Wealth Master

1.9K subscribers

About Wealth Master

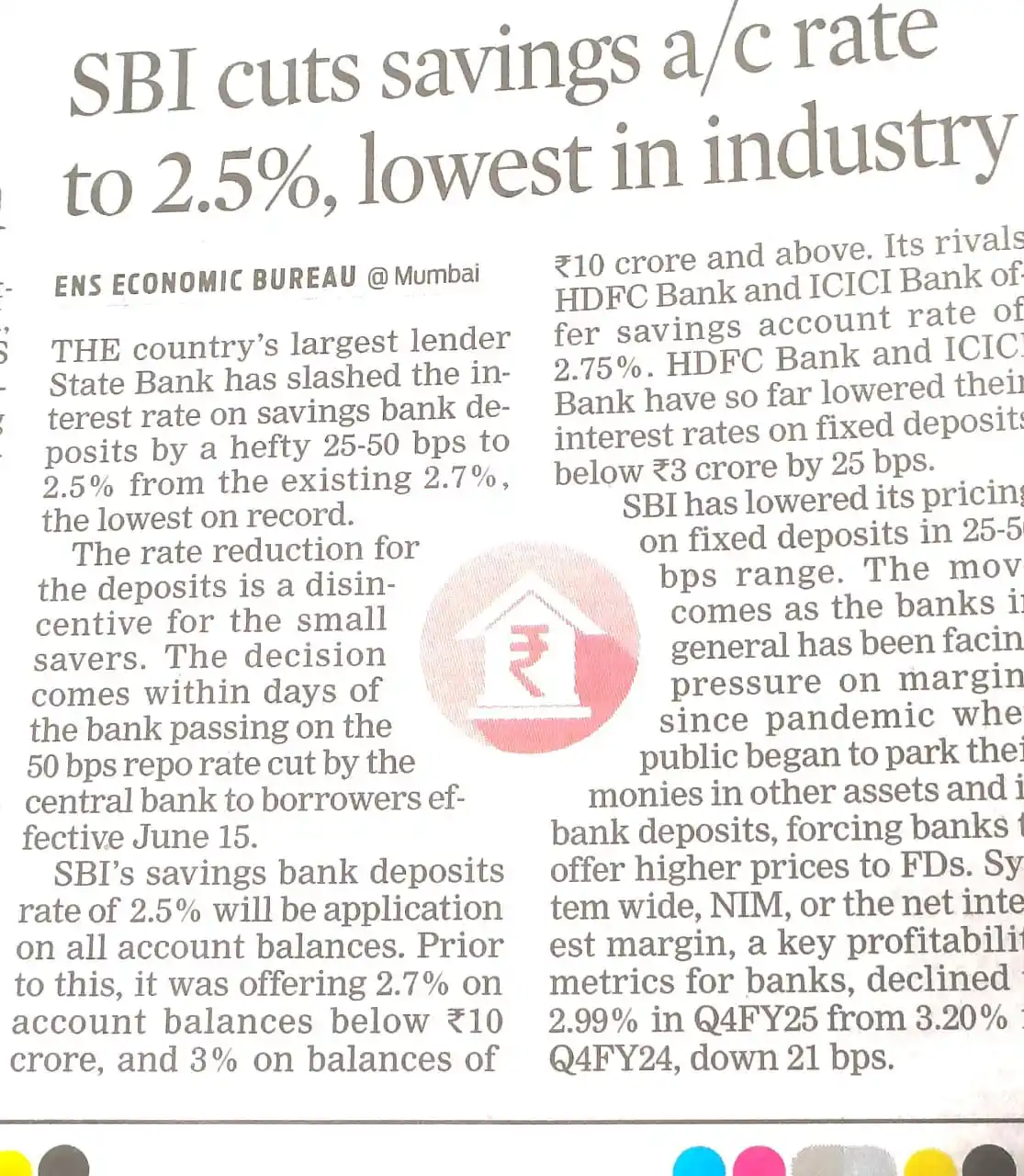

Success follows Discipline & consistent efforts paving the way for all financial achievements Stay Invested & Reap the Compounding Benefits #dontretirerich STANDARD DISCLAIMER APPLIES... Mutual fund investments involve market risks. Read scheme documents carefully before investing. Information provided is for education only, not financial advice. Investment decisions are the investor's responsibility Channel by Srikanth Matrubai Author DON'T RETIRE RICH Qualified Personel Finance Professional AMFI REGISTERED MUTUAL FUND DISTRIBUTOR REBALANCE VOLATILITY CERTIFIED COACH

