Prateek Garg & Company

June 15, 2025 at 12:33 PM

📌 IMPORTANT GST CASE LAW 🔥🔥

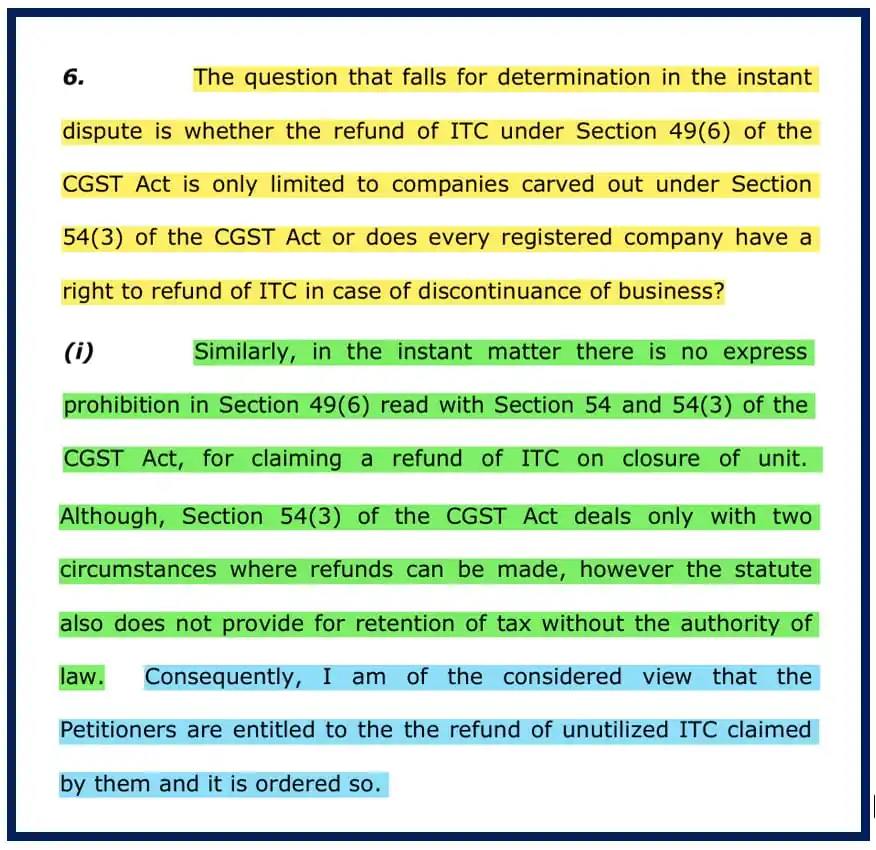

Court allows the refund of unutilized ITC for cases not covered by section 54.

The Hon'ble HC of Sikkim has ruled that petitioner is entitled to the refund of unutilized Input Tax Credit (ITC), lying in Electronic Credit Ledger, upon discontinuation of business.

Refund of ITC u/s 49(6) isn't limited to situations covered by Section 54 only (i.e. Export or inverted duty structure).

FULL ORDER -> https://1drv.ms/b/c/2DECE97F1A79D176/Edacugf8mzFOsADue1Gsz4MBP_rM7k7nzCdFOlhXnwJViw?e=LWYQxC

#caselaw #gst #refund

#highcourt #cbic