NCBA Investment Bank

May 27, 2025 at 10:38 AM

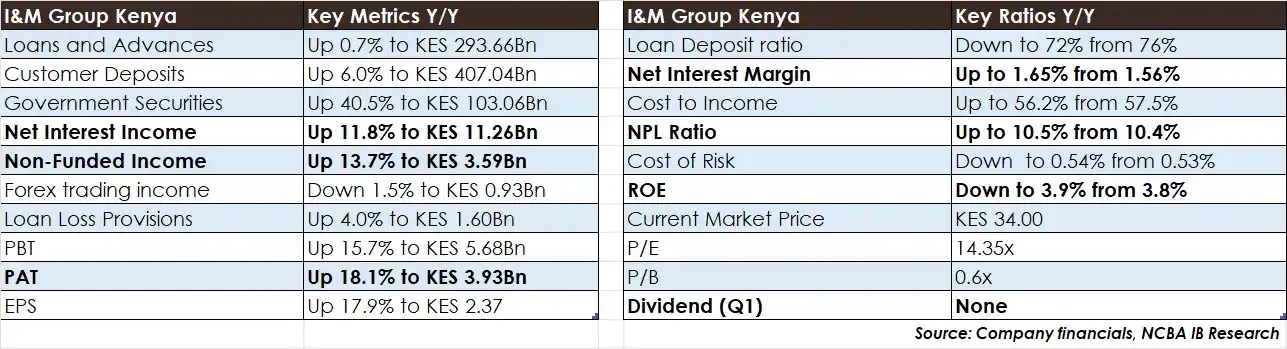

*I&M Group Kenya* reported a profit after tax (PAT) of KES 3.93Bn for the Q125, representing an 18.1% y/y increase, driven by double-digit growth in both interest and non-interest income. Earnings per share rose to KES 2.37, reflecting improved shareholder returns.

✅Earnings: Net interest income rose by 11.8% to KES 11.26Bn, supported by increased yields on interest-earning assets. Non-interest income grew by 13.7% to KES 3.59Bn, reflecting stronger performance in fees, commissions, and trading income. The combined effect led to an 18.1% jump in PAT.

✅Loan book: Loans and advances to customers increased slightly by 0.7% to KES 293.66Bn, reflecting cautious credit growth amidst a tighter lending environment. The loan-to-deposit ratio declined to 72%, down from 76%, indicating a more conservative lending approach.

✅Customer Deposits: Customer deposits rose by 6.0% y/y to KES 407.04Bn. The growth was supported by intensified deposit mobilization efforts and expansion network.