Trader Pulse By Vishal

June 6, 2025 at 10:58 AM

*📊 Bazaar Brief - 06th June, 2025*

*❕Trader Pulse By Vishal❕*

*RBI'S BAZOOKA SENDS SENSEX, NIFTY TO 3-WEEK HIGHS*

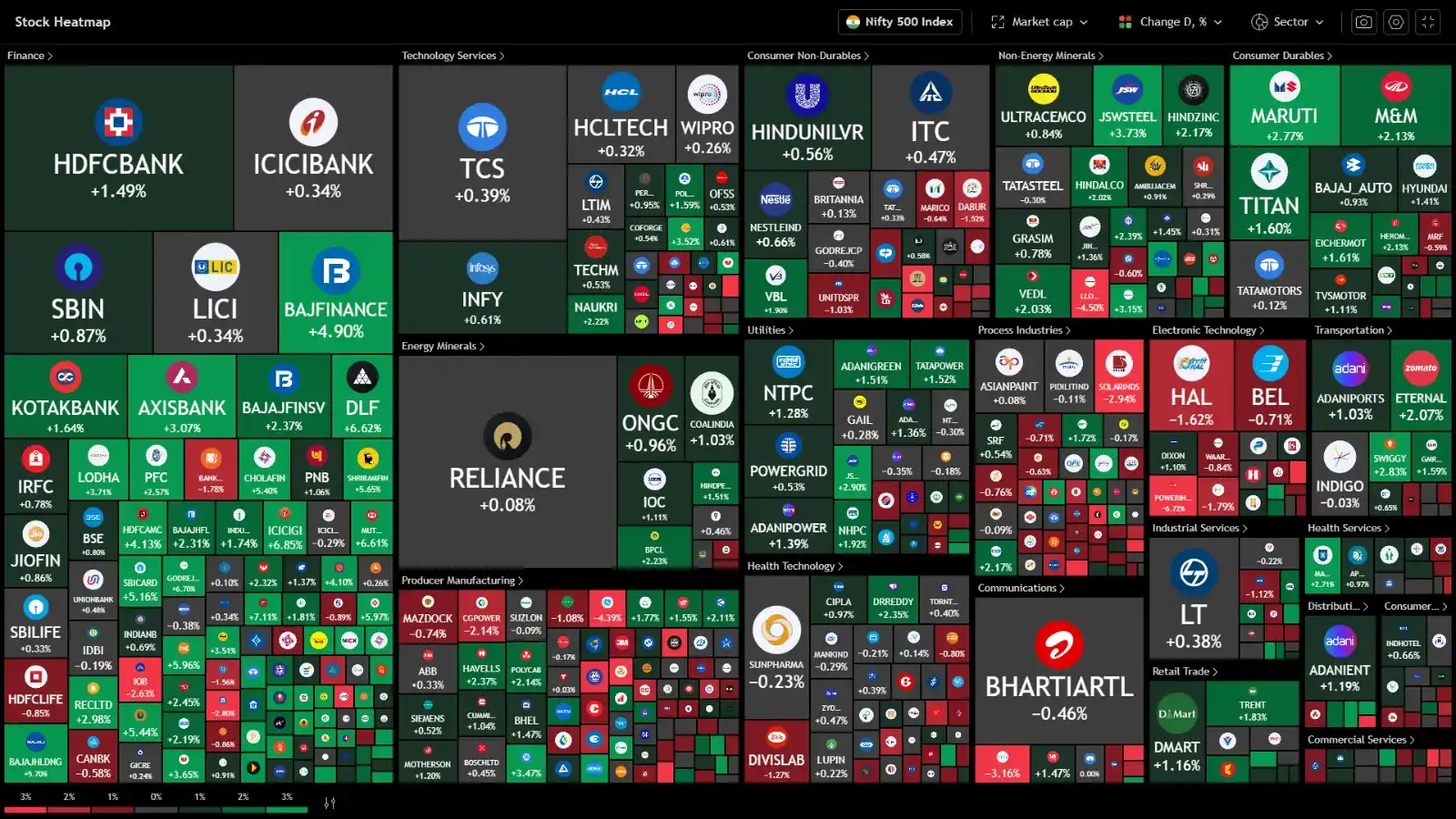

• Benchmark indices surged nearly a percent each, extending the winning streak to third consecutive day and closing at the highest level after 16th May. Sensex settled at 82188, up 746 points while Nifty added 252 points to finish at 25003. Nifty mid-cap and small-cap indices gained 1.2% and 0.8% respectively.

• Nifty Realty index soared 4.7%, becoming top gainer among the sectoral indices, followed by 2.1% higher Financial Services index. Media index was the sole loser, down 1.1%. Shriram Finance and Bajaj Finance were the top Nifty gainers, up 5.5% and 4.9% respectively whereas HDFC Life and BEL were the top losers, down 0.9% and 0.7% respectively. NSE advance-decline ratio stood at 1.4:1.

• Rupee appreciated 16 paise to end at 85.63/$.

• For the week, Sensex and Nifty gained 1% and 0.9% respectively, snapping a 2-week losing streak.

• Monetary Policy Committee delivered a larger-than-expected 50 bps repo rate cut, bringing the key rate to 5.5%.

• The committee also shifted its policy stance from 'accommodative' to 'neutral'. RBI retained FY26 GDP growth forecast at 6.5% while reducing inflation projection to 3.7% from 4% earlier. Bigger surprise was a 100-bps cut in CRR to 3%, which will happen in four equal tranches ending November 29, 2025.

• In Europe, FTSE was up 0.1% while DAX and CAC were marginally lower.

• U.S. futures were up 0.3%-0.5%.

*Open an account, react, and share. Follow us on social media for the latest updates and valuable financial content.*

_*ACCOUNT OPENING LINK's 👇🏻*_

_*• NUVAMA*_

_https://onboarding.nuvamawealth.com/Partner?utm_source=EMPLOYEE&utm_campaign=36638&utm_content=ELITE_

✅ WhatsApp Channel: https://t.ly/_6T9j

✅ Youtube: https://t.ly/frb4G

✅ Telegram: https://t.me/traderpulseyt

✅ Instagram: https://t.ly/wyjFy

✅ LinkedIn : https://t.ly/g_SjB

✅ Tradingview: https://t.ly/-UGgZ

*Note:* This post is just for educational purposes and not a buy/sell recommendation.