NCBA Investment Bank

12.9K subscribers

About NCBA Investment Bank

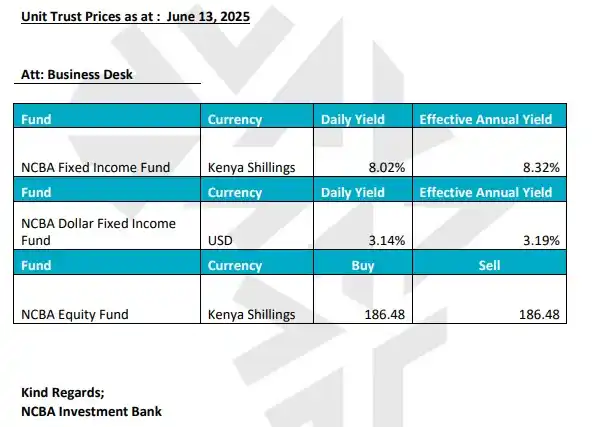

Stay informed with the latest market trends, insights and investment opportunities in just one quick read. Let's navigate the financial waters together and make the most of the available opportunities. Thank you for trusting us as your financial partner. For more information email us on: *[email protected]*

Similar Channels

Swipe to see more

Posts

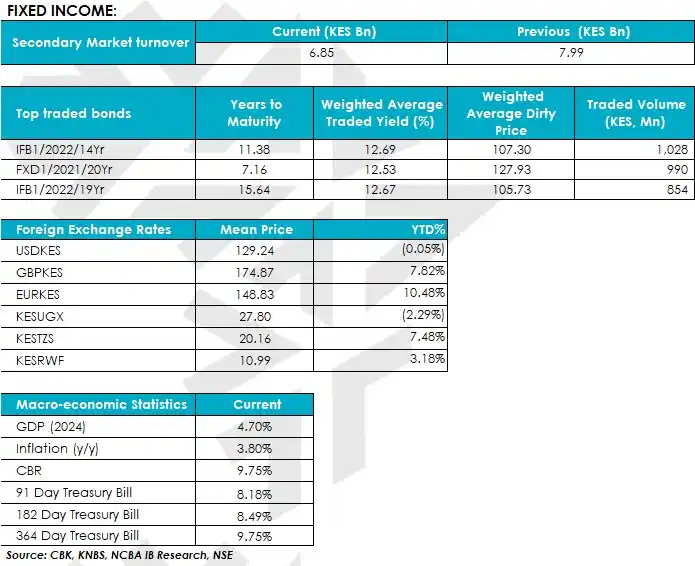

⏺️ secondary bond market turnover *decreased* to *KES 6.85Bn* from *KES 7.99Bn* ⏺️ The *IFB1/2022/14Yrr* was the day’s most traded bond with a weighted average traded yield of *12.69%* ⏺️ The local currency traded against the U.S. dollar at 129.24 ⏺️ on a year to date, the shilling has appreciated by *0.05%* to the U.S. dollar

