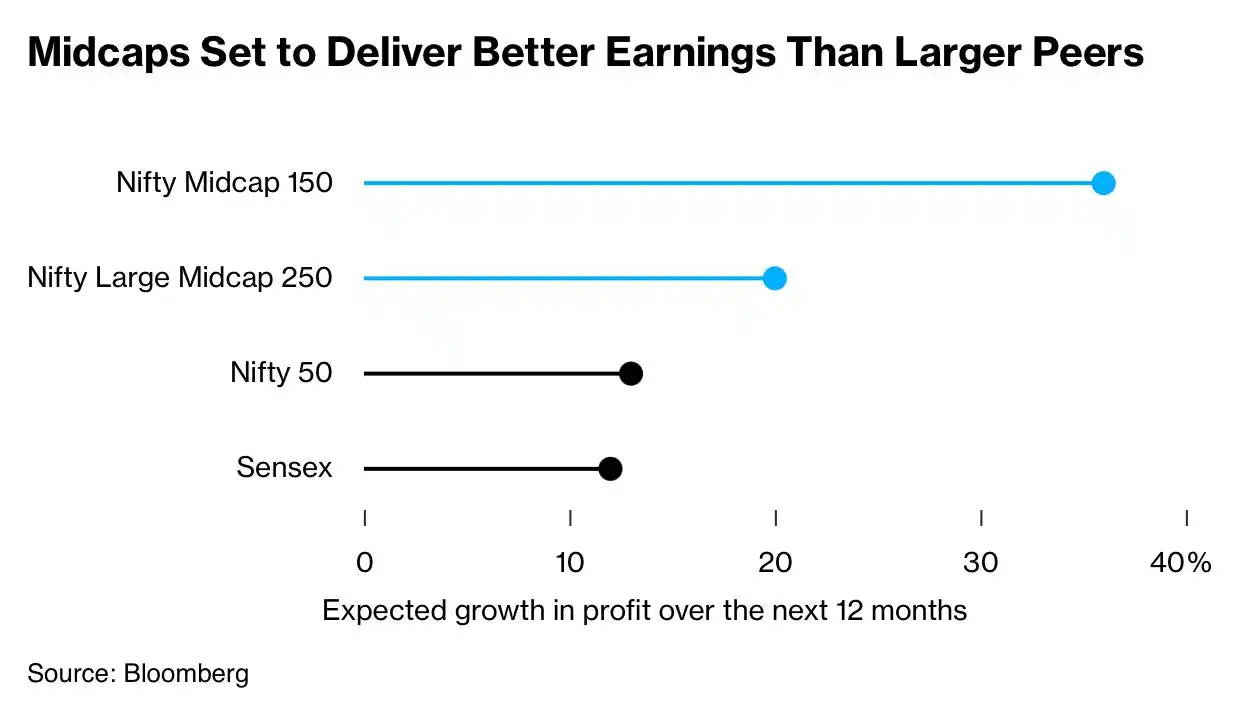

Local equities are likely to be under pressure amid the bearish trend in global markets. However, midcap firms’ resilient earnings growth, despite lacking major positive surprises, is expected to support retail investor sentiment. Consumption stocks still facing headwinds The much-awaited recovery in urban consumption may take longer to emerge, according to analysts at Antique Stock Broking. Insights gathered from distributors and dealers across various regions indicate that demand in the urban general trade segment remained under pressure through April. Analysts note that food categories witnessed stronger growth as compared to home and personal care products. While midcap shares may have lagged their larger peers in the recent rally, their earnings growth paints a stronger picture. Companies in the NSE Nifty Midcap 150 Index posted a 21.4% profit increase in the fourth quarter, outpacing the 4.3% increase reported by Nifty 50 firms. Forecasts for the midcap index have been raised by over 13% this year, while estimates for the Nifty 50 have remained unchanged, according to data compiled by Bloomberg.