Cowry Asset Mgt Channel

May 19, 2025 at 05:45 PM

*Daily Market Summary – May 19, 2025*

*Equities Market*

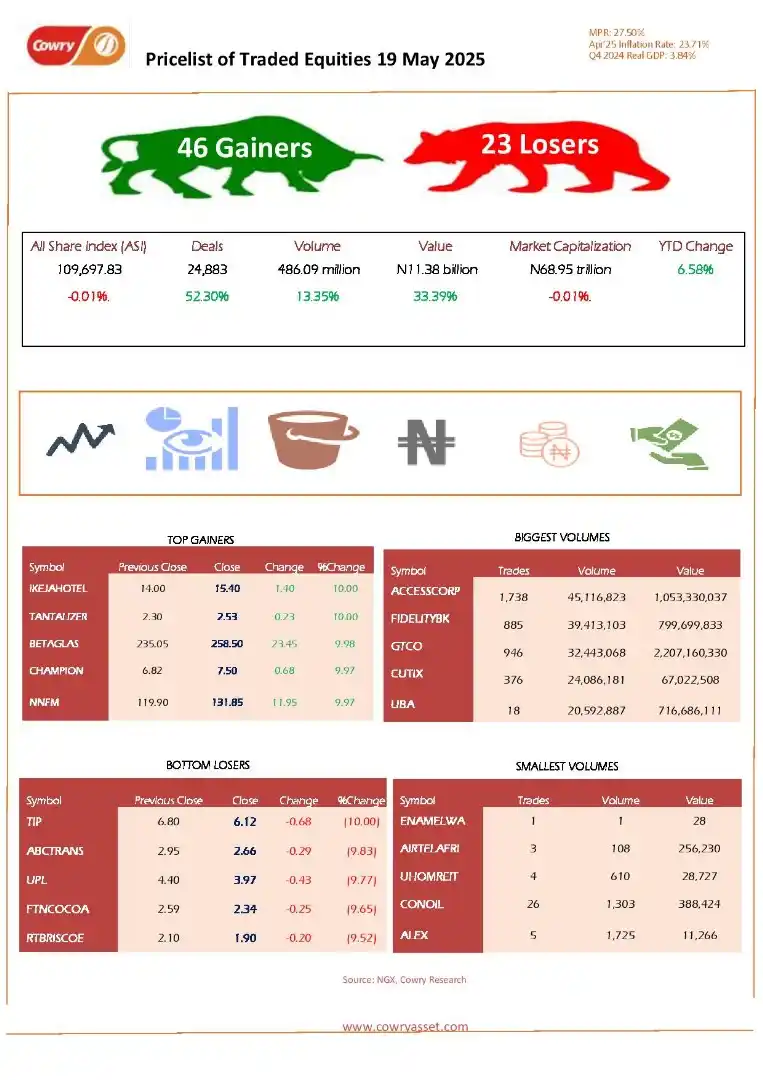

The Nigerian equities market opened the week on a tepid note as the NGX All-Share Index edged lower by 0.01% on Monday, settling at 109,697.83 points. Despite the slight pullback, market breadth remained strong with 46 advancers outpacing 23 decliners, reflecting resilient investor sentiment. Consequently, the market capitalization also slipped by 0.01% to N68.95 trillion, with the year-to-date return moderating slightly to 6.58%.

*Money Market*

In the money market, Overnight NIBOR held steady at 26.83%, reflecting mild liquidity inflows into the system while the NITTY curve advanced across all tenors amid improved investor appetite for shorter-term instruments. Despite this, the secondary market for Nigerian Treasury Bills was modestly bullish, with average yields retreating by 23bps to close at 20.81%.

*FGN Bond*

Activity in the FGN bond market was mild as the average yield on plain vanilla bonds slipped marginally to 19.06%, reflecting light sell-offs concentrated around the short and belly segments of the yield curve.

*Eurobond Market*

The Nigerian Eurobond space witnessed renewed bearish sentiment with noticeable sell pressure across the SEP-33, FEB-38, and NOV-47 maturities. This resulted in a 13bps rise in the average Eurobond yield, which closed at 9.91%, as global risk sentiment shifted cautiously.

*FX Market*

In the FX market, naira appreciated buoyed by the CBN’s liquidity intervention through FX swap arrangements with domestic banks. At the official and parallel windows, naira gained 0.11% and 0.06% to close at N1,597/$1 and N1,619/$1 respectively.