Trader Pulse By Vishal

156 subscribers

About Trader Pulse By Vishal

*Remember:* Trading carries risks, and past performance doesn't guarantee future results. Make informed decisions based on your risk tolerance, market analysis, and financial goals. _*✆ +919819144456*_ _*Social Handles*_ _*linkedin.com/in/ivishalpal*_ _*youtube.com/@traderpulseyt*_ _*in.tradingview.com/u/ivishalpal*_ _*®️NUVAMA ACCOUNT OPENING LINK👇🏻*_ _https://onboarding.nuvamawealth.com/Partner?utm_source=EMPLOYEE&utm_campaign=36638&utm_content=ELITE_

Similar Channels

Swipe to see more

Posts

_Morning Snippet:- 15th May 2025_ *Index Observation* Nifty spent majority of its yesterday’s trading session above the recently derived support of 24600. The index has been confined within a band after a wide range day seen at the start of this week. Balance of this week is expected to remain volatile with an upside possibility remaining open for 24900 / 25400 unless 24600 is decisively given away. Bank Nifty has been underperforming for the past 2 trading days, with yesterday’s closing seen below its previous day’s low as well as a break of range on the lower side. The expected range of 54900 - 55900 has been broken down on a closing basis furthering the possibility of the ongoing underperformance to continue against Nifty. A retest of 53900 now opens up on the index, if it starts trading below 54500 odd once again. Nifty’s weekly expiry is scheduled for today while the weekly closing on charts is scheduled for tomorrow. *Interesting Observation* The attached chart illustrates the daily price movements of spot Gold and Silver. Following the formation of a classic bearish pattern – the double top, Gold (upper panel) has broken below the consolidation range that had held since early April 2025. This breakdown, after a strong prior uptrend, suggests a corrective phase may be underway. In contrast, Silver (lower panel) did not experience a strong rally like Gold, but has demonstrated relative strength by maintaining support at the lower end of its range. As discussed last month, the Gold-to-Silver ratio had reached historically stretched levels, indicating a potential reversal. That correction appears to have begun, and ongoing price action in both precious metals could further support a retracement in the ratio—potentially signalling a broader shift in the trend dynamics between Gold and Silver. *DERIVATIVES | Trade Setup* *Cash Market Activity* FII: ₹ 931 Cr DII: ₹ 316 Cr *Week-to-Date (WTD)* FII: ₹ 1,701 Cr DII: ₹ 6,037 Cr *Month-to-Date (MTD)* FII: ₹ 9,558 Cr DII: ₹ 19,778 Cr *F&O Cues* FIIs have added 1.7k long contracts in the latest session. The net position now stand at 34.8k short contracts. In the options segment, the 24500 strike continues to act as a strong support level, indicated by the highest put open interest, while 25,000 remains the key resistance, marked by the highest call open interest. *New 52 Week High Low Data* *Large Cap:* New 52 Week Highs: 0 New 52 Week Lows: 0 *Mid Cap:* New 52 Week Highs: 5 New 52 Week Lows: 0 *Small Cap:* New 52 Week Highs: 8 New 52 Week Lows: 0 *NIFTY500:* New 52 Week Highs: 11 New 52 Week Lows: 0

