ENRICHWISE - Finance/TAX - Channel

May 14, 2025 at 12:42 PM

💡 Wondering which tax-saving investment is right for you under the Old Tax Regime?

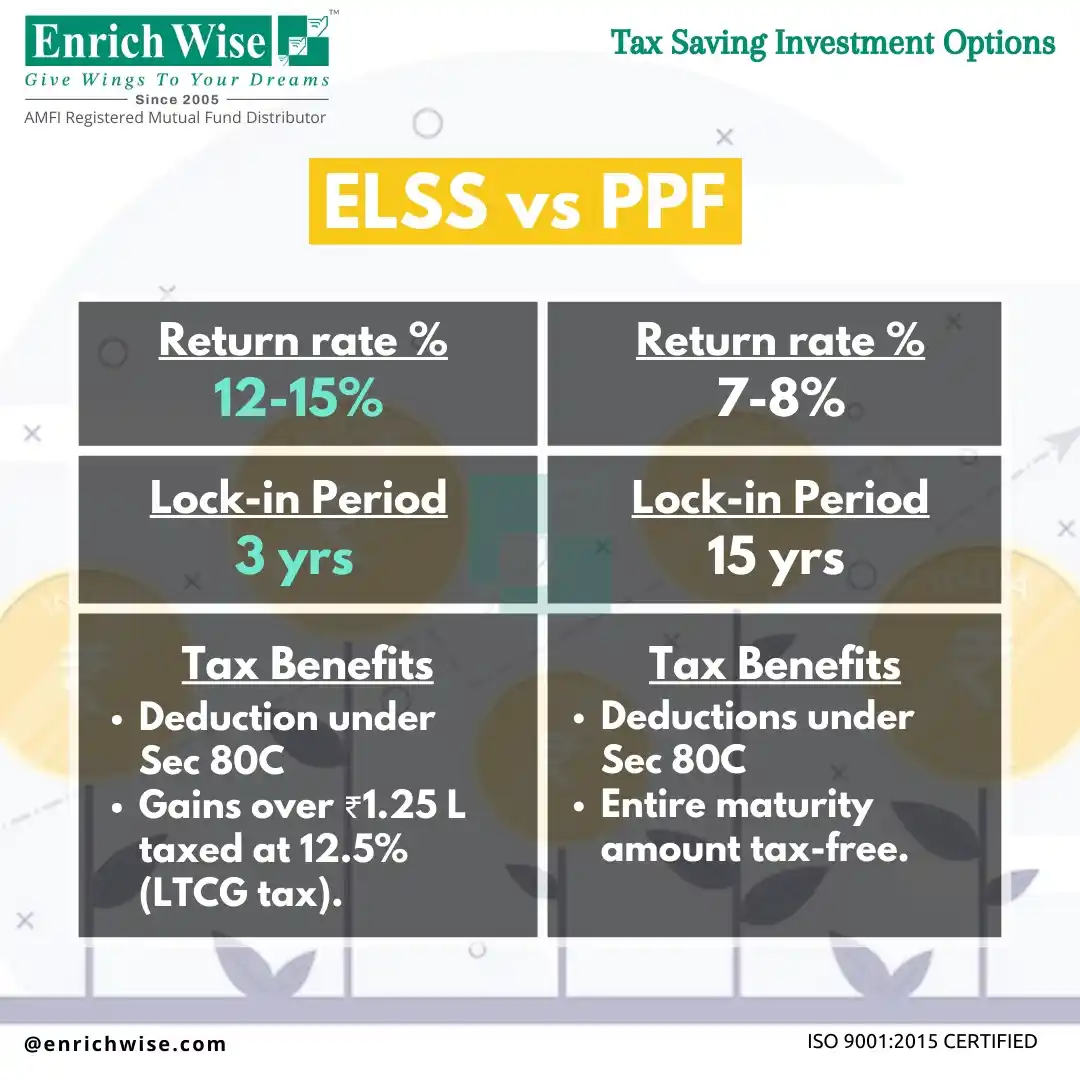

Let’s compare ELSS vs. PPF:

👉 ELSS (Equity-Linked Savings Scheme):

* Return Potential: 12-15% (market-linked).

* Lock-in Period: 3 years (short).

* Tax Benefits: Deduction under Section 80C (up to ₹1.5 lakh). LTCG tax on gains over ₹1.25 lakh (12.5%).

Best For: Risk-tolerant investors seeking higher returns.

👉 PPF (Public Provident Fund):

* Return Potential: 7-8% (government-backed).

* Lock-in Period: 15 years (long-term).

* Tax Benefits: Deduction under Section 80C (up to ₹1.5 lakh). Tax-free maturity.

Best For: Risk-averse investors wanting guaranteed, tax-free returns.

✨ Choose early to make the most of your tax-saving strategy! Which one fits your financial goals?

Let us know!

Call us at 98218 60804, 96533 87088, or 83694 18292, or visit us at 5th Floor, Bellona, The Walk, Hiranandani Estate, Thane (W) 400 607 for a complimentary portfolio and policy review.

Disclaimer: Enrichwise is an AMFI Registered MFD. This content is for informational purposes only and does not constitute financial or investment advice.