Cowry Asset Mgt Channel

238 subscribers

About Cowry Asset Mgt Channel

"to be the foremost pan-african wealth creating financial services provider of global repute"

Similar Channels

Swipe to see more

Posts

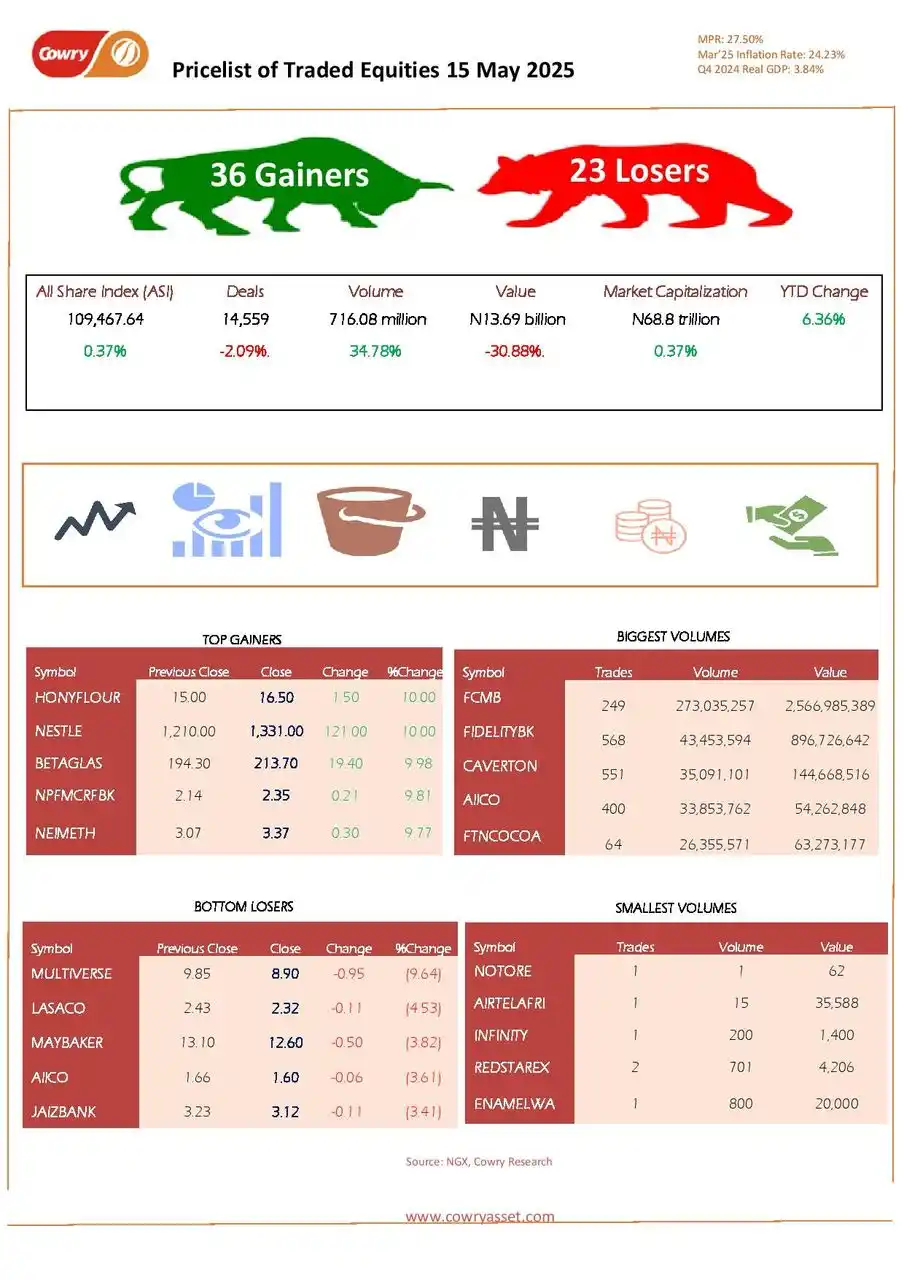

Daily Market Summary, 15 May, 2025 EQUITIES MARKET The local bourse closed positive on Thursday as the ASI rose 0.37% to 109,467.64 points and market cap gained ₦257bn to ₦68.8tn. Sector performance was mostly upbeat, led by Consumer Goods (+1.16%), while Oil & Gas dipped 0.18% and Insurance remained flat. Market breadth was strong with 36 gainers vs. 23 losers; HONYFLOUR and NESTLE led with 10% gains, while MULTIVERSE lost 9.64%. Despite a 2.09% drop in deals and 30.88% in value, volume surged 34.78% to 716.08m shares worth ₦13.69bn in 14,559 trades. NIBOR NIBOR rose across all tenors except overnight, while key rates like the Open Repo and Overnight Lending declined to 26.85% and 27.40%, respectively. NITTY NITTY declined across all maturities, with the average T-bill yield flat at 20.93%. FGN BOND Negative investor sentiment caused FGN bond yields to rise slightly to 19.04% EUROBOND Investor selloffs drove bearish sentiment across Nigeria’s sovereign Eurobond curve, notably lowering yields—especiespecially for Nov-2025 and Sep-2028 bonds—causing the average yield to drop 0.16% to 9.98%. FX MARKET In the foreign exchange market, the Naira appreciated by 0.25% in the official window, closing at ₦1,596.00 per dollar. Similarly, the Naira ended the day at ₦1,620 per dollar in the parallel market.

*Inflation Cooldown Deepens in April*: *A Turning Point or Just a Statistical Mirage*? The latest Consumer Price Index (CPI) report indicates that headline inflation eased to 23.71% in April 2025, down from 24.23% in March 2025. This reflects a 0.52ppt decline on a m/m basis and reinforces the gradual deceleration in price pressures observed in recent months; m/m, headline inflation stood at 1.86% in April 2025, down sharply from 3.90% in March 2025 — a 2.04ppt drop, indicating a slower pace in price increases between March and April. Food inflation, a major driver of overall CPI, came in at 21.26% y/y in April 2025, a