📊 *Bazaar Brief - 14th May, 2025* *❕Trader Pulse By Vishal❕* *THIRD STRAIGHT DAY OF GAINS FOR MID, SMALL-CAP INDICES* *•* Sensex and Nifty gained 0.2% and 0.4% respectively. Sensex settled at 81330, up 182 points while Nifty added 88 points to finish at 24666. Nifty mid-cap and small-cap indices surged 1.1% and 1.4% respectively, extending the winning streak to third straight session and closing at the highest level after 8th and 23rd January respectively. *•* Except 0.2% lower Bank index and flat Financial Services index, all the sectoral indices ended higher, with Metal and Realty indices on the top, up 2.5% and 1.7% respectively. Tata Steel and Shriram Finance were the top Nifty gainers, up 3.9% and 2.8% respectively whereas Asian Paints and Cipla were the top losers, down 1.7% and 1.3% respectively. NSE advance-decline ratio stood at 3.1:1. *•* Rupee appreciated 6 paise to end at 85.27/$. *•* India's wholesale price inflation dipped to a 13-month low of 0.85% in April from 2.05% in the previous month. *•* Main European markets were down 0.2%-0.6%. *•* U.S. stock futures were little changed. *Open an account, react, and share. Follow us on social media for the latest updates and valuable financial content.* _*ACCOUNT OPENING LINK's*_ 👇🏻 *_• NUVAMA_* _https://onboarding.nuvamawealth.com/Partner?utm_source=EMPLOYEE&utm_campaign=36638&utm_content=ELITE_ ✅ WhatsApp Channel: https://t.ly/_6T9j ✅ Youtube: https://t.ly/frb4G ✅ Telegram: https://t.me/traderpulseyt ✅ Instagram: https://t.ly/wyjFy ✅ LinkedIn : https://t.ly/g_SjB ✅ Tradingview: https://t.ly/-UGgZ *Note:* This post is just for educational purposes and not a buy/sell recommendation.

_Morning Snippet :- 16th May 2025_ *Index Observation* With a sharp rally unfolding backed by extremely volatile moves on the index, Nifty completed its initial target of 24900 and closed above the same. The index now is open to scale further towards 25400 which we have been highlighting for the past 2 sessions. Support can now be trailed higher to 24800 odd as Nifty ended its weekly expiry session at a 6 month high. Bank Nifty reversed tracing Nifty’s strong move despite showing weakness in the past 2 trading session. Instead if retreating towards 53900 the index moved northwards forming a bullish flag formation on daily charts. A closing above 55600 is now likely to confirm further bullish breakout in this set up for a strong leg upside. Weekly closing on charts is seen today. *Interesting Observation* This chart illustrates the year-to-date normalized returns of the S&P 500 and the Magnificent Seven. The Magnificent Seven stocks are a group of high-performing and influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. Once seen as dominant market leaders, these tech giants have underperformed the broader index in 2025. While the S&P 500's returns remain relatively neutral, the Magnificent Seven are in negative territory. This lagging performance questions their dominance and marks a notable shift in leadership from the market's usual tech-driven narrative. **DERIVATIVES | Trade Setup** **Cash Market Activity** FII: 5,392.94 crore DII: -1,668.47 crore **Week-to-Date (WTD)** FII: 7,094.94 crore DII: 4,368.53 crore **Month-to-Date (MTD)** FII: 14,950.94 crore DII: 18,109.53 crore **F&O Cues** FIIs added 21,000 long contracts in index futures in the latest session, bringing their net position down to 13,800 short contracts. In the options segment, the range has shift higher with 24,500 strike to act as strong support, indicated by the highest put open interest, while 25,500 to act as resistance, marked by the highest call open interest. *New 52 Week High Low Data* *Large Cap:* New 52 Week Highs: 3 New 52 Week Lows: 0 *Mid Cap:* New 52 Week Highs: 6 New 52 Week Lows: 0 *Small Cap:* New 52 Week Highs: 4 New 52 Week Lows: 0 *NIFTY500:* New 52 Week Highs: 13 New 52 Week Lows: 0

*Limited time opportunity* on *Gold Twin Win*. We had launched Gold TW with 5% min IRR for an exclusive time period as a limited opportunity for clients to lock-in minimum 5% return (the Nifty 50 equivalent Nifty Twin Win has 6% min IRR). Going ahead (*from 1st June*) this min *5% IRR will get normalized to 4%* (absolute min return will be 14.7% reduced from current 18.62%) basis underlying asset i.e., Gold. So request all to leverage on this limited time opportunity and provide your clients with higher guaranteed returns in the current volatile markets.

