Adcap House View - Finanzas y Mercados

February 19, 2025 at 10:42 PM

*Vista Energy (VIST): 4Q24 Earnings Preview and Model Update*

See full report here: https://tinyurl.com/02192025AdcapVIST4Q24Preview

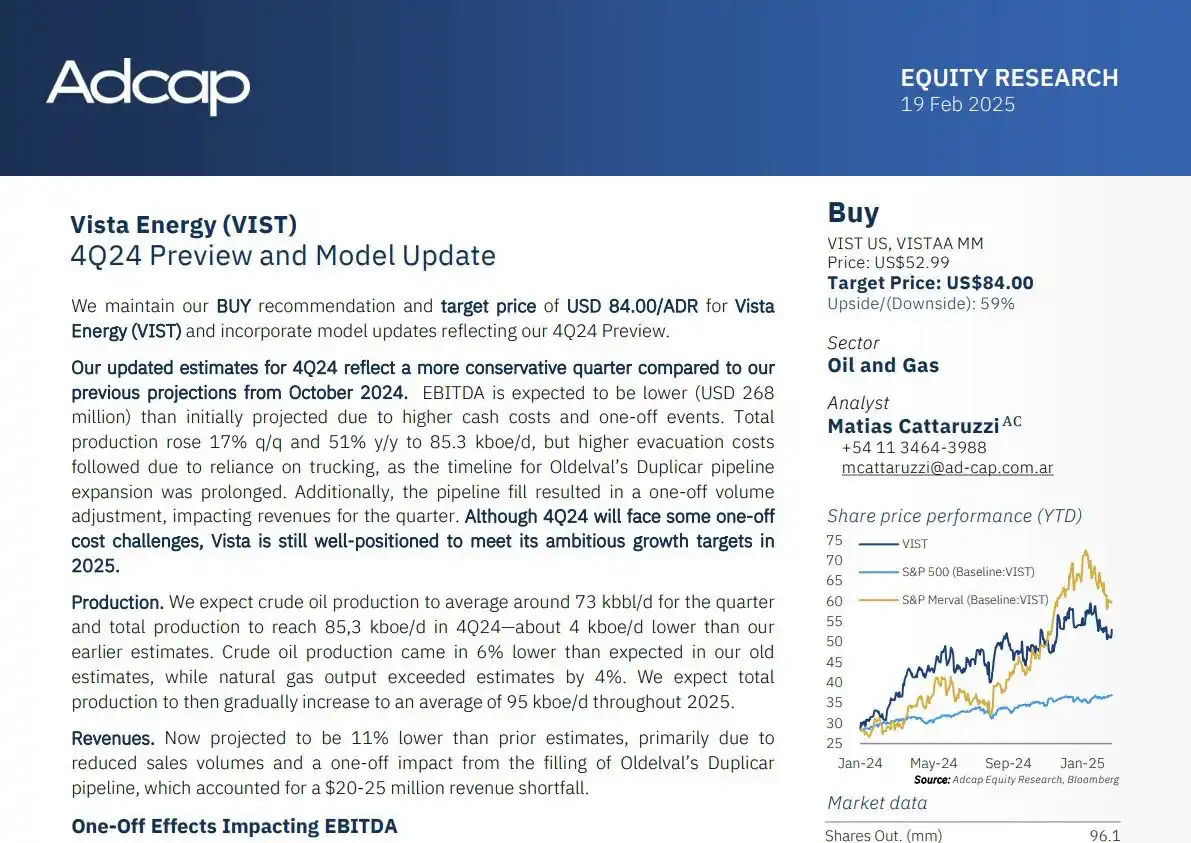

We maintain our *BUY* recommendation and *target price of USD 84.00/ADR* for VIST and incorporate model updates reflecting our 4Q24 Preview.

*Our revised estimates for 4Q24 reflect a more conservative quarter compared to our previous projections, with EBITDA expected at USD 268 million*—20% below prior projections—*due to higher cash costs and one-off impacts* (increased trucking costs and inventory build-up needs). Total production rose 17% q/q and 51% y/y to 85.3 kboe/d but came in ~5% below previous estimates, driven by a 6% shortfall in crude oil output, partially offset by stronger natural gas volumes (+4%). Elevated trucking costs, due to delays in Oldelval’s Duplicar pipeline expansion, and the pipeline fill led to a combined shortfall of USD 40–50 million. COGS rose 5% from increased trucking reliance, while lifting costs also saw slight pressure from peso appreciation. We revised Capex down to USD 330 million (from USD 350 million) and expect lower evacuation costs in 1Q25 as Duplicar comes online.

*On the corporate side, Vista raised USD 750 million through two bond issuances*, strengthening liquidity to cover near-term obligations and support its ambitious 2025 Capex plan (~USD 1.25 billion), including participation in Vaca Muerta Sur (VMOS).