Finshots

4.2K subscribers

About Finshots

Financial news made simple!

Similar Channels

Swipe to see more

Posts

*India is not for beginners!* After government bans bike taxis, people start booking themselves as parcels to book rides on Rapido. 📦 That's not a joke, it's Bengaluru's latest jugaad. Since passengers aren’t technically allowed, some riders are now labeling them as “parcels” and delivering humans across the city like courier packages. Sounds absurd? Well, it is. But it also tells you how desperate the situation has become. Because this hack didn’t come out of nowhere. It’s the result of years of confusion between bike taxi startups and the government. Private bikes can’t be used for commercial rides. But demand was high. Services grew anyway. Now, the state has cracked down. Over 100 bikes were seized this week. And apps like Rapido have had to shut operations across Karnataka. It’s a big blow. Not just to businesses, but to riders too. For many, this was their main source of income. And let’s not forget the commuters. Bike taxis were cheap. Quick. And perfect for Bengaluru’s traffic chaos. So why didn’t the government just regulate it? They could’ve set permit rules. Safety norms. Tax structures. Other states like Maharashtra and Delhi have already done it. Karnataka could have too. In fact, it’s missing out on serious money. Just the permit fees and GST could bring in around ₹85 crore a year. But the cost of this delay is real. Thousands lose work. Startups lose trust. And citizens lose options. A promising mode of transport gets stuck in limbo. Read the full story in today’s Finshots: https://tinyurl.com/Bengaluru-Bike-Rapido-Parcel

A fertiliser shortage in Uttar Pradesh. A delayed shipment in Visakhapatnam. A military strike in the Middle East. Sounds unrelated, right? But zoom out, and a bigger picture emerges. Fertilisers. The unsung backbone of our food system. While the world obsesses over oil prices after a fresh Iran-Israel conflict, a quieter, more dangerous shock is brewing: one that starts with fertiliser shortages and ends with higher food prices on your plate. You see, the core ingredients that go into making fertilisers — nitrogen, phosphorus, and potassium, largely come from countries sitting on geopolitical fault lines. Iran, Saudi Arabia, Russia, Morocco - all critical suppliers. And when war or sanctions hit, these supply chains buckle. For India, which imports most of its fertilisers and spends over ₹1.8 lakh crore on subsidies just to keep prices low for farmers, this creates a dangerous squeeze. If prices rise globally, the government either swallows the extra cost, worsening the fiscal deficit, or lets prices trickle down to farmers and eventually to your local kirana store. So if your next packet of dal or atta feels slightly more expensive, the reason might be a fertiliser shipment stuck at a foreign port, not just a fuel hike. It’s a classic second-order effect. And it’s happened before. We break it down in today's Finshots: https://openinapp.link/m2is5

L&T threw out the founders of this IT major from their own company! Here's the story: https://www.linkedin.com/feed/update/urn:li:activity:7340967133838745601 PS: This week Finshots plans on bringing you the most dripping boardroom dramas from Corporate India, so stay tuned!

This man was responsible for the biggest bank defaults - Jet Airways, IL&FS, DHFL! Here’s the full story👇 https://www.linkedin.com/feed/update/urn:li:activity:7340612389257584641

Is your home also caught in the AC temperature war - 18°C or 24°C? Well, the government might actually settle the debate for good. That's because they're thinking of putting a cap on how low your AC can go. Under this, ACs will no longer cool below 20°C or heat above 28°C. Sounds odd, right? But there’s a reason. You see, air conditioner ownership in India has tripled since 2010. With AC ownership rising fast and electricity bills soaring, the government wants to cut down on the power we use to stay cool. But here’s the thing: temperature caps alone won’t solve the crisis. India’s cities are built in a way that trap heat instead of reflecting it. Roads made of asphalt, glassy high-rises, everything around us is working against efficient cooling. And while some parts of the world are already experimenting with better designs, India might have its own answers hidden in traditional architecture, like the classic jaali or using materials like bricks or clay. Plus right now, ACs are taxed like luxury goods. But in a country where summer feels like 50°C, that label and the 28% GST that comes with it, feels increasingly out of place, making people go for cheaper, less efficient models. So yes, setting limits on your AC may be one step. But the real fix lies in rethinking how we build, design, and cool our spaces. We unpack the details in today’s Finshots! https://tinyurl.com/One-nation-one-ac