📊 *Bazaar Brief - 13th May, 2025* *❕Trader Pulse By Vishal❕* *SENSEX, NIFTY COOL-OFF; MID, SMALL-CAP INDICES EXTEND UPMOVE* *•* Sensex and Nifty slipped 1.6% and 1.4% respectively, giving away 40% of the mammoth gains earned yesterday. Sensex settled at 81148, down 1281 points while Nifty lost 346 points to finish at 24578. Nifty mid-cap and small-cap indices gained 0.2% and 0.8% respectively. *•* Nifty IT and FMCG indices were the top losers among the sectoral indices, down 2.4% and 1.3% respectively while Media and PSU Bank indices were the top gainers, up 1.7% and 1.6% respectively. Infosys and Eternal dipped 3.6% and 3.3% respectively, becoming top Nifty losers whereas BEL surged 4.1%, becoming top gainer, followed by 1.8% higher Jiofin and Hero Motocorp. NSE advance-decline ratio stood at 2.1:1. *•* Rupee appreciated 4 paise to end at 85.33/$. *•* European markets were little changed. *•* U.S. stock futures were modestly lower. *Open an account, react, and share. Follow us on social media for the latest updates and valuable financial content.* _*ACCOUNT OPENING LINK's*_ 👇🏻 *_• NUVAMA_* _https://onboarding.nuvamawealth.com/Partner?utm_source=EMPLOYEE&utm_campaign=36638&utm_content=ELITE_ ✅ WhatsApp Channel: https://t.ly/_6T9j ✅ Youtube: https://t.ly/frb4G ✅ Telegram: https://t.me/traderpulseyt ✅ Instagram: https://t.ly/wyjFy ✅ LinkedIn : https://t.ly/g_SjB ✅ Tradingview: https://t.ly/-UGgZ *Note:* This post is just for educational purposes and not a buy/sell recommendation.

📊 *Bazaar Brief - 15th May, 2025* *❕Trader Pulse By Vishal❕* *9-MONTH HIGH* *•* Sensex and Nifty surged 1.5% and 1.6% respectively to close at the highest level after 1st and 14th October 2024 respectively. Sensex settled at 82530, up 1200 points while Nifty added 395 points to finish at 25062. Nifty mid-cap and small-cap indices gained 0.7% and 0.5% respectively. *•* All the sectoral indices ended higher with Auto and Realty indices on the top, up 1.9% each. Except 0.2% lower IndusInd Bank, all the Nifty 50 stocks ended higher, with Hero MotoCorp and JSW Steel being the top gainers, up 6.2% and 4.8% respectively. NSE advance-decline ratio stood at 2.2:1. *•* Rupee depreciated 28 paise to end at 85.55/$. *•* In Europe, FTSE was marginally higher while DAX and CAC were down quarter of a percent each. Data showed the U.K. economy grew by an unexpectedly strong 0.7% in the fourth quarter. *•* U.S. futures were down 0.3%-0.6%. *Open an account, react, and share. Follow us on social media for the latest updates and valuable financial content.* _*ACCOUNT OPENING LINK's*_ 👇🏻 *_• NUVAMA_* _https://onboarding.nuvamawealth.com/Partner?utm_source=EMPLOYEE&utm_campaign=36638&utm_content=ELITE_ ✅ WhatsApp Channel: https://t.ly/_6T9j ✅ Youtube: https://t.ly/frb4G ✅ Telegram: https://t.me/traderpulseyt ✅ Instagram: https://t.ly/wyjFy ✅ LinkedIn : https://t.ly/g_SjB ✅ Tradingview: https://t.ly/-UGgZ *Note:* This post is just for educational purposes and not a buy/sell recommendation.

