THE INVESTMENT BLUEPRINT 📊🌐

June 12, 2025 at 03:32 AM

🔴 *Kotak Analysts Take on Railway Stocks*: 📝

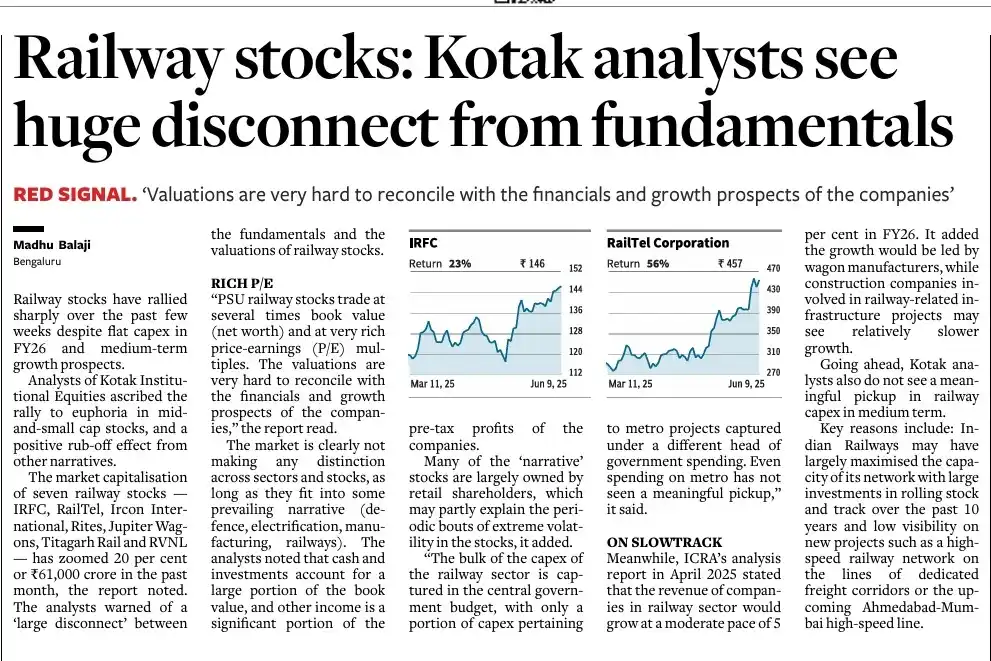

Kotak Institutional Equities believes recent sharp rallies in railway stocks (like IRFC, RailTel, RVNL, Titagarh Rail, RITES, Jupiter Wagons) are driven more by market euphoria and narratives than by actual fundamentals.

These PSU railway stocks are trading at very high price-to-book and P/E ratios, which Kotak calls "hard to reconcile" with their financial and growth prospects.

Despite a 20% rise in market capitalization (~₹61,000 crore added in a month), analysts see no meaningful pickup in railway capex in the medium term, especially for infrastructure companies.

Growth in FY26 is expected mainly from wagon manufacturers, not construction or infra-related players.

ICRA’s report (April 2025) projects just 5% revenue growth for railway sector companies.

Indian Railways has already maximized its capacity, and with major investments already made in past years, there’s low visibility of new big projects like dedicated freight corridors or the bullet train.