Prateek Garg & Company

95 subscribers

About Prateek Garg & Company

This is the official WhatsApp channel of Prateek Garg & Company, Chartered Accountants. Follow to get regular updates and posts on Tax, Finance, Business, Economy and Investing. *Connect with us* https://linktr.ee/PGCCA *Brief Introduction of Prateek Garg & Company* Prateek Garg & Company is a chartered accountant firm in Delhi. We are a professionally managed firm offering best and credible services to individuals as well as businesses. We offer one stop solution to all the tax related requirements of a business entity. We offer following services 👉 Setting up of businesses 👉 Tax Compliance & Consultancy 👉 Tax Representation and Litigation 👉 Accounting & Bookkeeping 👉 Business & Financial Planning. *Brief Introduction of CA Prateek Garg* Prateek Garg is a fellow member of the Institute of Chartered Accountants of India and a graduate in commerce. He has also completed his law degree. He has vast experience in field of direct as well as indirect taxation, business and financial planning.

Similar Channels

Swipe to see more

Posts

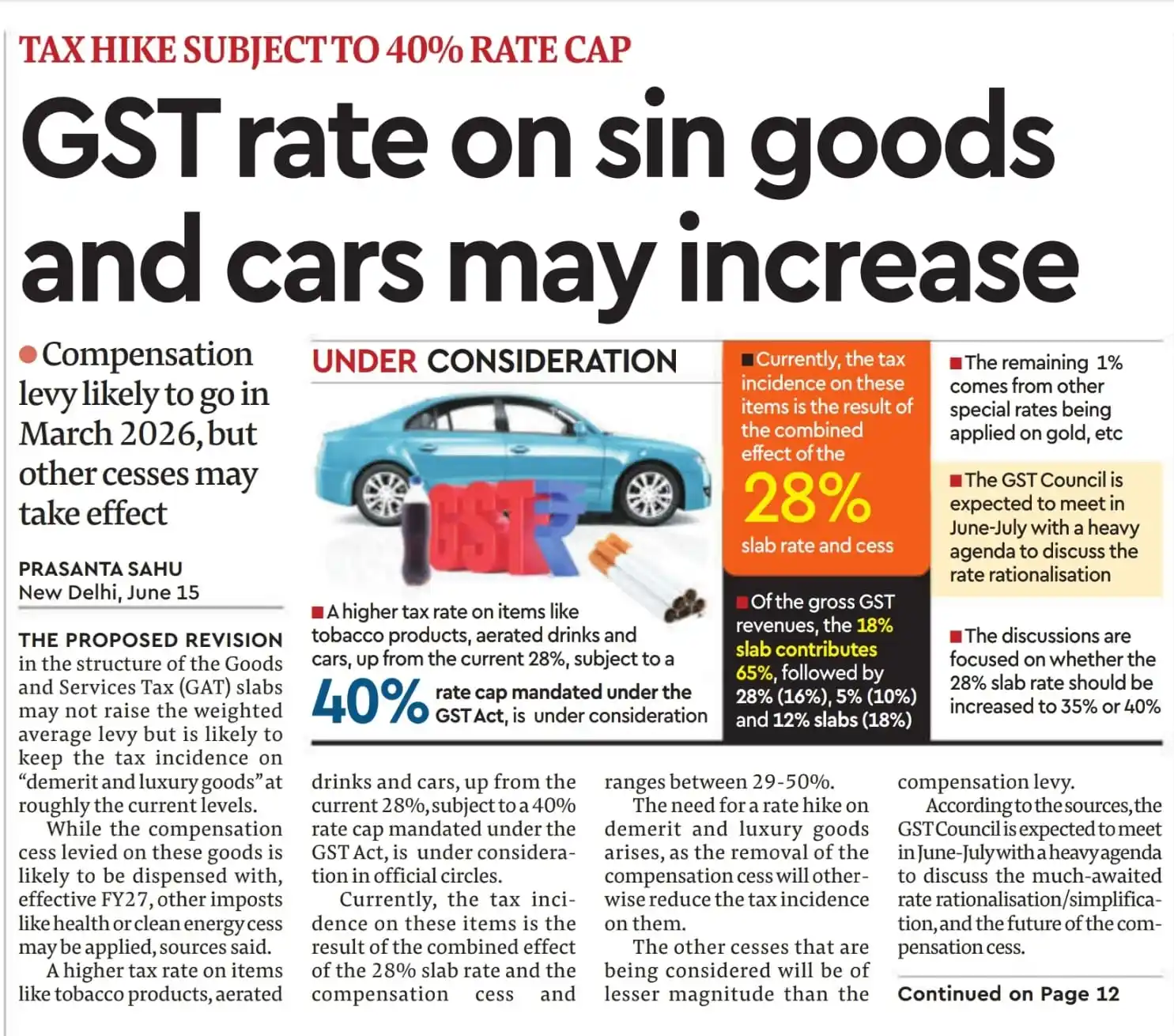

ICAI resumes detailed probe into Byju’s from today ICAI is restarting its disciplinary probe into edtech firm Byju’s after reconstituting four new benches, each with five members. The earlier benches had dissolved in February awaiting government nominees. One bench will specifically continue Byju’s case. ICAI president confirmed FRRB is also reviewing financials of IndusInd and Gensol, expected to conclude in 6 months. Disciplinary action may include removal or penalties if misconduct is found. #ICAI #ByjusInvestigation #CorporateGovernance #CharteredAccountants #IndusIndBank #Gensol #FinancialTransparency