sharp 19.27ppt decrease from 40.53% in April 2024. The steep fall is largely attributed to the base year re-benchmarking, rather than a fundamental improvement in food supply chains. On a m/m basis, food inflation declined marginally to 2.06% in April, from 2.18% in March, reflecting slight price moderation in essential food items. Also, the core inflation, which excludes volatile items such as food and energy, stood at 23.39% y/y in April 2025, representing a 3.45ppt decline from 26.84% in April 2024. Monthly reading shows core inflation also slowed sharply to 1.34% in April, from 3.73% in March — a substantial 2.39ppt drop, suggesting underlying inflationary momentum is weakening. The April 2025 CPI figures reflect broad-based disinflation across headline, food, and core inflation metrics and indicates a potential turning point in Nigeria’s inflation trajectory.

*Market News as at Monday, May 19, 2025* Market rallies, gains N613 billion in one week ahead of MPC meeting - Guardian https://guardian.ng/business-services/market-rallies-gains-n613-billion-in-one-week-ahead-of-mpc-meeting/ Lokpobiri: $5 Billion African Energy Bank in Final Stage Before Kick-off - Thisday https://www.thisdaylive.com/index.php/2025/05/19/lokpobiri-5-billion-african-energy-bank-in-final-stage-before-kick-off/ NNPCL refineries not producing enough petrol – DAPPMAN - Punch https://punchng.com/nnpcl-refineries-not-producing-enough-petrol-dappman/ Rates Swing as Banks Take Out N1.4trn from CBN Facility – Market Forces https://dmarketforces.com/rates-swing-as-banks-take-out-n1-4trn-from-cbn-facility/ FG’s electricity debt balloons by N800bn – Senate - Punch https://punchng.com/fgs-electricity-debt-balloons-by-n800bn-senate/ Enugu Earmarks N30bn for Tourism Developemt, Approves N13.8bn for First Phase - Thisday https://www.thisdaylive.com/index.php/2025/05/19/enugu-earmarks-n30bn-for-tourism-developemt-approves-n13-8bn-for-first-phase/ CBN slashes FG loans by over N4tn - Punch https://punchng.com/cbn-slashes-fg-loans-by-over-n4tn/ FG grants China approval to establish electric vehicle factories - Punch https://punchng.com/govt-grants-china-approval-to-establish-electric-vehicle-factories/

