Market Mania

May 23, 2025 at 05:51 AM

Billionaire Kumar Mangalam Birla’s Grasim Industries just snagged its cheapest local-currency bond in years. The company is raising up to 10 billion rupees ($117 million) with a five-year bond, thanks to the RBI’s recent rate cuts and cash injections. It’s a win-win for Grasim and the economy, showing the central bank’s efforts are paying off. Looks like other corporates are also making the most of the low-rate environment, with Jio Credit Ltd., a shadow lender owned by Mukesh Ambani, set to seek bids next week to raise three-year money at 7.08% coupon. That’s 11 basis points lower than a similar tenor deal last week.

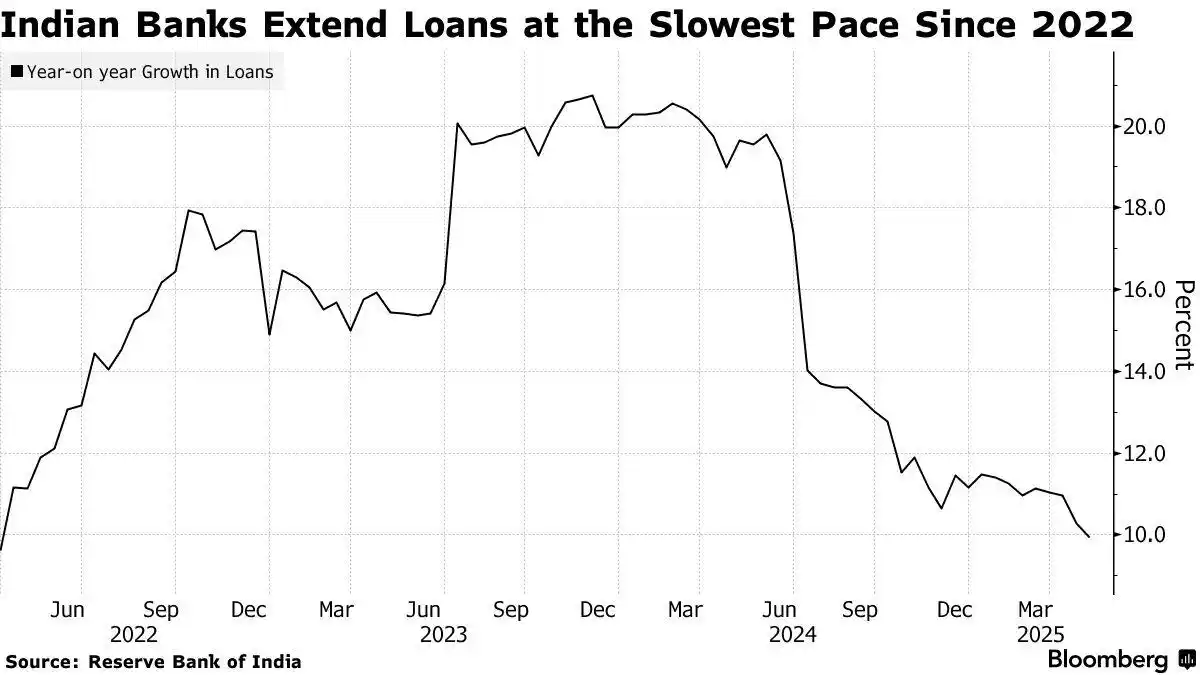

India’s loan growth has hit a snag, slipping below 10% for the first time in over three years. With a uncertain economic outlook and cheaper bond options, companies are holding back on borrowing. Bank loans grew just 9.95% to 182.9 trillion rupees ($2.1 trillion) as of May 2, marking the slowest pace since March 2022.