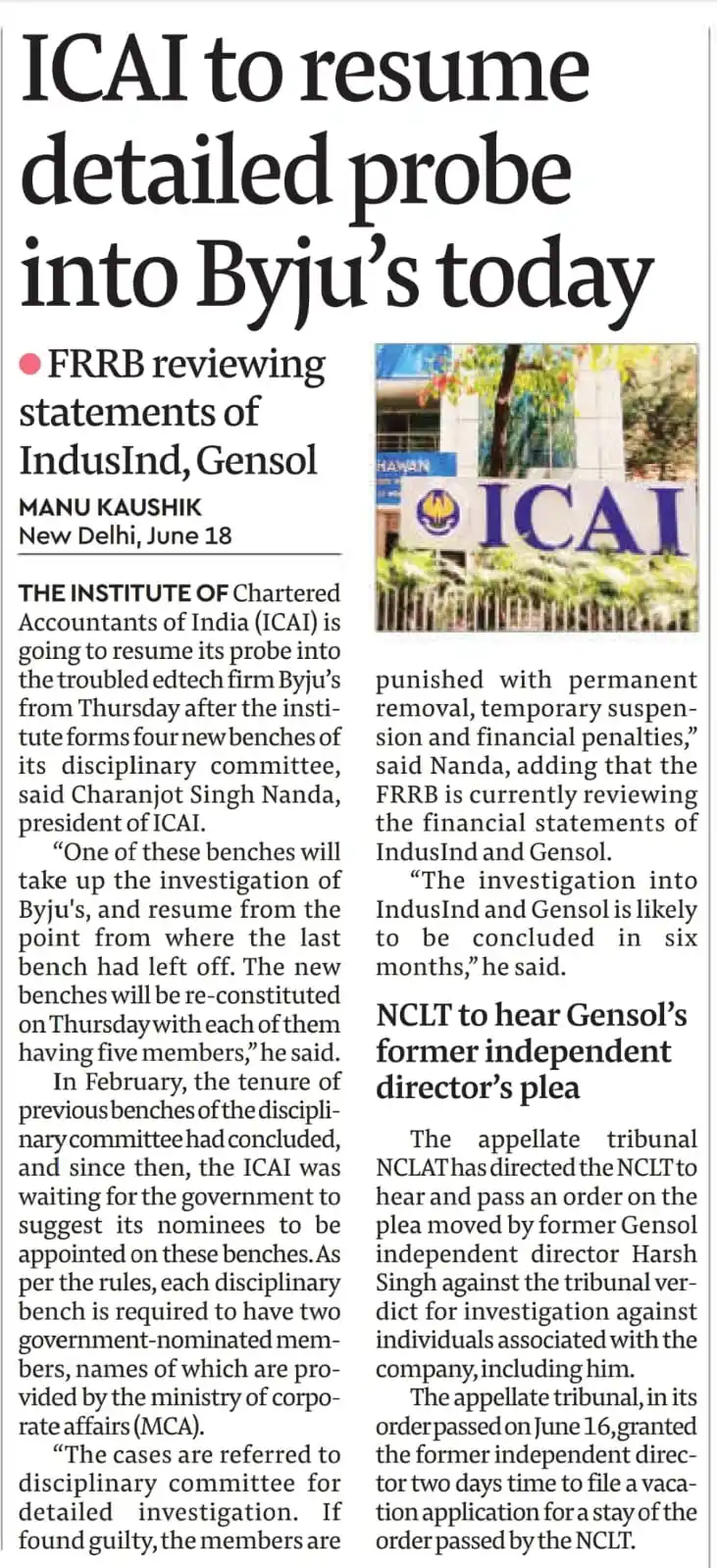

📌 Updated TCS Rate Chart (as amended by Finance Act 2025) Keep your compliance in check with this updated TCS rate chart as amended by Finance Act 2025. Covers all key sections including 206C(1), 206C(1F), 206C(1G), and more. Essential reference for businesses, professionals, and consultants involved in tax compliance and transaction planning. 🔎 Amendments highlighted for quick reference. #TCSUpdate #FinanceAct2025 #TaxCompliance #IncomeTaxIndia #CharteredAccountant #GSTIndia #TCSRates #Section206C #TaxAdvisory

SEBI to Mandate @valid UPI Handles for Investor Payments from Oct 2025 to Curb Frauds SEBI, in collaboration with NPCI, will enforce @valid UPI handles for capital market entities from October 1, 2025. Only registered and verified intermediaries can obtain these handles, allowing investors to confirm the recipient’s authenticity before transferring funds. The move aims to combat rising fraud cases and ensures smoother, safer payments, especially for SIPs and investment-linked transactions. #SEBI #MutualFunds #investor