*Market News as at Friday, May 16, 2025* NUPRC to Raise Nigeria’s Active Oil Rigs from 36 to 50 By End of 2025 - Thisday https://www.thisdaylive.com/index.php/2025/05/16/nuprc-to-raise-nigerias-active-oil-rigs-from-36-to-50-by-end-of-2025/ NGX Index Surges as Equities Investors Gain N257bn – Market Forces https://dmarketforces.com/ngx-index-surges-as-equities-investors-gain-n257bn/ Africa needs $600bn annually for energy growth – NUPRC - Punch https://punchng.com/africa-needs-600bn-annually-for-energy-growth-nuprc/ Food inflation to 21.26% in April, pushed lower by maize, wheat prices – Business Day https://businessday.ng/business-economy/article/food-inflation-to-21-26-in-april-pushed-lower-by-maize-wheat-prices/ Nigerians to pay more for vehicle licensing as JTB hikes prices – Business Day https://businessday.ng/news/article/nigerians-to-pay-more-for-vehicle-licensing-as-jtb-hikes-prices/?utm_source=auto-read-also&utm_medium=web Economic strain: Inflation surges above 30% in Abuja, 10 states - Punch https://punchng.com/economic-strain-inflation-surges-above-30-in-abuja-10-states/ Udoma: Seplat Energy Marks New Era with MPNU Acquisition - Thisday https://www.thisdaylive.com/index.php/2025/05/16/udoma-seplat-energy-marks-new-era-with-mpnu-acquisition/ Nigeria’s Headline Inflation Drops to 23.71% - Market Forces https://dmarketforces.com/nigerias-headline-inflation-drops-to-23-71/ NASD reports N212m Q1 profit - Punch https://punchng.com/nasd-reports-n212m-q1-profit/ Modular refineries decry exclusion from naira-for-crude deal - Punch https://punchng.com/modular-refineries-decry-exclusion-from-naira-for-crude-deal/