Similar Channels

Swipe to see more

Posts

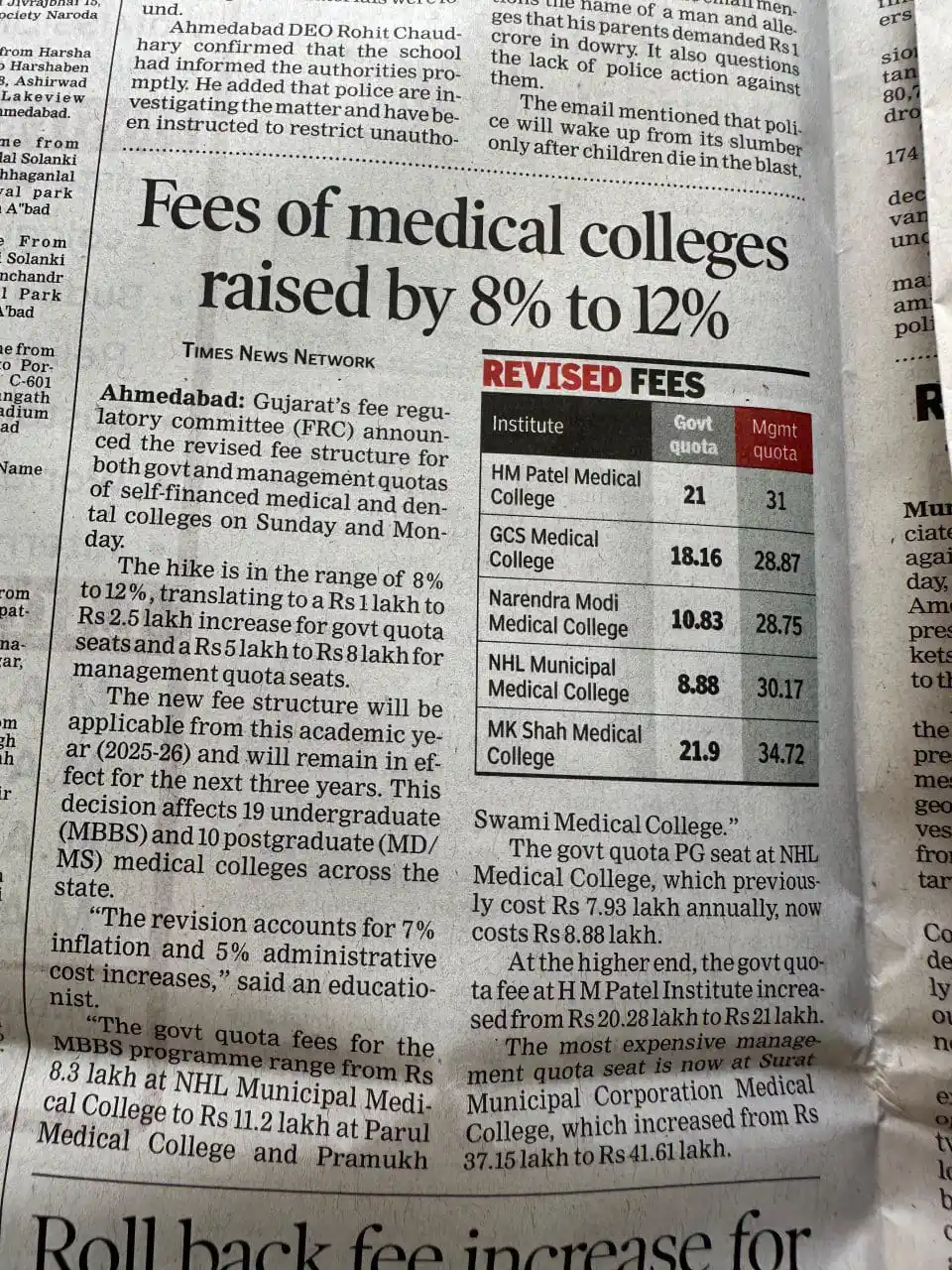

Mutual Funds Sahi Nahi... Mutual Funds Zaruri Hai! Have a look at Education Inflation!! A ₹10 lakh degree today may cost ₹35-40 lakhs in just 10–15 years! No FD, no gold scheme is going to keep up with that pace. But your SIP can. Start early. Stay disciplined. Because your child’s dreams deserve more than just savings. #srikavi #dontRetireRich

*People are disappointed looking at price bands for HDB financial ipo at 740s. When it was trading at 1200+ in unlisted space.* Wait till IPO price bands for Nsdl and Nse get announced. Unlisted investing= Fomo investing many times with no regards to fundamentals. Just ask the people investing in unlisted about the market cap of the co. 70-80% of the folks won't be able to answer in my experience. people bought 1200 - 1400 HDB Financial and 3000 - 3500 Paytm and heavily disappointed ☹️ on ipo. Apart from these, they unlisted Share buyers need to hold for 6 months post ipo as lock-in period.