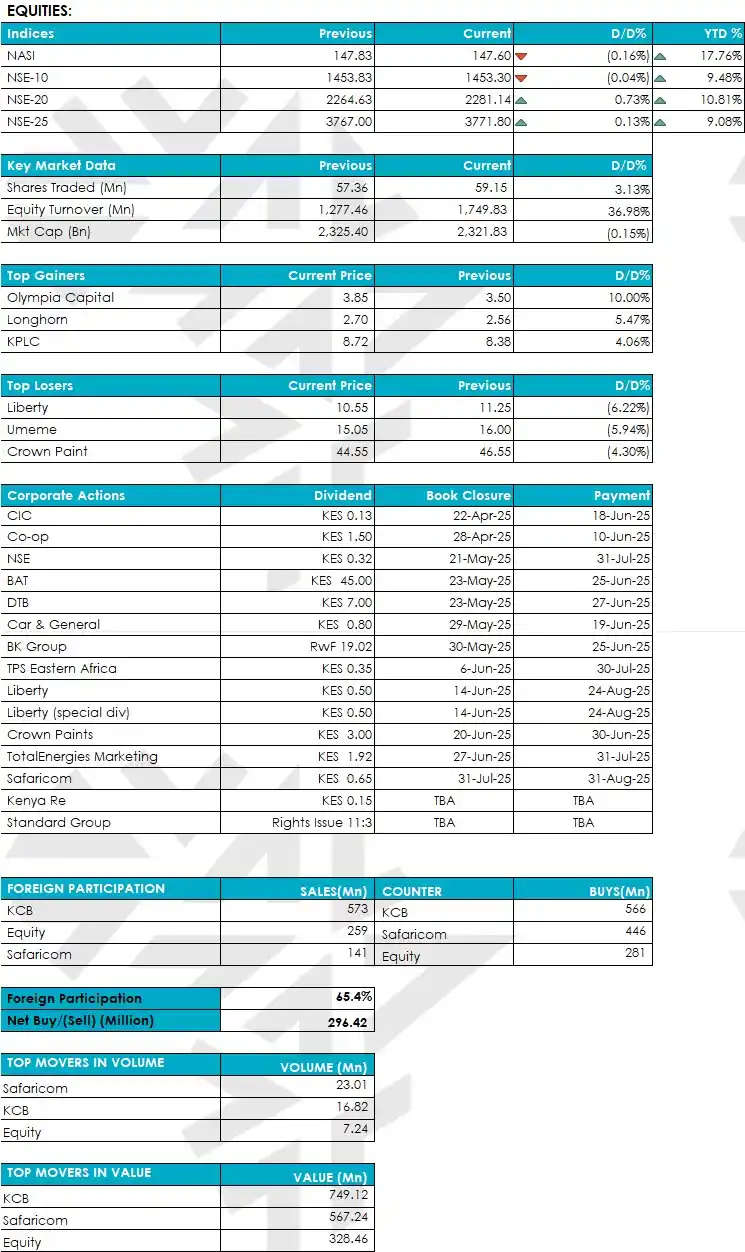

Greetings, Find today’s market highlights below: • The market was down with NASI recording an increase of 0.16% to 147.60. • Shares traded increased by 3.13% to 59.15Mn, with equity turnover also increasing by 36.98% to KES 1,749.83Mn • Safaricom led in volume (23.01Mn shares) while KCB led in value (KES 749.12Mn). • Foreign participation stood at 65.4%, with net foreign buys of KES 296.42Mn, mainly in KCB, Safaricom and Equity. • Olympia Capita (+10%), Longhorn and KPLC led the gainers, while Liberty (-6.22%), Umeme and Crown Paint were the biggest losers

*Former KRA chair acquires Sh1.6bn stake in HF Group* Former Kenya Revenue Authority (KRA) chair Anthony Mwaura, his spouse and daughter bought a Sh1.6 billion stake in HF Group, making the family the second-largest shareholder of the listed mortgage firm. Mr Mwaura, through Toddy Civil Engineering, purchased 81.6 million shares or 4.33 percent of the bank currently worth Sh548.3 million via HF's rights issue, which altered the lender's top ownership list. Source: Business Daily

Happy Father's Day! Your sacrifices may often go unseen, but the impact you make is deeply felt—at home, at work, and in the communities you lead and serve. Today, we celebrate your strength, your quiet leadership, and your unwavering support. Thank you for all you do. #NCBAFathersDay #Goforit