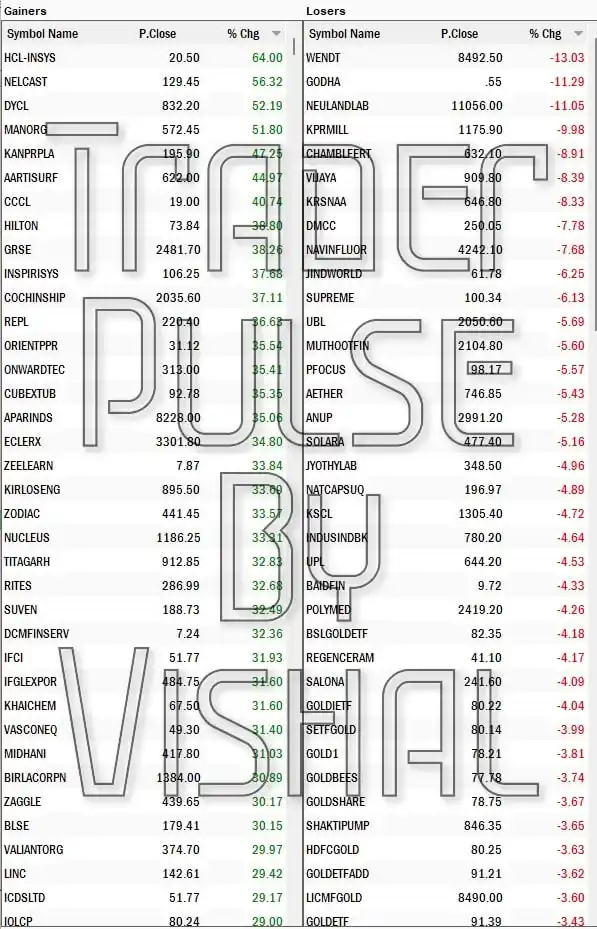

📊 *Weekly Bazaar Top Gainers, Losers, Cash - 16th May, 2025* ❕Trader Pulse By Vishal❕ Premium service?, So you just need to do the following things. * Open an account under us, Account opening link is given below. * Those who want direct access ping me here. _*VISHAL PAL*_ _*✆ t.me/iVishalPal*_ _*ACCOUNT OPENING LINK's*_ 👇🏻 *_• Nuvama Wealth_* _https://onboarding.nuvamawealth.com/Partner?utm_source=EMPLOYEE&utm_campaign=36638&utm_content=ELITE_ *Open an account, react, and share. Follow us on social media for the latest updates and valuable financial content.* ✅ WhatsApp Channel: https://t.ly/_6T9j ✅ Youtube: https://t.ly/frb4G ✅ Telegram: https://t.me/traderpulseyt ✅ Instagram: https://t.ly/wyjFy ✅ LinkedIn : https://t.ly/g_SjB ✅ Tradingview: https://t.ly/-UGgZ *Note:* this post is for educational purposes not a buy or sell.

📊 *Bazaar Brief - 16th May, 2025* *❕Trader Pulse By Vishal❕* *HIGHEST WEEKLY CLOSE SINCE SEPTEMBER 2024* *•* Benchmark indices ended lower by a fifth of a percent after a rangebound session. Sensex settled at 82330, down 200 points while Nifty lost 42 points to finish at 25019. Nifty mid-cap and small-cap indices however surged 0.9% and 1.9% respectively, both extending the winning streak to fifth straight session and closing at the highest level after 3rd and 20th January respectively. *•* Nifty Realty and FMCG indices were the top gainers among the sectoral indices, up 1.6% and 0.7% respectively while IT and Healthcare indices were the top losers, down 0.8% and 0.3% respectively. BEL climbed 3.8%, becoming top Nifty gainer, followed by 2% higher Tata Consumer and Bajaj Auto. Bharti Airtel and HCL tech dipped 2.8% and 2.1% respectively, becoming top losers. NSE advance-decline ratio stood at 2.2:1. *•* Rupee appreciated 4 paise to end at 85.51/$. For the week, Sensex and Nifty gained 3.6% and 4.2% respectively, both posting their highest weekly close since the week ended 27th September 2024. *•* European markets were up 0.6%-0.7%. *•* U.S. futures were up 0.2%-0.3%. *Open an account, react, and share. Follow us on social media for the latest updates and valuable financial content.* _*ACCOUNT OPENING LINK's*_ 👇🏻 *_• NUVAMA_* _https://onboarding.nuvamawealth.com/Partner?utm_source=EMPLOYEE&utm_campaign=36638&utm_content=ELITE_ ✅ WhatsApp Channel: https://t.ly/_6T9j ✅ Youtube: https://t.ly/frb4G ✅ Telegram: https://t.me/traderpulseyt ✅ Instagram: https://t.ly/wyjFy ✅ LinkedIn : https://t.ly/g_SjB ✅ Tradingview: https://t.ly/-UGgZ *Note:* This post is just for educational purposes and not a buy/sell recommendation.

