Cowry Asset Mgt Channel

May 16, 2025 at 04:29 PM

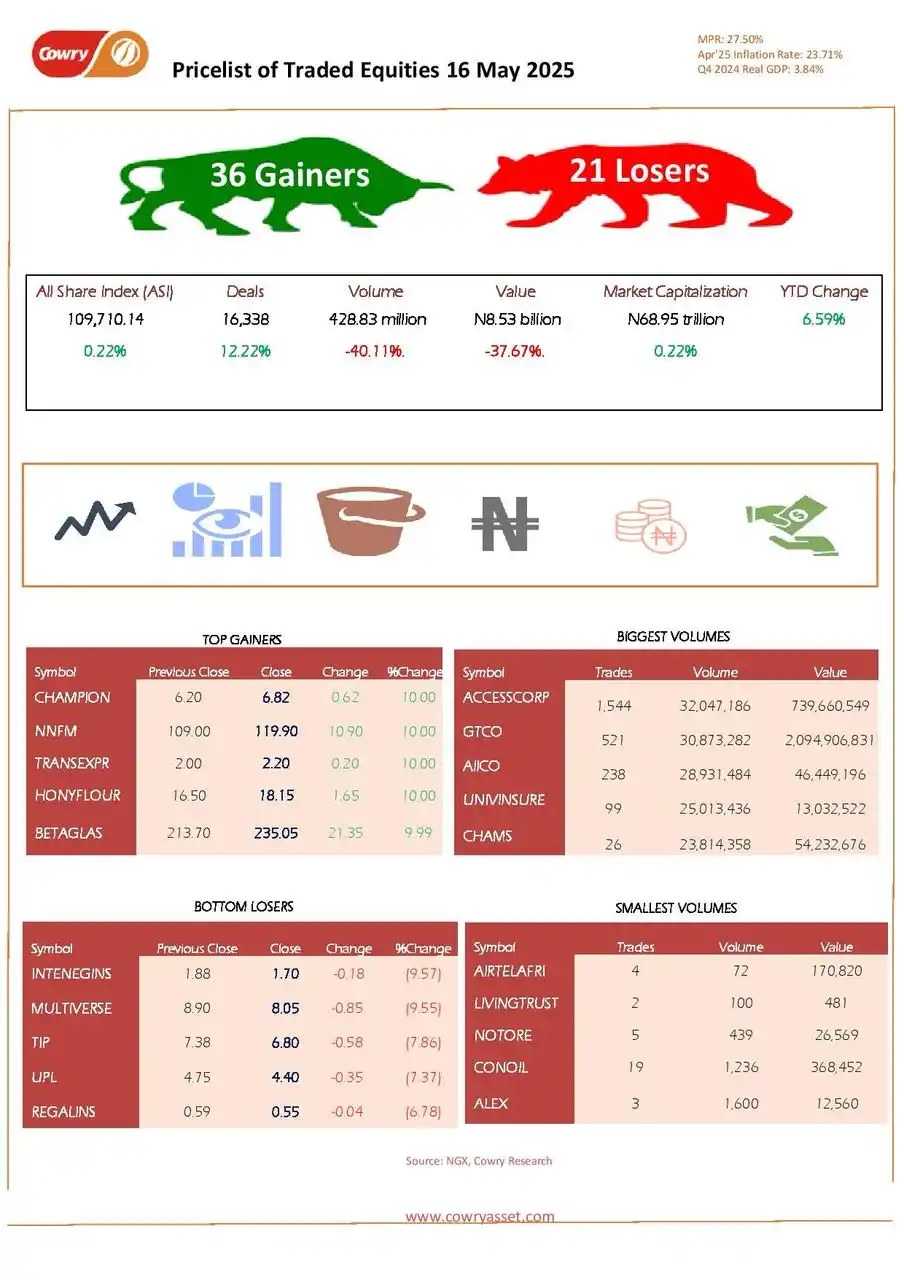

Daily Market Summary, 16 May, 2025

EQUITIES MARKET

The NGX ended the week on a positive note as the ASI rose 0.22% to 109,701.14 points, with market cap up ₦153bn to ₦68.95tn. Sector performance was largely bullish, led by Commodities (+2.08%), while Consumer Goods dipped 0.26%. Market breadth was strong with 36 gainers vs. 21 losers; CHAMPION and NNFM topped the gainers’ list. Despite a 40% drop in volume and 38% in value, deals rose 12%, totaling 427.83m shares worth ₦8.53bn in 16,338 trades.

NIBOR

NIBOR declined across all tenors, while the Open Repo and Overnight Lending Rates fell to 26.50% and 26.96%, respectively, reflecting improved banking system liquidity.

NITTY

NITTY rose across all maturities as average T-bill yield inched up 0.02% to 20.94% on selling pressure.

FGN BOND

Bullish sentiment in the FGN bond market trimmed average yields by 0.02% to 19.03%.

EUROBOND

Investor demand drove bullish momentum in Nigeria’s sovereign Eurobond market, notably lowering yields on Sep-2028 and Mar-2029 bonds and reducing the average yield by 0.19% to 9.79%.

FX MARKET

In the foreign exchange market, the Naira depreciated by 0.17% in the official window, closing at ₦1,598.72 per dollar. Similarly, the Naira ended the day at ₦1,620 per dollar in the parallel market.