Cowry Asset Mgt Channel

May 14, 2025 at 04:16 PM

Daily Market Summary, 14 May, 2025

EQUITIES MARKET

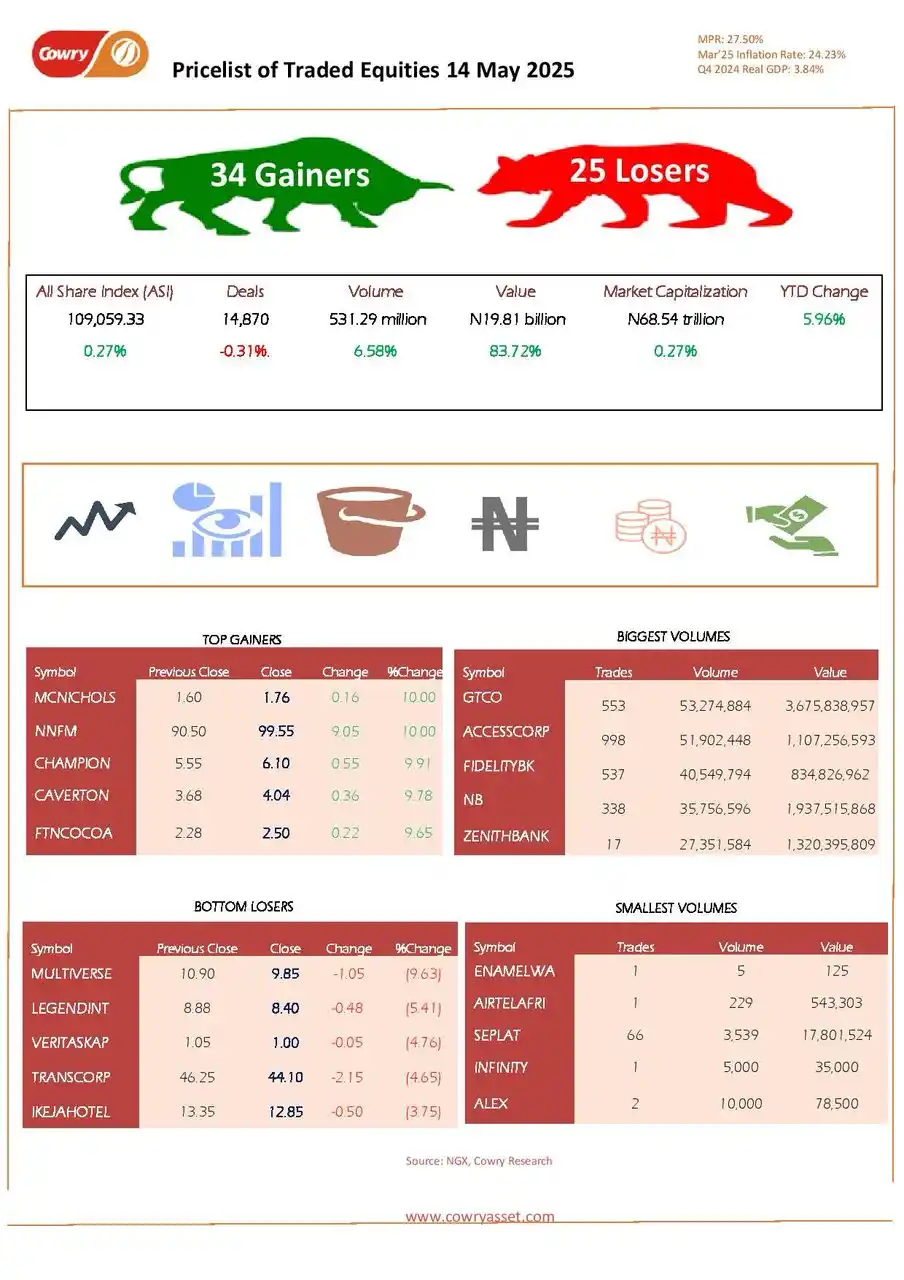

The Nigerian stock market closed bullish midweek, with the ASI up 0.27% to 109,059.33 points and market cap rising ₦185.9bn to ₦68.54tn. Sectoral performance was broadly positive, led by Consumer Goods (+1.25%) and Oil/Gas (+0.75%). Market breadth favored the bulls, with 34 gainers against 25 losers; MCNICHOLS and NNFM topped the chart at +10.00%. Trading activity surged, with volume up 6.58% and value up 83.72% to ₦19.81bn across 14,870 deals.

NIBOR

NIBOR rose across all tenors amid tight liquidity, as the Open Repo and Overnight Lending Rates climbed to 28.50% and 29.42%, respectively.

NITTY

NITTY declined across all tenors, with average T-bill yield down 1bp to 20.93%.

FGN BOND

Investor sentiment improved, slightly lowering average FGN bond yields by 0.02% to 19.03%.

EUROBOND

Investor demand boosted Nigeria's sovereign Eurobond market, particularly for the Sep-2028 and Mar-2029 bonds, leading to a 0.04% drop in the average yield to 9.81%.

FX MARKET

In the foreign exchange market, the Naira appreciated by 0.03% in the official window, closing at ₦1,600.03 per dollar. Similarly, the Naira ended the day at ₦1,620 per dollar in the parallel market.