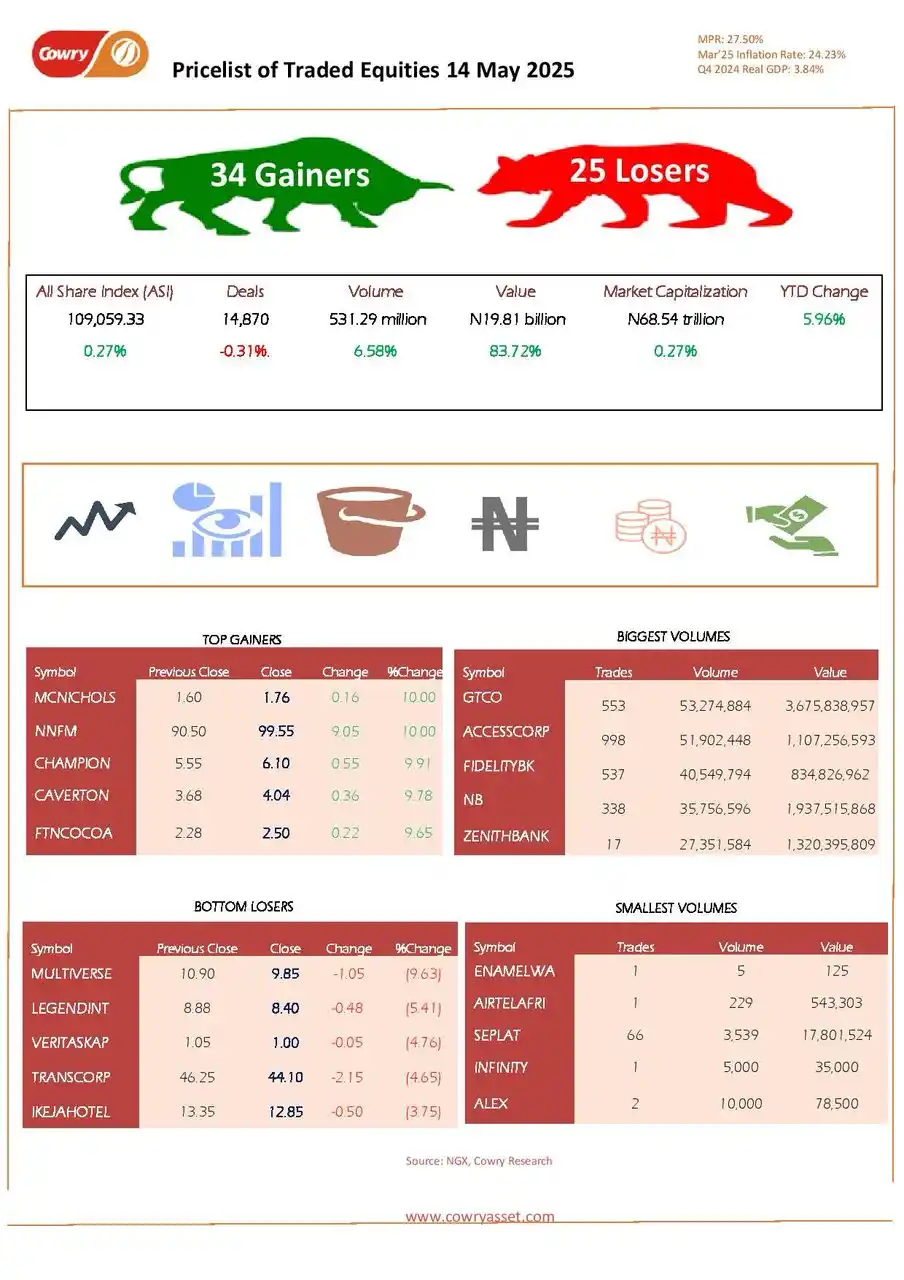

Daily Market Summary, 14 May, 2025 EQUITIES MARKET The Nigerian stock market closed bullish midweek, with the ASI up 0.27% to 109,059.33 points and market cap rising ₦185.9bn to ₦68.54tn. Sectoral performance was broadly positive, led by Consumer Goods (+1.25%) and Oil/Gas (+0.75%). Market breadth favored the bulls, with 34 gainers against 25 losers; MCNICHOLS and NNFM topped the chart at +10.00%. Trading activity surged, with volume up 6.58% and value up 83.72% to ₦19.81bn across 14,870 deals. NIBOR NIBOR rose across all tenors amid tight liquidity, as the Open Repo and Overnight Lending Rates climbed to 28.50% and 29.42%, respectively. NITTY NITTY declined across all tenors, with average T-bill yield down 1bp to 20.93%. FGN BOND Investor sentiment improved, slightly lowering average FGN bond yields by 0.02% to 19.03%. EUROBOND Investor demand boosted Nigeria's sovereign Eurobond market, particularly for the Sep-2028 and Mar-2029 bonds, leading to a 0.04% drop in the average yield to 9.81%. FX MARKET In the foreign exchange market, the Naira appreciated by 0.03% in the official window, closing at ₦1,600.03 per dollar. Similarly, the Naira ended the day at ₦1,620 per dollar in the parallel market.

