Taxation_Update

June 7, 2025 at 01:05 PM

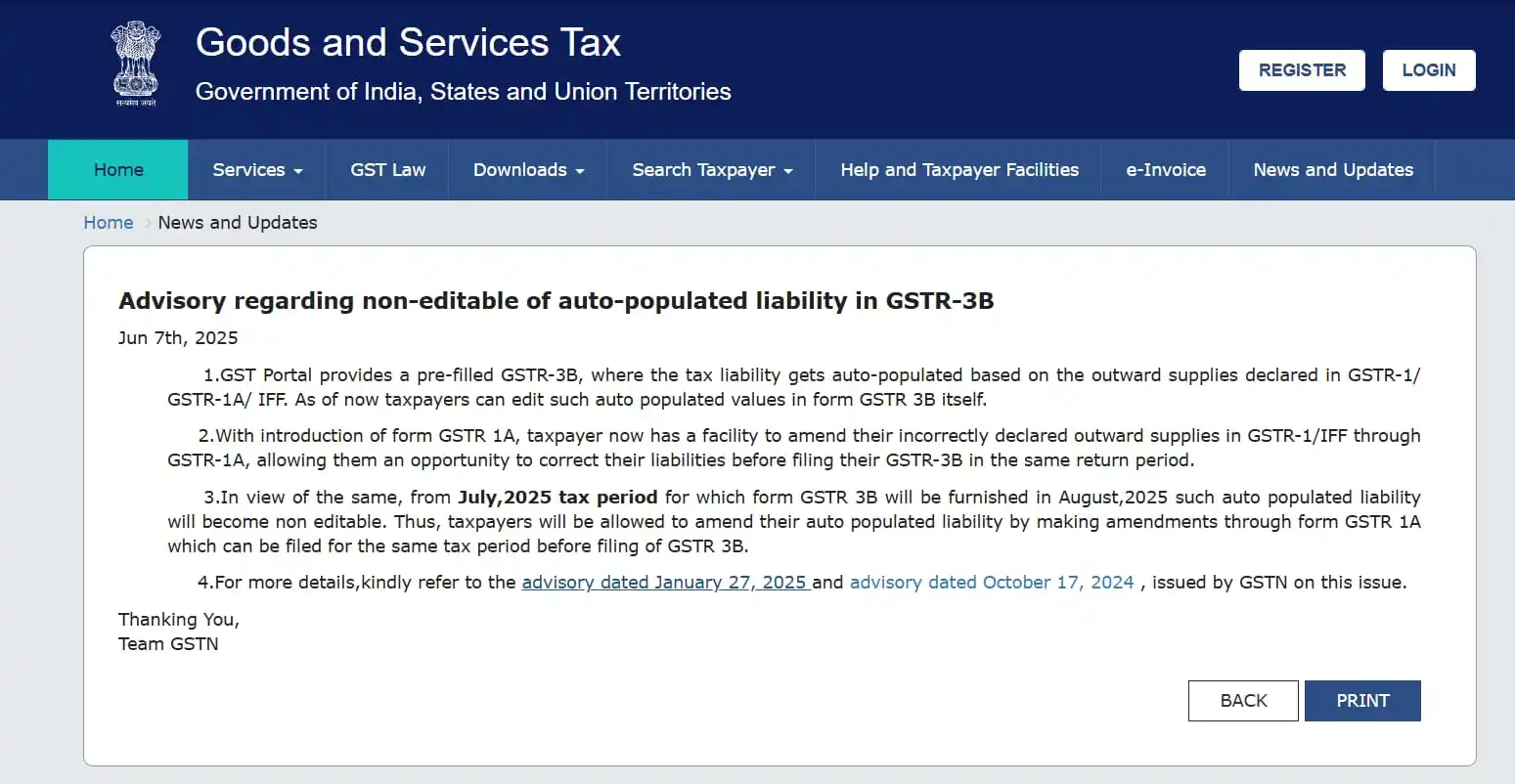

🚨 GSTN Update – Un-editable Outward Liability in GSTR-3B from July 2025

Auto-populated liability from GSTR-1/IFF will be locked in GSTR-3B!!

Amendments only via GSTR-1A.

Consequence-Recipient will now have a role in final Outward Liability of taxpayer 👇

If recipient rejects Credit Note in IMS, value will be added to outward liability & will be non-editable in GSTR-3B.

(Please let me know in case of difference in opinion)

Expecting similar non-editability for ITC (based on GSTR-2B) soon. Will be interesting to see how Trade would react to the same!! 🙂