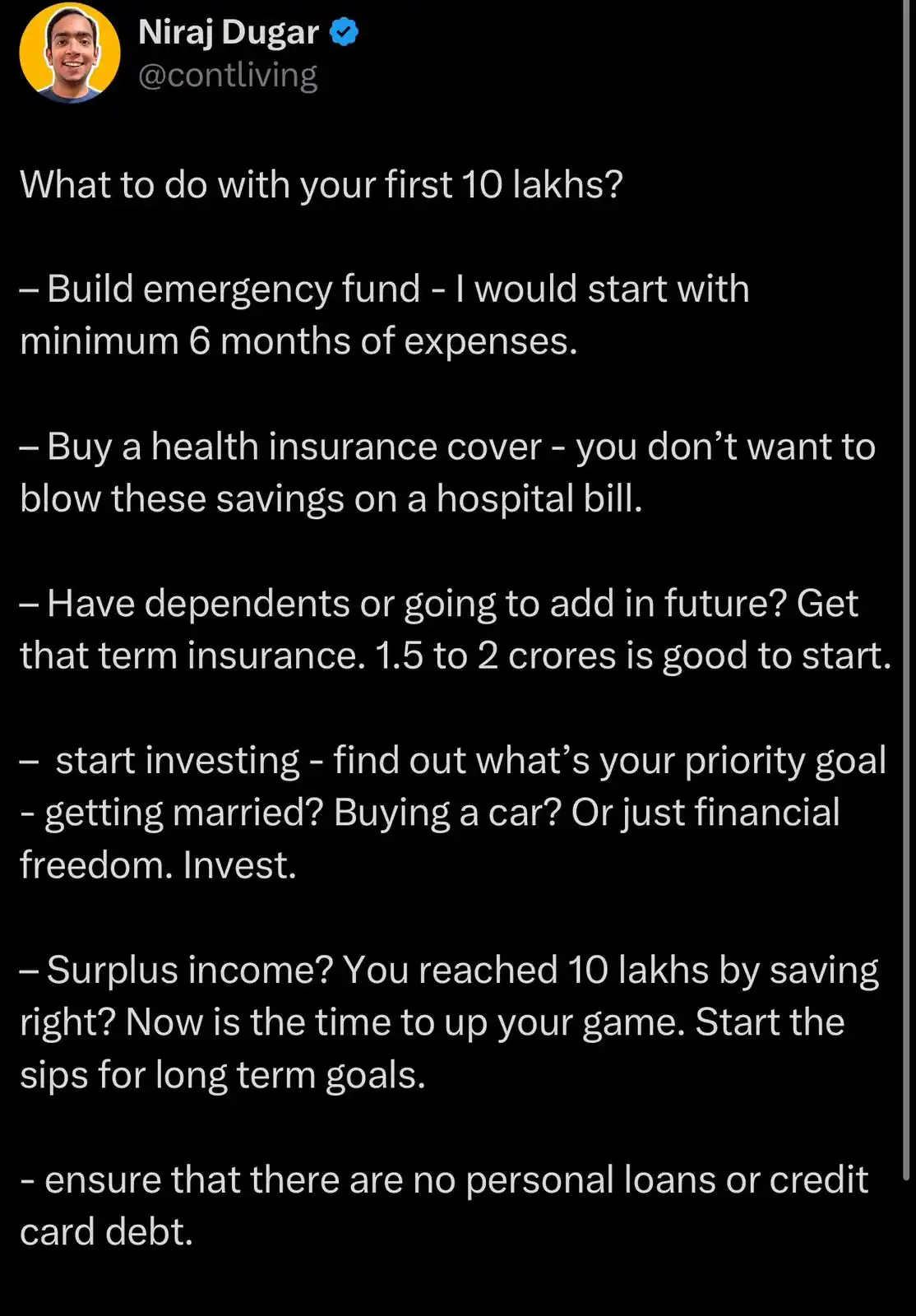

All things personal finance and growth 🚀

1.5K subscribers

About All things personal finance and growth 🚀

Some links - https://linktr.ee/nirajdugar

Similar Channels

Swipe to see more

Posts

https://www.instagram.com/reel/DKRr0YYxFe1/?igsh=b3Rqand3eWNnZGpv

Must read if you plan to buy a car in the future! https://x.com/contliving/status/1925801960466203012

Going to be active here for credit cards https://x.com/rewardsandcards?s=21

https://www.instagram.com/reel/DJ_pU-CsgXT/?igsh=MW1jYmYybnpianFjZQ==

🌍 Meet One of the Best Forex Cards Out There 💳✈️ ✔️ 0% Forex Markup – Spend globally, save big ✔️ Available on RuPay – UPI + Credit = Win ✔️ Lounge Access – Just spend ₹10,000/month to unlock* ✔️ 4% Rewards – On Flights & Hotels booked via app ➕ Up to ₹1,000 in Airport Credit 💸 Spend ₹10K Monthly → Unlock Travel Perks Apply - https://bitli.in/ckBV184