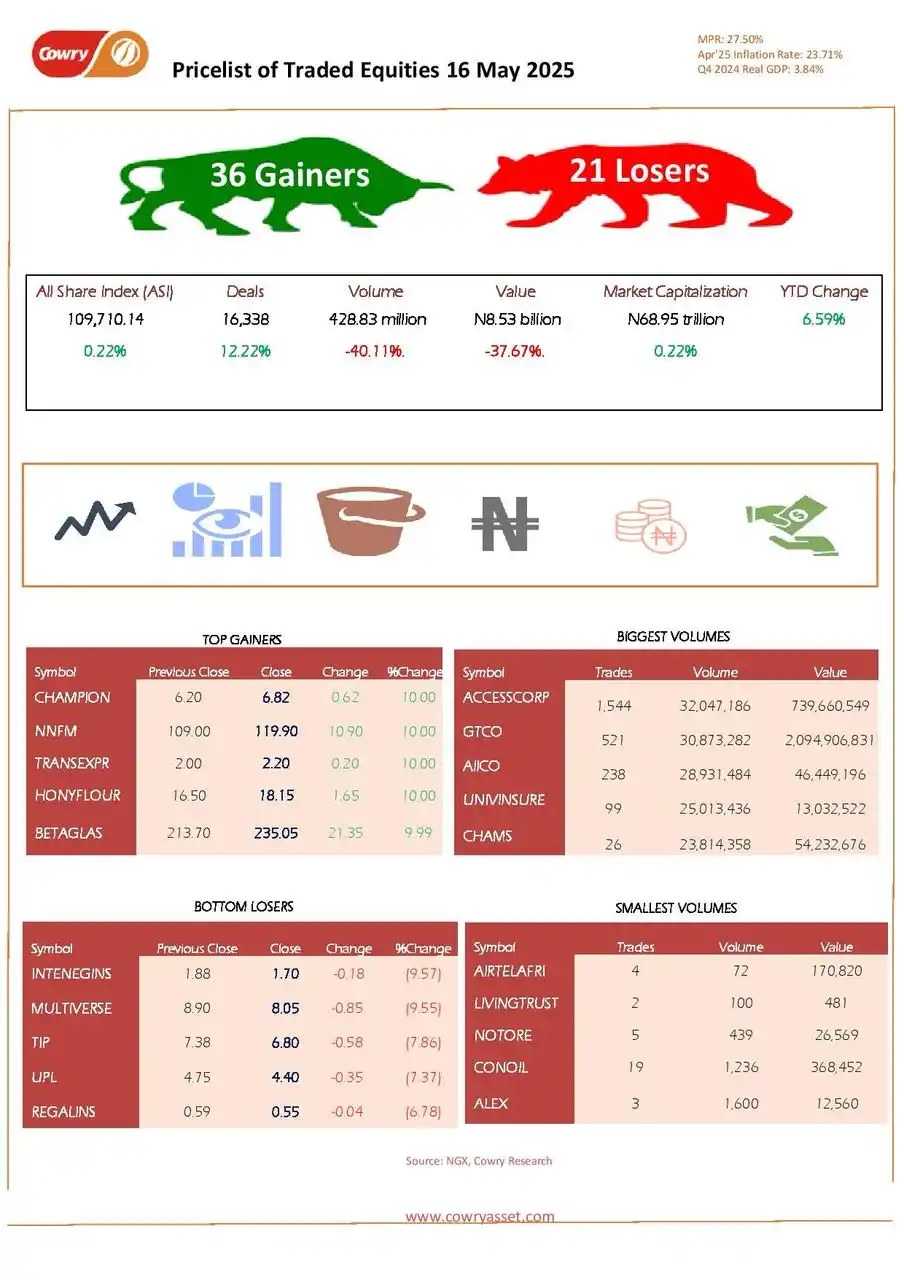

Daily Market Summary, 16 May, 2025 EQUITIES MARKET The NGX ended the week on a positive note as the ASI rose 0.22% to 109,701.14 points, with market cap up ₦153bn to ₦68.95tn. Sector performance was largely bullish, led by Commodities (+2.08%), while Consumer Goods dipped 0.26%. Market breadth was strong with 36 gainers vs. 21 losers; CHAMPION and NNFM topped the gainers’ list. Despite a 40% drop in volume and 38% in value, deals rose 12%, totaling 427.83m shares worth ₦8.53bn in 16,338 trades. NIBOR NIBOR declined across all tenors, while the Open Repo and Overnight Lending Rates fell to 26.50% and 26.96%, respectively, reflecting improved banking system liquidity. NITTY NITTY rose across all maturities as average T-bill yield inched up 0.02% to 20.94% on selling pressure. FGN BOND Bullish sentiment in the FGN bond market trimmed average yields by 0.02% to 19.03%. EUROBOND Investor demand drove bullish momentum in Nigeria’s sovereign Eurobond market, notably lowering yields on Sep-2028 and Mar-2029 bonds and reducing the average yield by 0.19% to 9.79%. FX MARKET In the foreign exchange market, the Naira depreciated by 0.17% in the official window, closing at ₦1,598.72 per dollar. Similarly, the Naira ended the day at ₦1,620 per dollar in the parallel market.

