Financial Wellness ( Hittesh Kothari )

504 subscribers

About Financial Wellness ( Hittesh Kothari )

*Services* *EQUITY & COMMODITY BROKING,* *MUTUAL FUND DISTRIBUTORS,* *FIXED DEPOSITS, NCD, BONDS, ETC.* *LIFE INSURANCE,* *NON-LIFE INSURANCE* (Health/Motor/Travel / SME) *IPO* *P2P FIXED RETURN INVESTMENT*

Similar Channels

Swipe to see more

Posts

Iranian media: This night will not be like the previous ones.

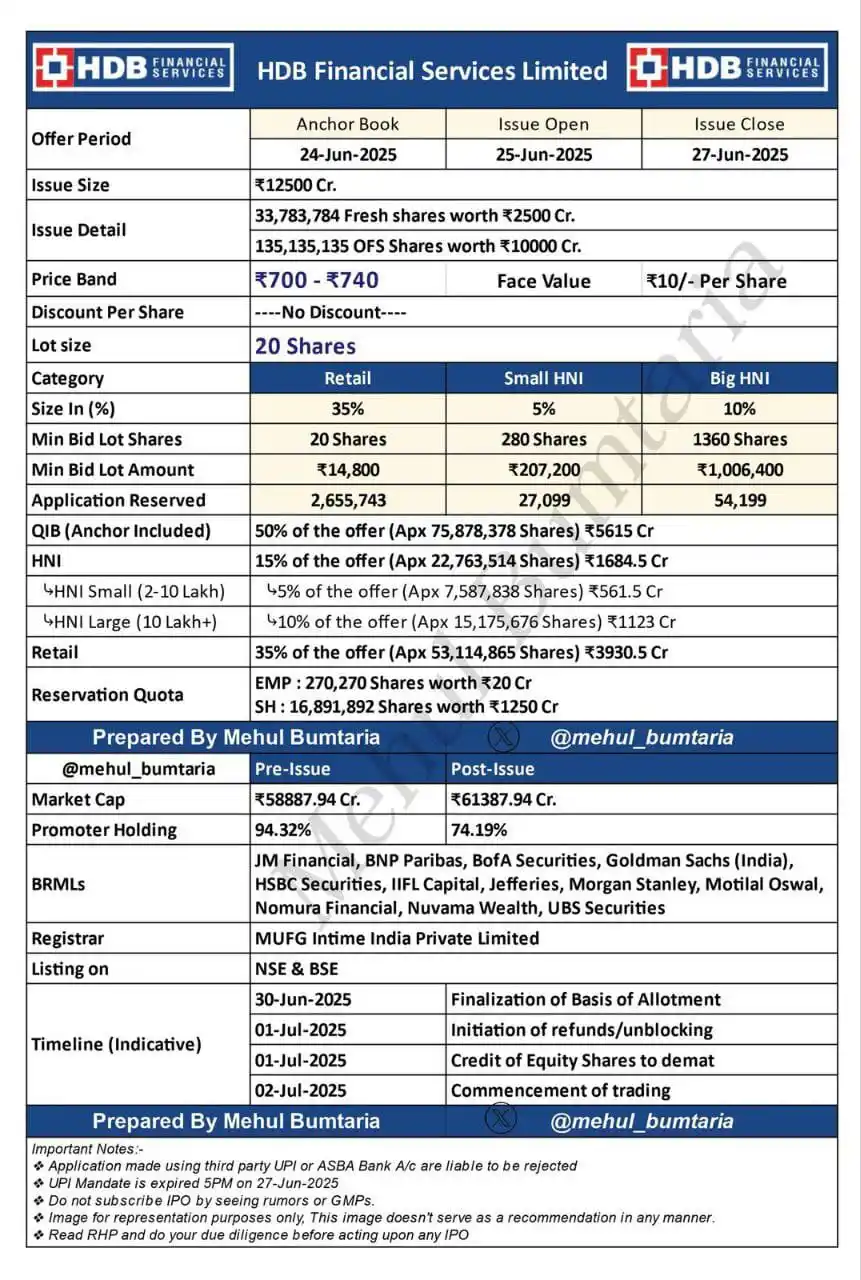

HDB Financial Price band: ₹700-740/share lower than unlisted share price - NDTV PROFIT Price band set at nearly 40% discount to unlisted market price Unlisted share price indicate valuation of nearly 1 lk cr At upper end of price band, valuation seen at 61,000 cr

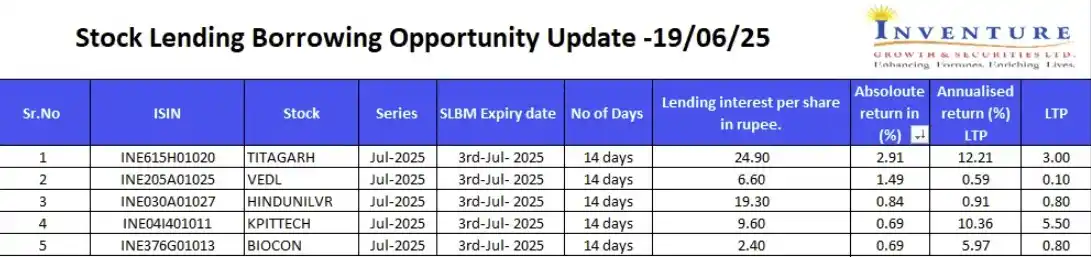

SLBM OFFER RATE FOR TODAY AS ON 19/06/2025

"Achieve your financial goals with a diversified SIP! Blend equity and debt funds to balance growth and stability. Minimize risks, align with your time horizon, and secure your future. Start diversifying today for confident goal planning!"

$6.8 trillion worth of options on stock indexes, ETFs, equity index futures, and individual stocks are set to expire during today's trading session. This is potentially the biggest “triple witching” OpEx on record, according to SpotGamma estimates. It will also be the first monthly post-holiday OpEx in at least 25 years. Furthermore, ~$4.5 trillion in notional value of expiring options is tied to S&P 500 index options. ~$1.0 trillion worth of options expiring are tied to single stocks. It's a big day. (S&P500) 🇺🇸

40 Cr fraud by a broker of Mumbai dealing in Unlisted shares of NSE. Delivery not given after taking money. (HOS) -------------------- 🚨 Investor Alert: Don’t Fall for Cheap Rate Traps in Unlisted Shares! 🚨 Beware of deals that look too good to be true. Many fraudsters offer unlisted shares at unrealistically low prices to lure investors. These could be: 🔴 Fake sellers 🔴 Non-transferable shares 🔴 Shares with legal/lock-in issues Real value comes from verified sources, due diligence, and transparency. Always check SEBI compliance, company fundamentals, and consult with a trusted advisor before investing. 🛡️ Your money is your responsibility. Stay informed. Stay safe. That is where we stand out. Please deals with known person only

Jio will be launching 3 Mutual Funds in India shortly which are using Blackrock's ALADDIN model. ALADDIN literally stands for Asset, Liability, and Debt and Derivative Investment Network In total, ~200 global institutions use the analytics platform which represents ~₹1,750 lakh crore in AUM. First time that ALADDIN will be launched in India by any institution: