Swarnadhaaraa FinServ

355 subscribers

About Swarnadhaaraa FinServ

Helping Individuals Build Real Wealth Stories via Lumpsum, SIP, & SWP | Trusted by 800+ families | Since 1984 | Trichy | Mutual Funds, PMS, AIF & Term Insurance Distributor https://linktr.ee/swarnadhaaraa Mob: +919994371711, +918072688020

Similar Channels

Swipe to see more

Posts

*India – 4th Largest Economy… But Are We Growing Equally?* India recently became the *4th largest economy in the world* by nominal GDP, a milestone worth celebrating. But behind the celebration lies a deeper question: *How is the average Indian truly doing?* Let’s look beyond GDP, and focus on *GDP per capita and the Human Development Index (HDI)*, two key indicators of individual well-being: *A Decade of Progress: Then vs Now* *_GDP per Capita (Nominal)_* • 2015: ~$1,600 | Rank: 148 • 2025 (est.): ~$2,900 | Rank: 143 *_UNDP – Human Development Index (HDI)_* • 2015: 0.624 | Rank: 130 out of 188 • 2025: 0.685 | Rank: 130 out of 193 Despite strong headline growth, *India’s per capita income and HDI ranking still lags behind many developing peers*. *What can be done to bridge this gap?* The government has initiated efforts across several key areas, but *greater policy focus and execution* are essential: 1. *_Job creation & skilling_*: Empower MSMEs, boost manufacturing, and drive large-scale upskilling. 2. *_Education reform_*: Shift toward skill-based, tech-enabled, and inclusive learning in public education. 3. *_Healthcare access_*: Strengthen public health infrastructure and increase investment in healthcare. 4. *_Financial inclusion_*: Expand access to banking, savings, insurance, and social security for all. 5. *_Urban & Rural Infrastructure_*: Improve roads, connectivity, logistics, and digital access. 6. *_Women & Youth Empowerment_*: Bridge gaps in income & opportunity through focused policies. 7. *_Governance & Institutional Reform_*: Enable transparent, efficient, and citizen-first policy delivery. Economic size is important. But *real progress* is when growth is *felt by every citizen* through better health, education, and income. Let’s build an India where progress is *inclusive, equitable, and sustainable*. #India #HDI #GDP #PerCapitaIncome #InclusiveGrowth #PolicyMatters #HumanDevelopment #Economy #SwarnadhaaraaInsights #GrowthWithPurpose

*RBI’s Rs. 2.69 Lakh Crore Dividend to Government: How the Largest-Ever Transfer Can Power India Forward* *What is a Dividend from RBI to Government?* The RBI earns income from interest on government bonds, foreign exchange reserves, and other financial operations. After accounting for its expenses and risk provisions, it transfers the surplus (or dividend) to its sole owner, the Government of India. For FY25, the RBI has announced a record dividend of *Rs. 2.69 lakh crore*, which is *28% higher* than the Rs. 2.1 lakh crore transferred in FY24. But what does this really mean for our economy and for us as citizens? *Here is the impact in simple terms:* - *_Boosts Government Finances_*: Strengthens the fiscal position and reduces the need for borrowing. - *_Room for Growth-Focused Spending_*: Funds may be channeled into infrastructure, rural welfare, or even tax relief. - *_Positive for Markets_*: Lower borrowing can ease bond yields and improve investor confidence. - *_Indirect Benefits to Citizens_*: Potential for better public services, Stable EMIs if interest rates stay steady, More job creation if capital expenditure increases If used wisely, this windfall can accelerate India’s journey toward a stronger, and more resilient economy. *Responsible fiscal management + strong monetary support = a powerful combination for a developing economy* #RBI #Dividend #IndiaEconomy #FiscalPolicy #Investing #MutualFunds #FinancialPlanning