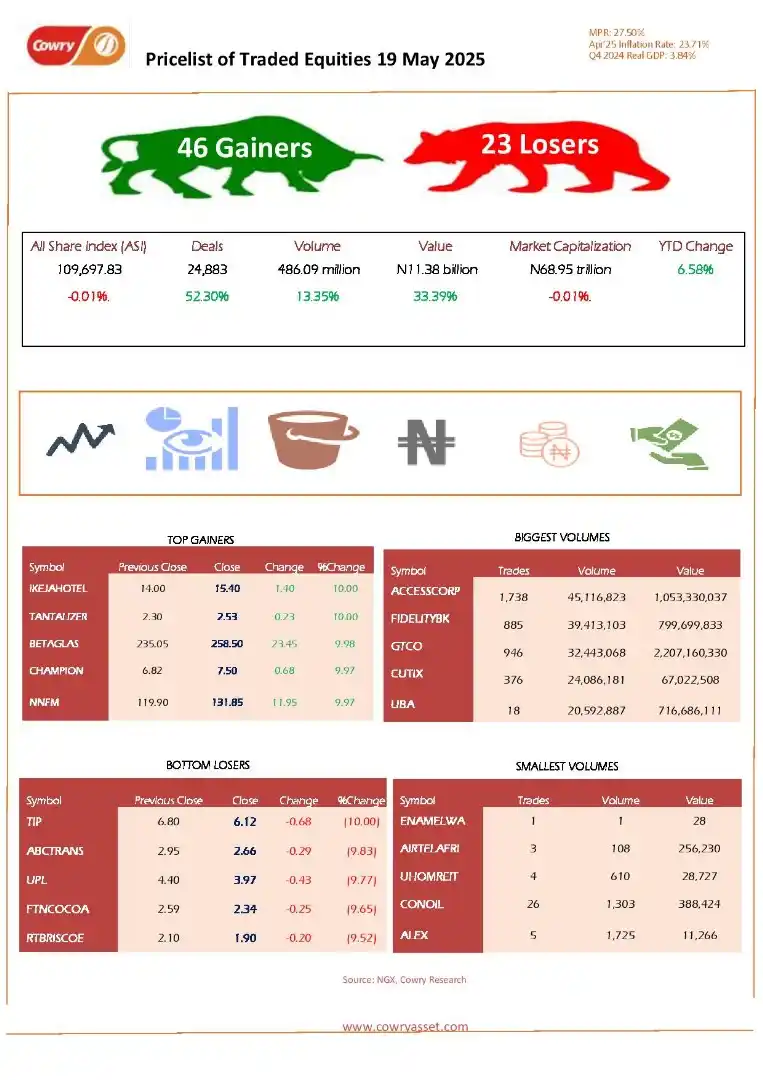

*Daily Market Summary – May 19, 2025* *Equities Market* The Nigerian equities market opened the week on a tepid note as the NGX All-Share Index edged lower by 0.01% on Monday, settling at 109,697.83 points. Despite the slight pullback, market breadth remained strong with 46 advancers outpacing 23 decliners, reflecting resilient investor sentiment. Consequently, the market capitalization also slipped by 0.01% to N68.95 trillion, with the year-to-date return moderating slightly to 6.58%. *Money Market* In the money market, Overnight NIBOR held steady at 26.83%, reflecting mild liquidity inflows into the system while the NITTY curve advanced across all tenors amid improved investor appetite for shorter-term instruments. Despite this, the secondary market for Nigerian Treasury Bills was modestly bullish, with average yields retreating by 23bps to close at 20.81%. *FGN Bond* Activity in the FGN bond market was mild as the average yield on plain vanilla bonds slipped marginally to 19.06%, reflecting light sell-offs concentrated around the short and belly segments of the yield curve. *Eurobond Market* The Nigerian Eurobond space witnessed renewed bearish sentiment with noticeable sell pressure across the SEP-33, FEB-38, and NOV-47 maturities. This resulted in a 13bps rise in the average Eurobond yield, which closed at 9.91%, as global risk sentiment shifted cautiously. *FX Market* In the FX market, naira appreciated buoyed by the CBN’s liquidity intervention through FX swap arrangements with domestic banks. At the official and parallel windows, naira gained 0.11% and 0.06% to close at N1,597/$1 and N1,619/$1 respectively.