_Morning Snippet:- 14th May 2025_ *Index Observation* Nifty gave up 1/3rd of its previous day’s gain in yesterday’s session on account of profit taking after an extended rally. Index has ended just below its trailing to its support of 24600. Upside to 24900 / 25400 remains open unless the index fails to hold above 24600. Next 2-3 trading days are expected to remain volatile after a large range day at the start of this week. Bank Nifty has reversed its course from its 5 year polarity trendline support highlighted earlier this week. Unless a closing below its previous bearish target of 53500 is not seen, further downside cannot be seen on this index. For this week - a range between 54900 and 55900 can be seen unfolding. NSE Nifty, weekly expiry is scheduled for tomorrow while the weekly closing is seen on Friday on charts. *Interesting Observation* Since the tragic Pahalgam attack on 22nd April 2025, Indian equities have largely demonstrated resilience, with the Nifty 50 standing at a 1.6% gain from that day’s opening level. However, a closer look at sectoral performance reveals a more nuanced picture. The IT sector has emerged as a clear outperformer, surging by 9.6%, followed by the Defence sector with a 9.4% gain and Auto up 6%. Conversely, sectors like PSE and PSU Banks have struggled, declining by 2.4% and 2% respectively. These divergences highlight which segments of the market one should be looking at - or which one should be avoided —during this periods of uncertainty and heightened volatility. *DERIVATIVES | Trade Setup* *Cash Market Activity* FII: ₹ -476 Cr DII: ₹ 4,273 Cr Week-to-Date (WTD) FII: ₹ 770 Cr DII: ₹ 5,721 Cr Month-to-Date (MTD) FII: ₹ 8,627 Cr DII: ₹ 19,462 Cr *F&O Cues* FIIs have reversed their stance again in index futures, adding 36,650 short contracts in the latest session. The net position has turned short-heavy, and currently stand at 36.5k short contracts In the options segment, the 24,000 strike remains a strong support level, indicated by the highest put open interest, while 25,000 continues to act as key resistance, marked by the highest call open interest. *New 52 Week High Low Data* *Large Cap:* New 52 Week Highs: 0 New 52 Week Lows: 0 *Mid Cap:* New 52 Week Highs: 3 New 52 Week Lows: 0 *Small Cap:* New 52 Week Highs: 6 New 52 Week Lows: 0 *NIFTY500:* New 52 Week Highs: 9 New 52 Week Lows: 0

📊 *Bazaar Brief - 12th May, 2025* *❕Trader Pulse By Vishal❕* *BEST DAY IN 4 YEARS* *•* Benchmark indices soared 3.8% each for their best day since 1st February 2021 after India-Pakistan ceasefire. Sensex settled at 82430, up 2975 points while Nifty added 916 points to finish at 24924. Nifty mid-cap and small-cap indices climbed 4.1% and 4.2% respectively. *•* All the NSE sectoral indices ended higher with IT index on the top, up 6.7%, followed by 5.9% higher Realty and Metal indices. Except 3.4% and 3.2% lower IndusInd Bank and Sun Pharma respectively, all the Nifty 50 stocks gained, with Adani Enterprise and Infosys on the top, up 7.7% each. NSE advance-decline ratio stood at 7.9:1. *•* U.S. Treasury Secretary Scott Bessent said that talks with China had been "very productive" and both countries had agreed to cut "reciprocal" tariffs by 115% for 90 days. That brings U.S. tariffs on Chinese goods down to 30%, and Chinese tariffs on U.S. imports to 10%. *•* European markets were up 0.5%-1.8%. *•* U.S. futures were up 2.2%-3.8%. *Open an account, react, and share. Follow us on social media for the latest updates and valuable financial content.* _*ACCOUNT OPENING LINK's*_ 👇🏻 *_• NUVAMA_* _https://onboarding.nuvamawealth.com/Partner?utm_source=EMPLOYEE&utm_campaign=36638&utm_content=ELITE_ ✅ WhatsApp Channel: https://t.ly/_6T9j ✅ Youtube: https://t.ly/frb4G ✅ Telegram: https://t.me/traderpulseyt ✅ Instagram: https://t.ly/wyjFy ✅ LinkedIn : https://t.ly/g_SjB ✅ Tradingview: https://t.ly/-UGgZ *Note:* This post is just for educational purposes and not a buy/sell recommendation.