The CEO of this $365 billion corporate empire was fired in a 30 min meeting! This week Finshots plans on bringing you the most dripping boardroom dramas from Corporate India! https://www.linkedin.com/posts/finshots_tata-vs-mistry-activity-7340241579682484224-Y6Su?utm_source=share&utm_medium=member_desktop&rcm=ACoAADvCetcBqx_Pb9FINOdmA0Kk_yECvQK2cg8

📚*Do you plan on moving abroad, studying in a foreign university?* Well, we have a reality check for you. We spoke to real people to understand how their life experience was when they moved out of India, and did it make sense, atleast financially? Check out this video from FinshotsTV, and let us know if you would plan to move abroad after watching this👇🏻 https://youtu.be/k0NdBN194s0

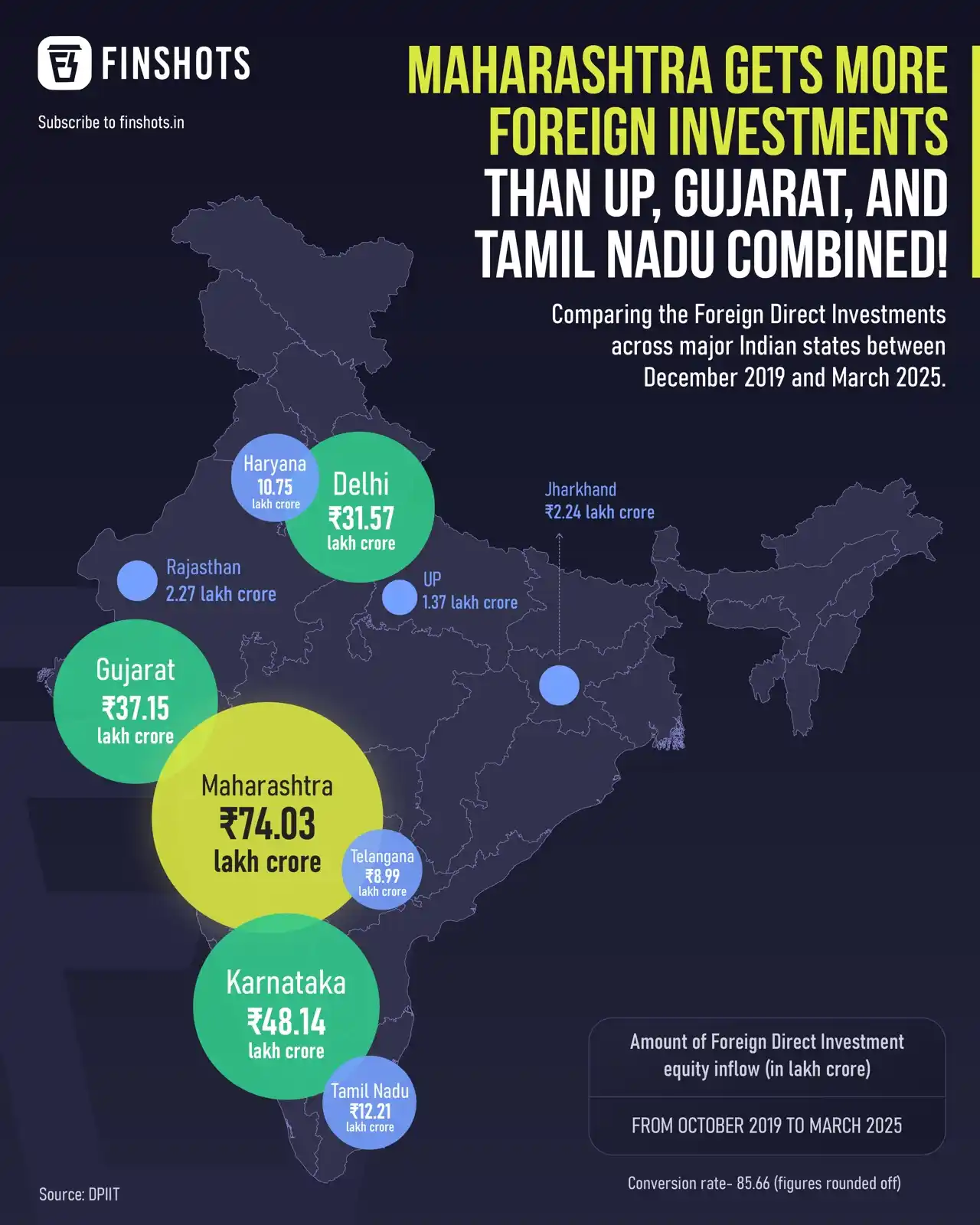

Maharashtra gets more Foreign Investments than UP, Gujarat, and Tamil Nadu combined! Do you think any state can beat Maharashtra in terms of FDI in the next decade? https://www.linkedin.com/feed/update/urn:li:activity:7337811521328005121