*Blow as EU adds Kenya on list of high-risk nations for money laundering* Kenya joins several third-world nations on the commission’s watch list including Algeria, Angola, Cote d'Ivoire, Laos, Lebanon, Monaco, Namibia, Nepal, and Venezuela. Other African countries already on the list include Burkina Faso, Cameroon, the Democratic Republic of Congo, Mali, Mozambique, Nigeria, South Africa, South Sudan and Tanzania. Outside Africa, some of the jurisdictions on this list are Afghanistan, Myanmar, Vietnam, and Yemen. The commission, however, delisted several jurisdictions from the watch list including Barbados, Gibraltar, Jamaica, Panama, the Philippines, Senegal, Uganda, and the United Arab Emirates. The listing means Kenya faces tough scrutiny of financial transactions involving its entities with the key 27-member European Union (EU) bloc. *_Source:Business Daily_*

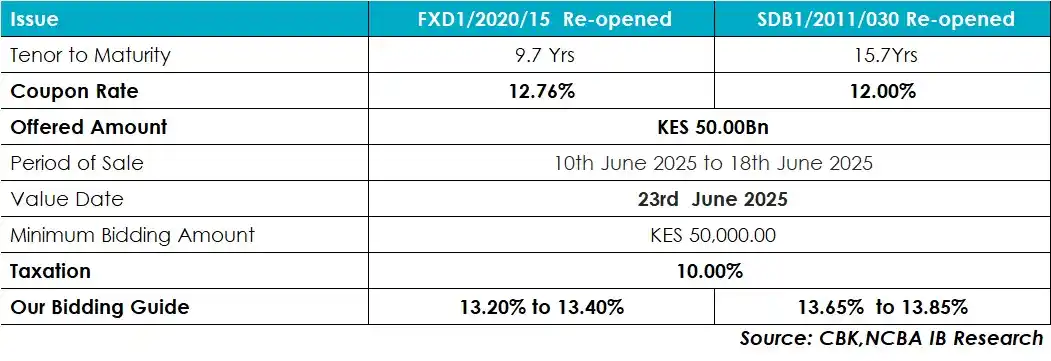

Greetings, The Central bank of Kenya acting in its capacity as fiscal agent for the Republic of Kenya is offering an opportunity to participate in the Re-opened FXD/2020/15 and SDB1/2022/030 seeking to raise KES 50.00Bn for budgetary support. *_Please find our comprehensive report here: https://investment-bank.ncbagroup.com/downloads/bond-auction-june-2025_*

*IRA seeks tighter scrutiny of money laundering life insurers* The Insurance Regulatory Authority (IRA) is seeking tighter scrutiny of life insurance business to lower exposure to money laundering and terrorism financing threats. The regulator says the packaging of life insurance products, also called long-term business, makes them prone to money laundering and terrorism financing threats and tighter supervision is required. Treasury Cabinet Secretary John Mbadi told Parliament on Thursday the IRA is currently reviewing the activities of long-term insurers to identify gaps that will inform improved supervision. Source: Business Daily

*Lake Turkana power output declines on lower wind speed* Company disclosures show that LTWP’s net generation was 1,367 Megawatts-hour (MWh) from 1,481MWh produced in 2023. The drop came in a year when average annual wind speed in the area dropped to 9.6 metres per second (m/s) from 10.6m/s the previous year. Last year’s annual net generation is the second lowest since the 310-Megawatt-Plant started supplying electricity to Kenya Power in 2018. _*Source: Business Daily*_

*State to borrow Sh635bn from domestic market* The National Treasury targets to borrow an additional Sh30 billion, 4.9 percent increase, from the Kenyan market compared to this financial year when it borrowed Sh605.7 billion. External borrowing will be Sh287.7 billion up from Sh281.5 billion borrowed this year or a 2.2 percent increase, signaling increased reliance on Treasury bills and bonds to cover the budget shortfall. “The fiscal deficit for the full year 2025/26 budget will be financed by net external borrowing of Sh287.7 billion, equivalent to 1.5 percent of gross domestic product (GDP) and net domestic borrowing of Sh635.5 billio,” said Treasury Cabinet Secretary John Mbadi. The fiscal deficit of 4.8 percent of the GDP is an improvement compared to last year’s estimate of Sh997.5 billion or 5.7 percent of the GDP. *_Source:Business Daily_*