Cowry Asset Mgt Channel

May 22, 2025 at 04:12 PM

Daily Market Summary, Thursday, 22 May, 2025

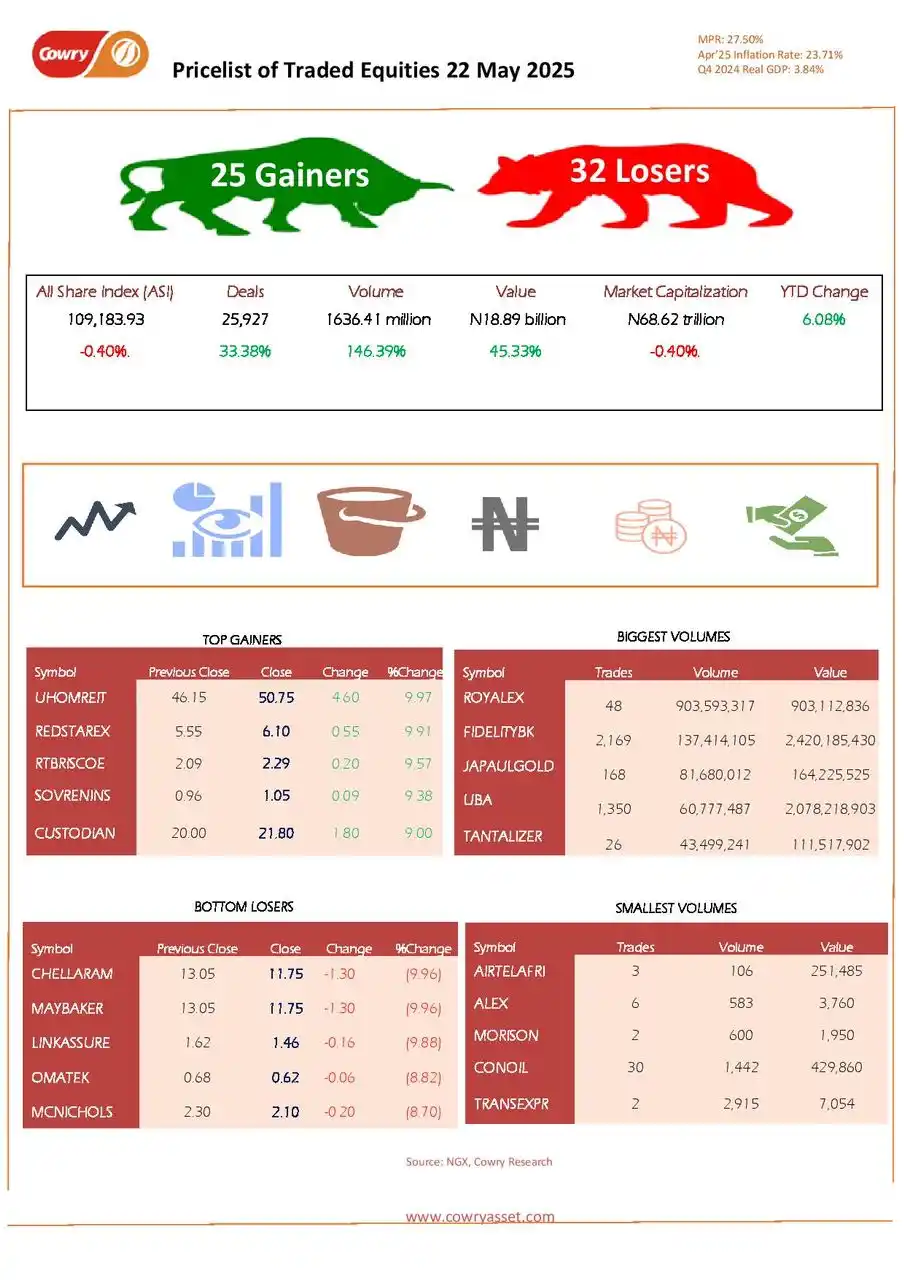

EQUITIES MARKET

The local bourse closed lower as the ASI dipped 0.40% to 109,183.93 points, with market capitalization also down 0.40% to ₦68.62 trillion, resulting in a ₦274 billion loss. Market breadth was negative (25 gainers vs. 32 losers), with UHOMREIT and REDSTAREX topping gainers, while CHELLARAM and MAYBAKER led decliners. Sector performance was broadly weak, except for Industrial Goods (+0.32%). Trading activity surged, with 1.64 billion shares worth ₦18.89 billion exchanged across 25,927 deals.

NIBOR

NIBOR rose across most tenors except the overnight rate (-2bps), while OPR held at 26.50% and OVN edged up 6bps to 26.96%.

NITTY

The NITTY curve declined across all tenors as strong demand pushed average T-bill yields down 7bps to 20.72%.

FGN BOND

FGN bond market activity was mildly positive, with average yields dipping 5bps to 19.00%.

EUROBOND

Bearish sentiment in Nigerian Eurobonds led to a 9bps rise in average yield to 9.86%, driven by sell-offsoffs in long-dated maturities.

FX MARKET

The naira appreciated at the official market, buoyed by the CBN’s liquidity intervention through FX swap arrangements with domestic banks. At the Nigerian Autonomous Foreign Exchange Market (NAFEM), the naira strengthened by 0.38% to close at N1,584.50 per US dollar. Similarly, in the parallel market, the local currency declined by 0.31%, ending the day at N1,620 per dollar.