Sauti Ya Bajeti - PFM Truth

June 5, 2025 at 06:39 AM

*Mbadi Cites Revenue Concerns for Delayed Tax Cuts, as IPF Warns of Growing Unpredictability*

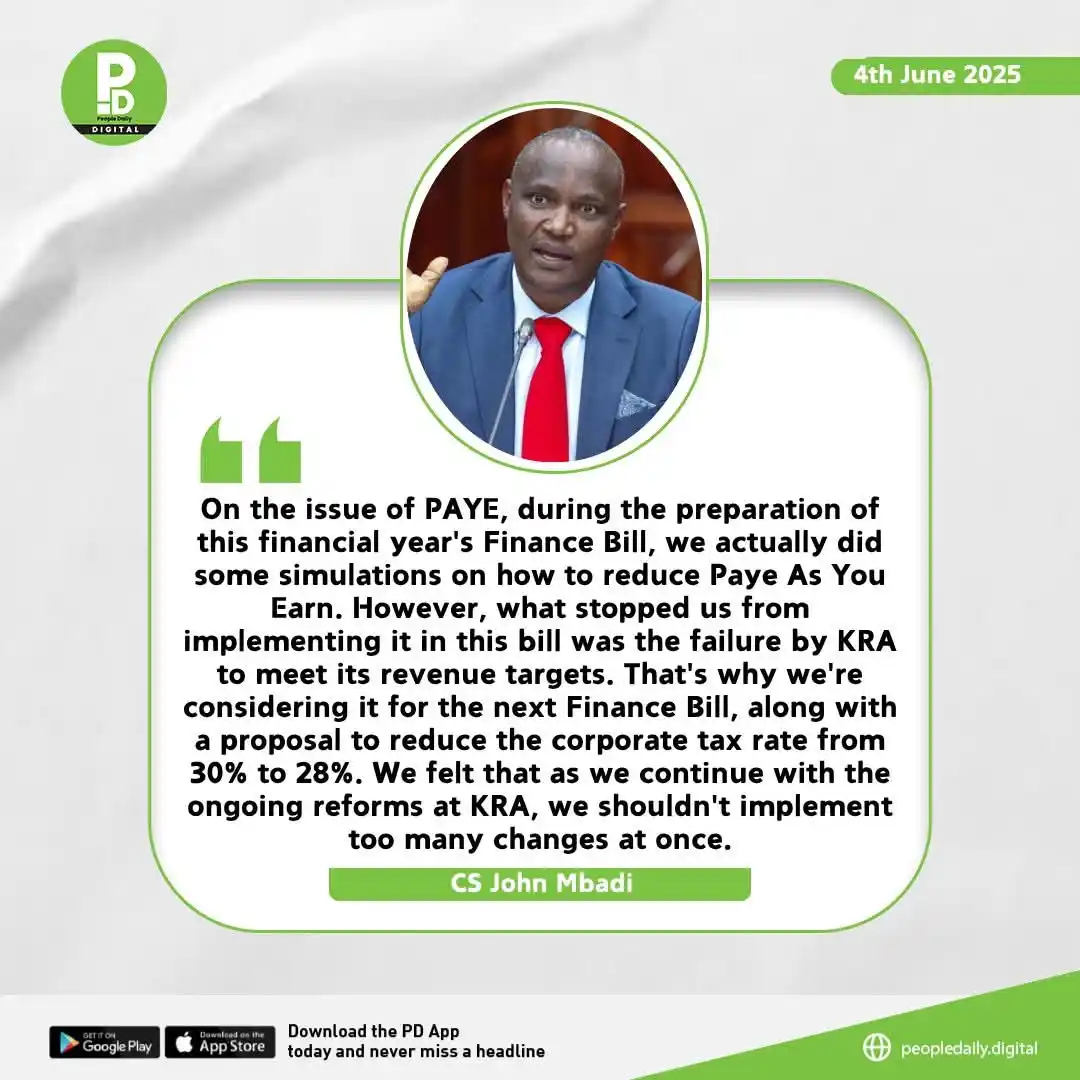

Treasury CS John Mbadi has revealed that the government explored lowering Pay As You Earn (PAYE) and cutting the corporate tax rate from 30% to 28% while drafting the 2025 Finance Bill. But those simulations didn’t make the cut. *“What stopped us was KRA’s failure to meet its revenue targets,”* he said, adding that the reforms are now being considered for the next Finance Bill.

In a detailed submission to the Finance and National Planning Committee, the Institute of Public Finance (IPF) notes that these measures, including a review of PAYE tax bands and a deeper corporate tax cut to 25% , were already outlined in Kenya’s Medium-Term Revenue Strategy (MTRS) and National Tax Policy (NTP 2024). Years later, they remain unimplemented.

Worse still, IPF warns that the government’s pattern of revising tax laws annually, from shifting VAT classifications to introducing new levies without a clear framework, has created a tax environment that’s unpredictable, costly for businesses, and harmful to investment decisions.

*“Promises of reform are not a substitute for predictability,”* IPF cautions, adding that stability drives long-term economic confidence.

As Treasury delays action in the name of revenue protection, IPF’s message is clear: *"stable and predictable tax environment often has a greater impact on economic stability and investment decisions than tax incentives."*

👍

❤️

9