*Moody’s Downgrade on US Credit Rating – Should Indian Investors Worry?* Moody’s has downgraded the US credit rating from Aaa (Negative) to Aa1 (Stable), raising concerns over growing fiscal deficits. The reduction in rating has triggered conversations across global markets *What does this mean* ? - US bond yields may rise, as investors demand higher returns for perceived risk. - Risk assets could see volatility, including equities and emerging markets. - The US dollar might face pressure, leading to potential currency movements. *India’s Perspective* : - There could be possibilities of temporary FII outflows, impacting capital markets and the rupee. - Indian bond yields may move in line with global trends, affecting borrowing costs. - But India’s strong macro fundamentals offer a cushion against short-term shocks. *Our message to investors* : Stay calm. Stay invested. Short-term noise doesn’t derail long-term goals. As always, market volatility creates opportunity for those with discipline and patience. #USDebt #IndiaMarkets #InvestorInsights #MutualFunds #SIP #StayInvested

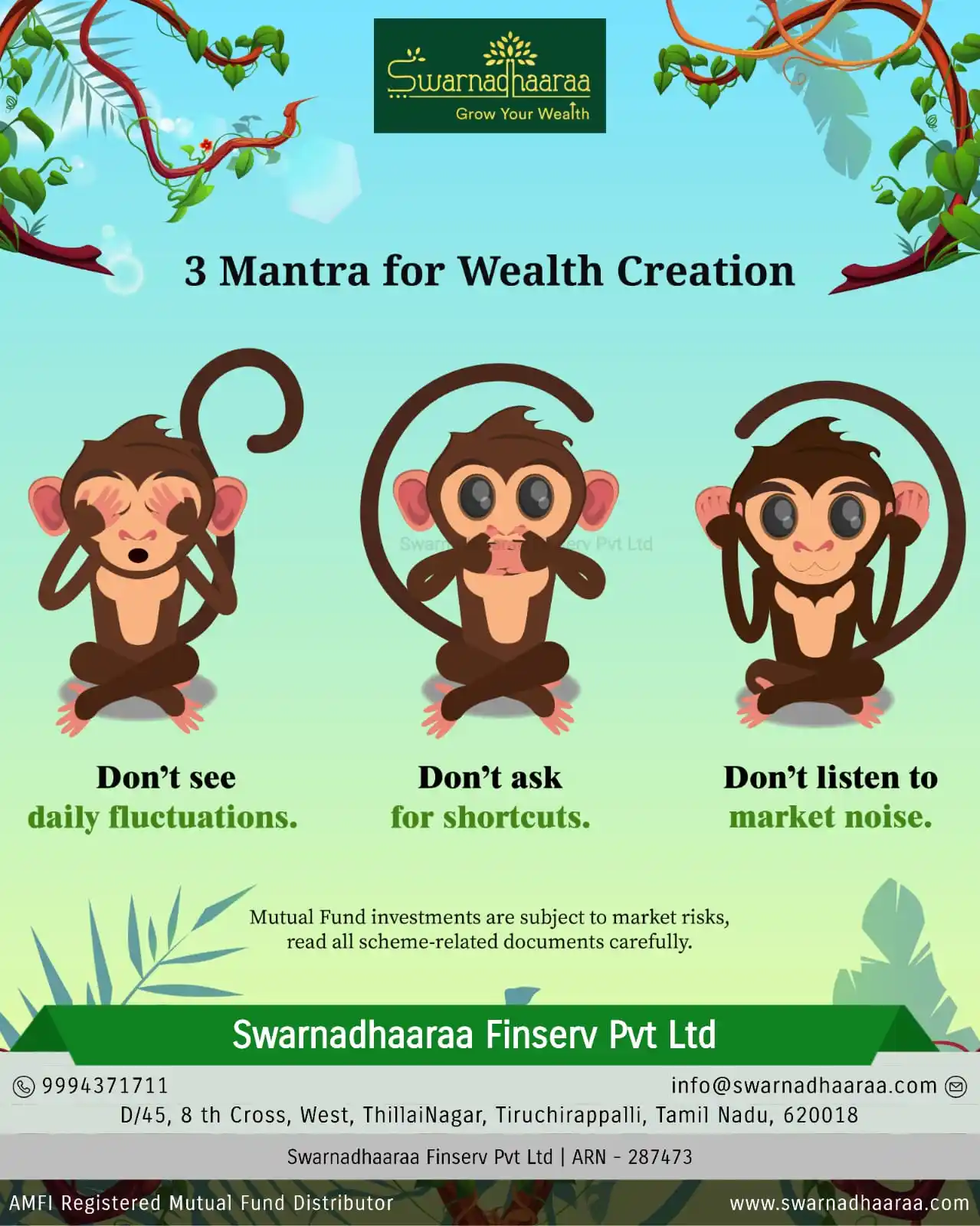

*3 Timeless Mantras for Wealth Creation* 1. *_Ignore Daily Fluctuations_*: Wealth is built over years, not days. Let time and compounding do their magic. 2. *_Avoid Shortcuts_*: There are no get-rich-quick schemes, only get-rich-slow disciplines. 3. *_Silence the Market Noise_*: Stay focused on your goals. News headlines don’t pay your bills, whereas your discipline does. #WealthCreation #InvestingMantras #LongTermThinking #FinancialDiscipline #CompoundingMagic #NoShortcuts #GoalBasedInvesting #MutualFundsSahiHai

*Get Rich ONCE – That’s All You Need.* And Mutual Funds can take you there. In a world chasing quick returns and overnight success, the *real wealth* is built quietly through *discipline, patience, and smart investing*. You don’t need to get rich again and again. *_You just need to do it once but in the right way_*. And *mutual funds* can be your *lifelong partner* in this journey: - Start small - Stay consistent - Let compounding do the magic Whether it is through *SIPs or lumpsum*, your journey to financial freedom begins with one simple decision — "*to start*". At