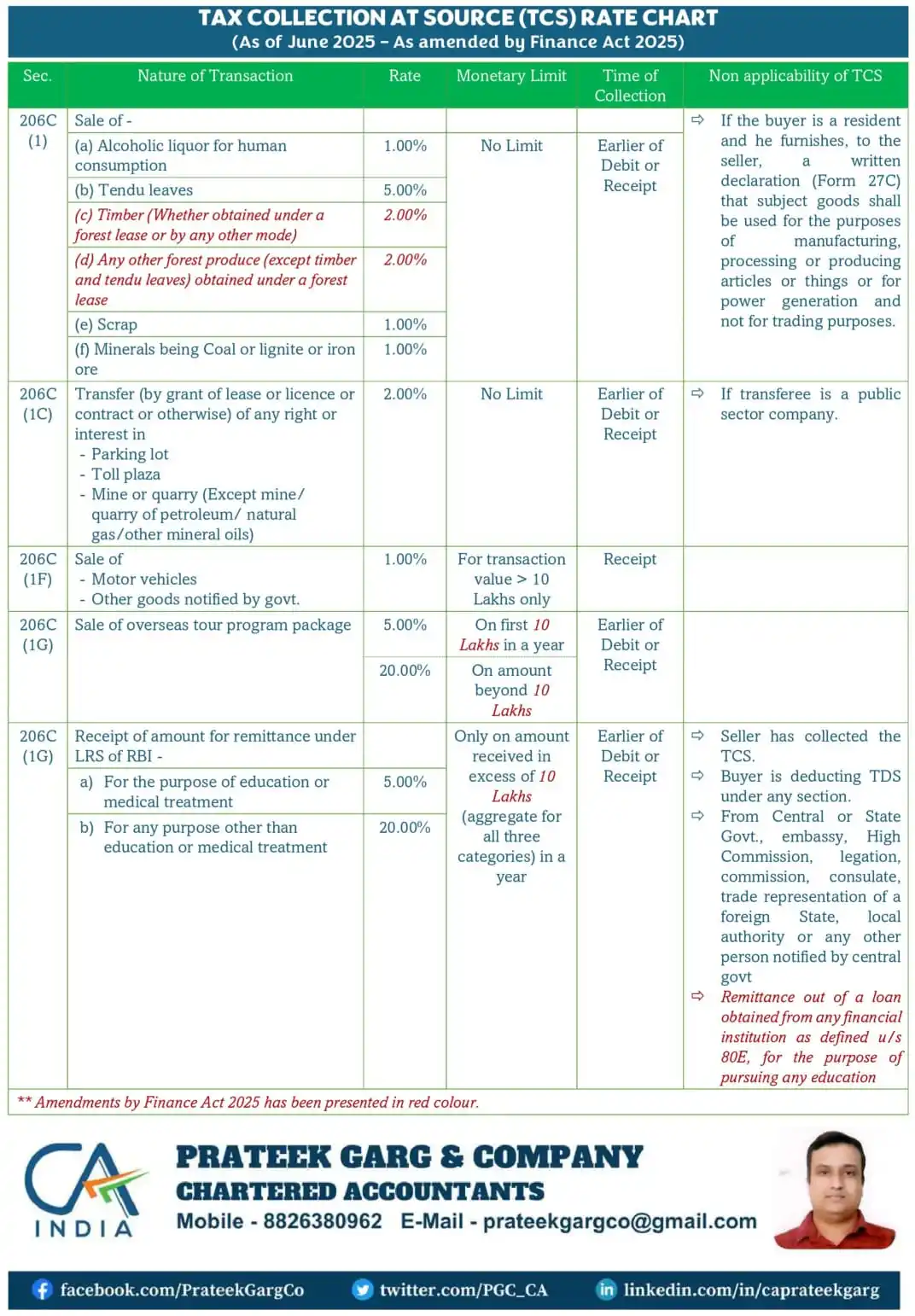

GSTN Advisory : Filing of SPL-01/ SPL-02 where payment made through GSTR 3B and other cases Taxpayers who are facing technical issues related to auto population of payment details in Table 4 of the forms SPL-01/SPL-02 are advised as follows - 1️⃣ Procceed with filing the application with payment details. 2️⃣ Upload the relevant payment information as attachment along with the application. https://www.gst.gov.in/newsandupdates/read/610 #GST #GSTN #CBIC #GSTAmnesty

Parl Panel Seeks Feedback on IBC Amendments by June 16; Bill Likely in Monsoon Session The standing committee on finance has invited comments on proposed amendments to the IBC, including a 14-day admission timeline and equitable treatment for operational creditors. Key changes will affect Sections 7, 9, and 10, and may involve increasing tribunal strength and forming special IBC benches. The amendments aim to address delays and bring clarity to the insolvency resolution process. #IBC #Parliament #Legislation

CA Firms to Assist CAG in Auditing 300 Government-Linked Bodies Across India For the first time, CAG will empanel CA firms in 30 cities to audit around 300 autonomous bodies implementing government schemes. The move aims to augment audit capacity amid rising responsibilities. Selected firms will work under CAG-led teams from July 2025 to March 2027, though individual CAs won’t be empanelled. Confidentiality agreements and defined accountability will ensure audit integrity. #CAG #ICAI #Auditing

Unaccounted income invested in cryptocurrencies on I-T radar CBDT is probing cases where taxpayers failed to report income from Virtual Digital Assets (VDAs) like cryptocurrencies. Emails have been sent to thousands asking them to review their ITRs for AY 2023–24 and 2024–25. Section 115BBH imposes 30% tax on VDA gains with no deduction or set-off of losses allowed. VDA TDS returns filed by exchanges are being cross-verified with ITRs for further scrutiny. #IncomeTax #BlackMoney #Crypto #VDA

