Adcap House View - Finanzas y Mercados

February 18, 2025 at 07:52 PM

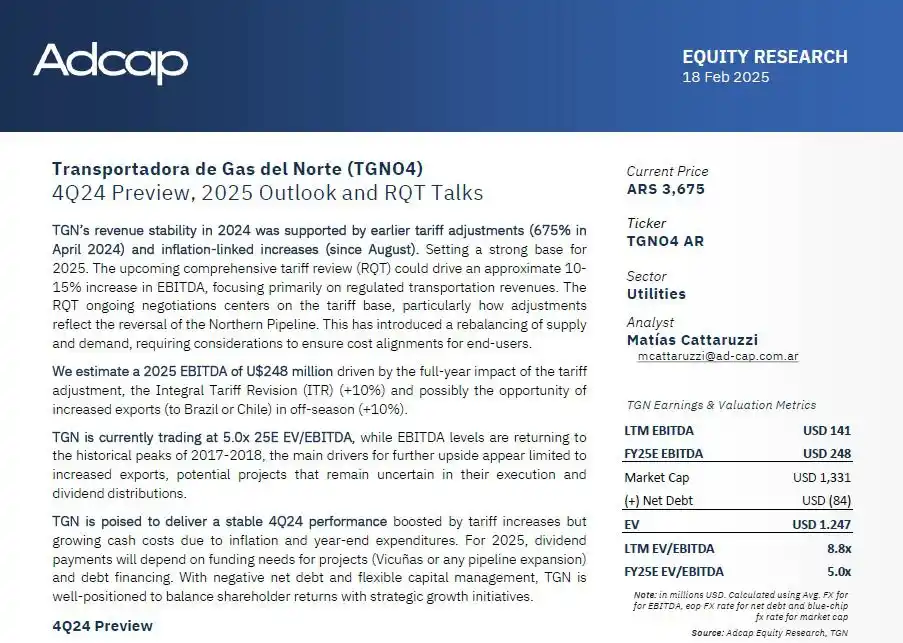

*Transportadora de Gas del Norte (TGNO4): 4Q24 Earnings Preview, 2025 Outlook and RQT Talks*

See full report here: https://tinyurl.com/02182025AdcapTGN4Q24Preview

*TGN’s revenue stability in 2024 was driven by a 675% tariff increase in April and inflation-linked adjustments since August, setting a solid base for 2025.* The upcoming RQT could boost EBITDA by 10-15%, mainly from regulated transportation revenues, as it balances supply and demand following the Northern Pipeline reversal.

*We estimate a 2025 EBITDA of USD 248 million,* supported by the full-year impact of tariff adjustments, the Integral Tariff Revision (+10%), and potential off-season export growth (+10%).

*TGN trades at 5.0x 25E EV/EBITDA*, with EBITDA levels nearing historical peaks from 2017-2018. Further upside relies on export growth, execution of strategic projects, and dividend distributions.

*4Q24 performance is expected to remain stable, driven by tariff hikes but impacted by inflation and year-end expenses.* In 2025, dividend payouts will depend on project funding (e.g., Vicuñas, pipeline expansions) and debt financing. With negative net debt and flexible capital management, TGN is well-positioned to balance shareholder returns with growth initiatives.