Swarnadhaaraa Finserv, we have seen clients transform their financial lives not by timing the market, but by *staying in it*. Still waiting for the “ *right time*”? The best time to *plant a tree was 20* years ago. *The second-best time is today*. Ready to get rich once, and stay rich for life? Let’s talk. We are here for you. #MutualFunds #WealthCreation #SIP #FinancialFreedom #LongTermInvesting #SwarnadhaaraaFinserv #GetRichOnce

*AUM of Rs. 1 Lakh Crore: A Historic Milestone for HDFC Balanced Advantage Fund!* It's been 31 years, and this fund is still going strong! Through multiple market cycles, global crises, and economic shifts, *HDFC Balanced Advantage Fund* has stood the test of time, and delivered an *impressive ~18% CAGR since inception*. *To put that in perspective*: An investment of Rs. 1 lakh made nearly 30 years ago would be worth ~*Rs. 1.7 crore today, a 170x growth*! We're happy and proud to share that *_many of our clients have benefited from this scheme and continue to do so with disciplined investing_*. *Congrats* to *HDFC Mutual Fund and the entire team* behind this remarkable feat. A true example of consistency, resilience, and long term wealth creation. P.S: _Past performance does not guarantee future results. Pls consult your advisor before investing_ #MutualFundsSahiHai #WealthCreation #LongTermInvesting #DisciplinedInvesting #PowerOfCompounding #MutualFundJourney

*Stronger Together: Team Swarnadhaaraa is Now AMFI-Certified!* We’re excited to share that all our four employees have successfully cleared the *AMFI certification*, and that too, on the *very first* attempt! What makes this achievement truly special for us is that we did it entirely through *self-study and helping each other* , without any external training or coaching. While this might be common in firms in Tier I cities or mutual fund houses or corporates, *it was the first time we attempted this internally*, and we’re proud to have set a new benchmark for ourselves. _*We are now a fully AMFI-certified team, better equipped to serve our clients with even more knowledge and confidence!*_ #SwarnadhaaraaFinserv #AMFICertified #MutualFunds #TeamMilestone #ContinuousLearning #ClientFirst #Trichy #Tier2Pride