*Market News as at Thursday, May 15, 2025* NGX investors gain N186bn on bullish trading - Punch https://punchng.com/ngx-investors-gain-n186bn-on-bullish-trading/ FG: Nigeria Attracted over $8bn in Deepwater Oil, Gas FIDs in Less Than One Year - Thisday https://www.thisdaylive.com/index.php/2025/05/15/fg-nigeria-attracted-over-8bn-in-deepwater-oil-gas-fids-in-less-than-one-year/ OPEC Maintains Global Oil Demand Forecasts for 2025 – Market Forces https://dmarketforces.com/opec-maintains-global-oil-demand-forecasts-for-2025/ Tariff hike boosts telcos’ average revenue per user by 15% - Business Day https://businessday.ng/technology/article/tariff-hike-boosts-telcos-average-revenue-per-user-by-15/ Inflation: Reps warn CBN high interest rates may backfire - Guardian https://guardian.ng/featured/inflation-reps-warn-cbn-high-interest-rates-may-backfire/ Petrobras eyes return to Nigeria’s Oil Sector, targets Deepwater Acreage – Business Day https://businessday.ng/companies/article/petrobras-eyes-return-to-nigerias-oil-sector-targets-deepwater-acreage/ SEC joins IOSCO-ISSB network - Punch https://punchng.com/sec-joins-iosco-issb-network/ Airtel Africa begins another $100m share buyback - Punch https://punchng.com/airtel-africa-begins-another-100m-share-buyback/ Africa’s Debt Crises Require Urgent Reform—ECA – Market Forces https://dmarketforces.com/africas-debt-crises-require-urgent-reform-eca/ First Bank’s Attempt to Get Stay of Execution against GHL’s Third Victory Dismissed - Thisday https://www.thisdaylive.com/index.php/2025/05/15/first-banks-attempt-to-get-stay-of-execution-against-ghls-third-victory-dismissed/

*Market News as at Wednesday, May 14, 2025* With Projected $12bn Annual Remittance, CBN Launches Non-resident BVN to Expand Financial Access for Nigerians in Diaspora - Thisday https://www.thisdaylive.com/index.php/2025/05/14/with-projected-12bn-annual-remittance-cbn-launches-non-resident-bvn-to-expand-financial-access-for-nigerians-in-diaspora/ Short-term Benchmark Interest Rates Rise over FX Settlement – Market Forces https://dmarketforces.com/short-term-benchmark-interest-rates-rise-over-fx-settlement/ FG lists N4.3bn savings bonds on NGX - Punch https://punchng.com/fg-lists-n4-3bn-savings-bonds-on-ngx/ How Nigeria can harness $6.45tr maritime tourism sector for growth - Guardian https://guardian.ng/business-services/maritime/how-nigeria-can-harness-6-45tr-maritime-tourism-sector-for-growth/ Rural electrification attracted N5.8bn private investment – REA - Punch https://punchng.com/rural-electrification-attracted-n5-8bn-private-investment-rea/ Bonds Yield Steady as DMO Opens Sukuk Offer – Market Forces https://dmarketforces.com/bonds-yield-steady-as-dmo-opens-sukuk-offer/ ELAN: Leasing Industry Transaction Volume Grew by 23.2% to N5.16trn in 2024 - Thisday https://www.thisdaylive.com/index.php/2025/05/14/elan-leasing-industry-transaction-volume-grew-by-23-2-to-n5-16trn-in-2024/ Dangote refinery cancels June maintenance – Report - Punch https://punchng.com/dangote-refinery-cancels-june-maintenance-report/ Nine banks earn N2.3tn interest on N61.6tn loans - Punch https://punchng.com/nine-banks-earn-n2-3tn-interest-on-n61-6tn-loans/