Can you guess who made the most money from IPL? The Government! Through indirect taxes, TDS, corporate tax, etc., IPL became a money minting machine for Indian government. Read more: https://www.linkedin.com/feed/update/urn:li:activity:7336354953352925186

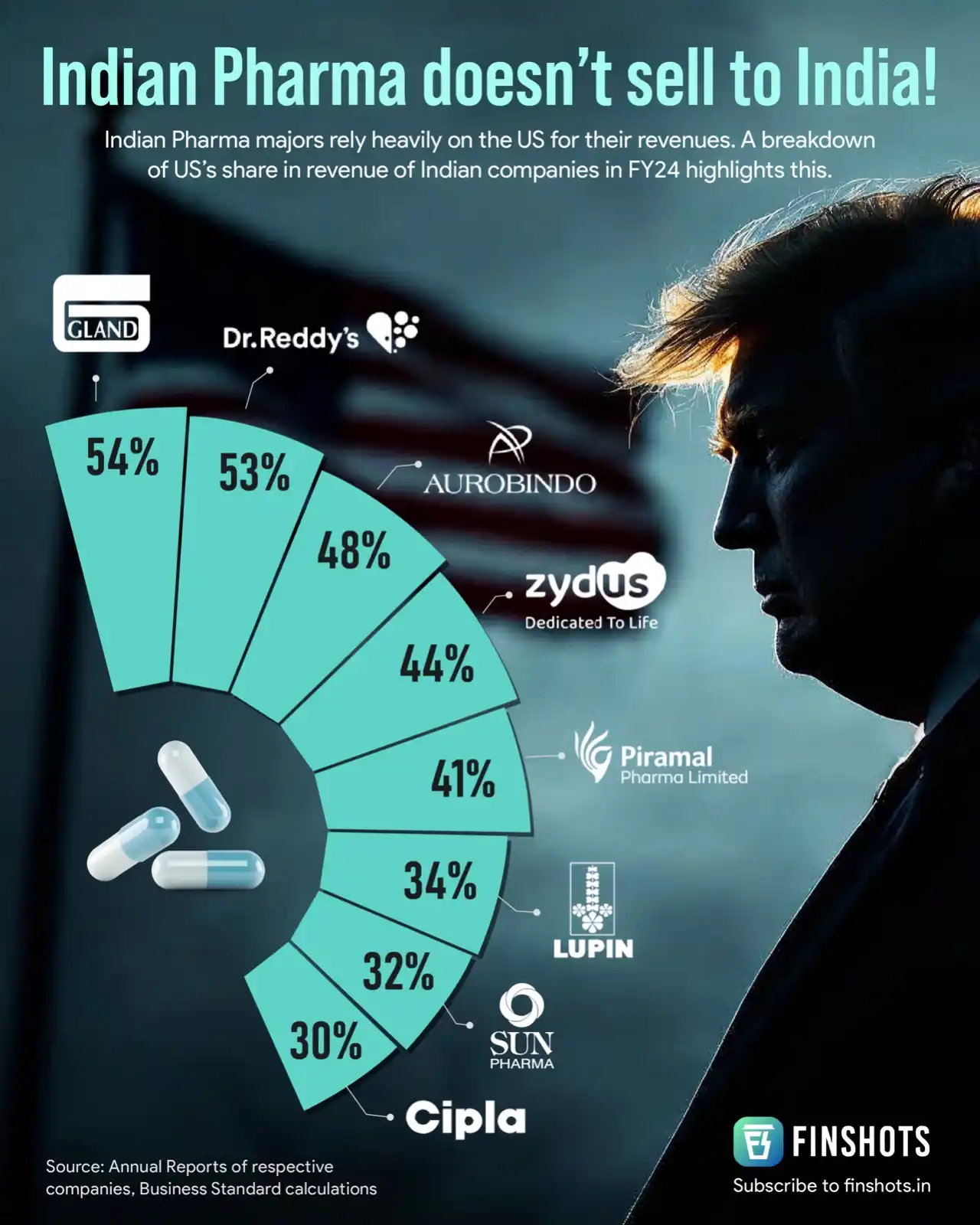

Indian Pharma companies don't sell to India! USA is one of the biggest markets for Indian Pharma giants. https://www.linkedin.com/feed/update/urn:li:activity:7338166165048803328