NCBA Investment Bank

May 27, 2025 at 08:26 AM

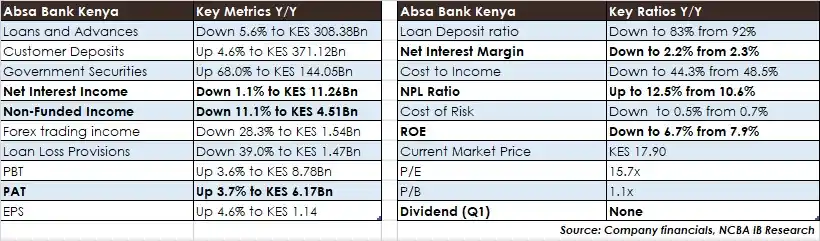

ABSA Bank reported a *3.7%* y/y growth in PAT to *KES 6.17Bn* for Q12024, driven by effective cost containment and operational efficiency, despite a decline in both net interest income and non-interest income.

✅*Earnings*: Net interest income declined marginally by 1.1% to KES 11.26Bn, primarily due to a significant reduction in income from loans and advances. This was partially offset by higher earnings from government securities. Non-interest income fell by 11.1% to KES 4.5Bn, reflecting reduced transactional volumes and fee-based income.

✅*Loan book*: Loans and advances to customers dropped by 5.6% to KES 308.38Bn, indicating tighter credit deployment during the period. Consequently, the loan-to-deposit ratio decreased to 83%, down from 92%, highlighting a more conservative lending stance.

✅*Customer Deposits*: Customer deposits rose by 4.6% y/y to KES 371.12Bn. The growth was supported by intensified deposit mobilization efforts, including the expansion of the agency banking network, enhancement of digital banking platforms, and aggressive retail customer acquisition strategies.

🇰🇪

1