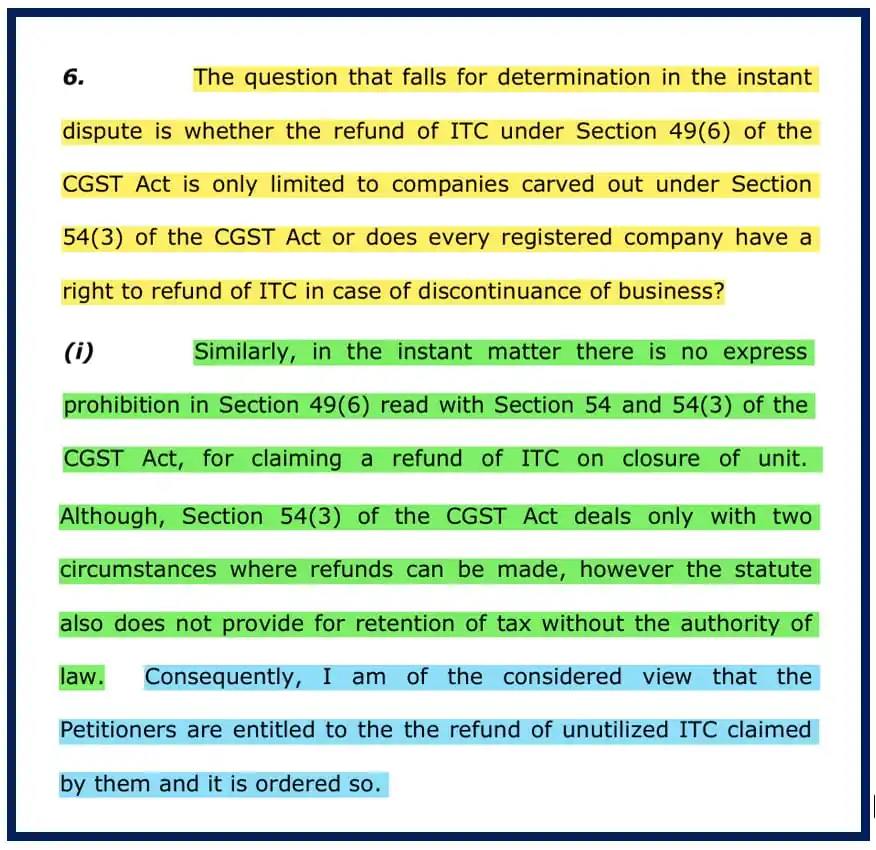

📌 IMPORTANT GST CASE LAW 🔥🔥 Court allows the refund of unutilized ITC for cases not covered by section 54. The Hon'ble HC of Sikkim has ruled that petitioner is entitled to the refund of unutilized Input Tax Credit (ITC), lying in Electronic Credit Ledger, upon discontinuation of business. Refund of ITC u/s 49(6) isn't limited to situations covered by Section 54 only (i.e. Export or inverted duty structure). FULL ORDER -> https://1drv.ms/b/c/2DECE97F1A79D176/Edacugf8mzFOsADue1Gsz4MBP_rM7k7nzCdFOlhXnwJViw?e=LWYQxC #CaseLaw #GST #Refund #HighCourt #CBIC

Local CA firms seek relief in Big 4 push Indian CA firms are demanding relaxation in existing norms—especially restrictions on advertising, external funding, and partnership with non-ICAI members—under the CA Act, 1949. They argue these hinder their growth compared to Big 4 firms. The government is considering reforms to build domestic equivalents to Big 4 by encouraging policy changes akin to China's strategy of supporting local firms over foreign players. #ICAI #MCA #Big4

![Learn & Share Zone..Vtu Cse/Ise Notes [2021 Scheme] WhatsApp Channel](https://cdn1.wapeek.io/whatsapp/2025/02/25/14/learn-and-share-zonevtu-cseise-notes-2021-scheme-cover_fabe23c68653977b3ed3be8742c2866b.webp)