*Have you invested in crypto currency and not declared it?* Beware... the Taxman (Taxwoman?) cometh... (FE)

🔍 Step-by-Step Guide: Using SEBI MITRA to Find Forgotten Mutual Fund Investments 🧾💡 ✅ 1. Visit the Official Portal 🌐 Go to 👉 MFcentral.com – the official platform for SEBI MITRA. 🧾 2. Enter Your PAN 🪪 Input your Permanent Account Number (PAN) to begin your search. 🔐 3. Verify Your Identity 📲 You’ll receive a One-Time Password (OTP) on your registered 📞 mobile number or 📧 email. 👉 Enter the OTP to proceed. 🛠 4. Provide Additional Details (Optional but Helpful) 📝 To boost your chances of locating old folios (especially pre-2006), you can add: 📱 Registered phone number 📧 Email address 🏦 Bank account number 🏙 City, PIN code, or address 🎂 Date of birth or 🧾 Nominee details 💡 These help locate folios created before PAN became mandatory. 🔍 5. Initiate the Search 🚀 Click “Proceed” to start looking for inactive or unclaimed folios linked to your inputs. 🔄 6. Review and Update KYC (If Match Found) 📋 If any folios are found: 🛂 Follow the steps to update your KYC 💸 Begin the process to reclaim your investments 📌 Important Points to Remember 🧠📎 💤 Inactive Folios 🕰 A folio is considered inactive if: There have been no investor-initiated transactions (financial or non-financial) for 10 years ⏳ But it still holds a balance 💼 🔁 Multiple Search Attempts Allowed 🎯 You can make up to 25 search attempts per user 👤 — giving you plenty of chances to find what’s yours! 😄 🏢 Platform Availability 🌍 SEBI MITRA is managed by: 🏛 KFin Technologies & CAMS (India’s top QRTAs) Also accessible via: 🌐 MF Central 🏢 Mutual Fund AMCs 📊 AMFI 🏛 SEBI 🎉 Start your search today and take a step closer to reclaiming your forgotten investments! 🪙📈

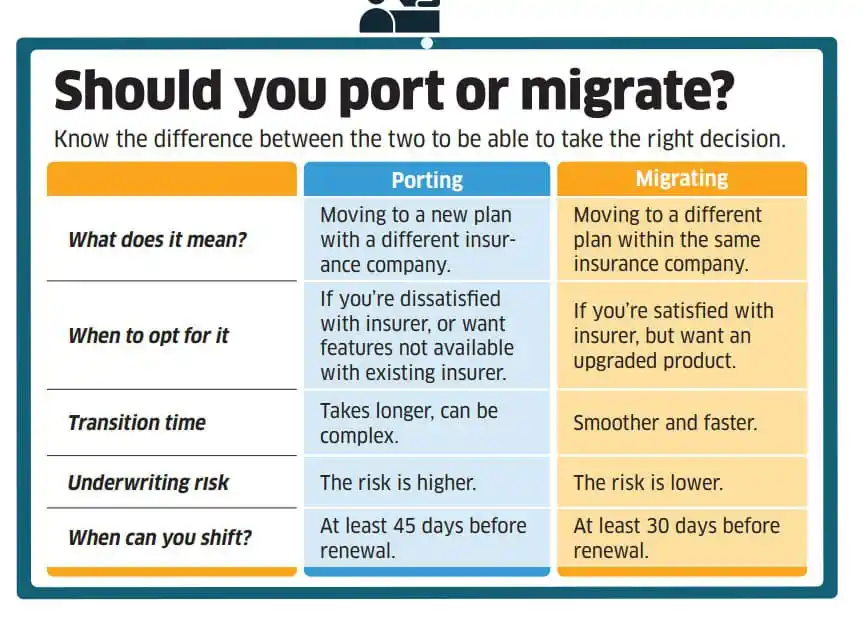

Should you port or migrate your insurance? Which is better?

Most fathers are like coconuts—tough on the outside, but pure emotion inside! A father isn’t just your first protector—he’s your FIRST career counsellor, your biggest cheerleader, and your silent strength. I lost my dad when I was just 9, but his words still echo in my mind: “Son, focus on knowledge, not just on exams. Marks will follow automatically.” Isn’t it the same with investing? Focus on the process, not just the markets. Financial goals will follow automatically! Thank you, Dad, for your timeless wisdom, your love, and the values you’ve instilled in me. #Srikavi #DontRetireRich