Cowry Asset Mgt Channel

June 10, 2025 at 04:07 PM

*Daily Market Summary, Tuesday, 10 June, 2025*

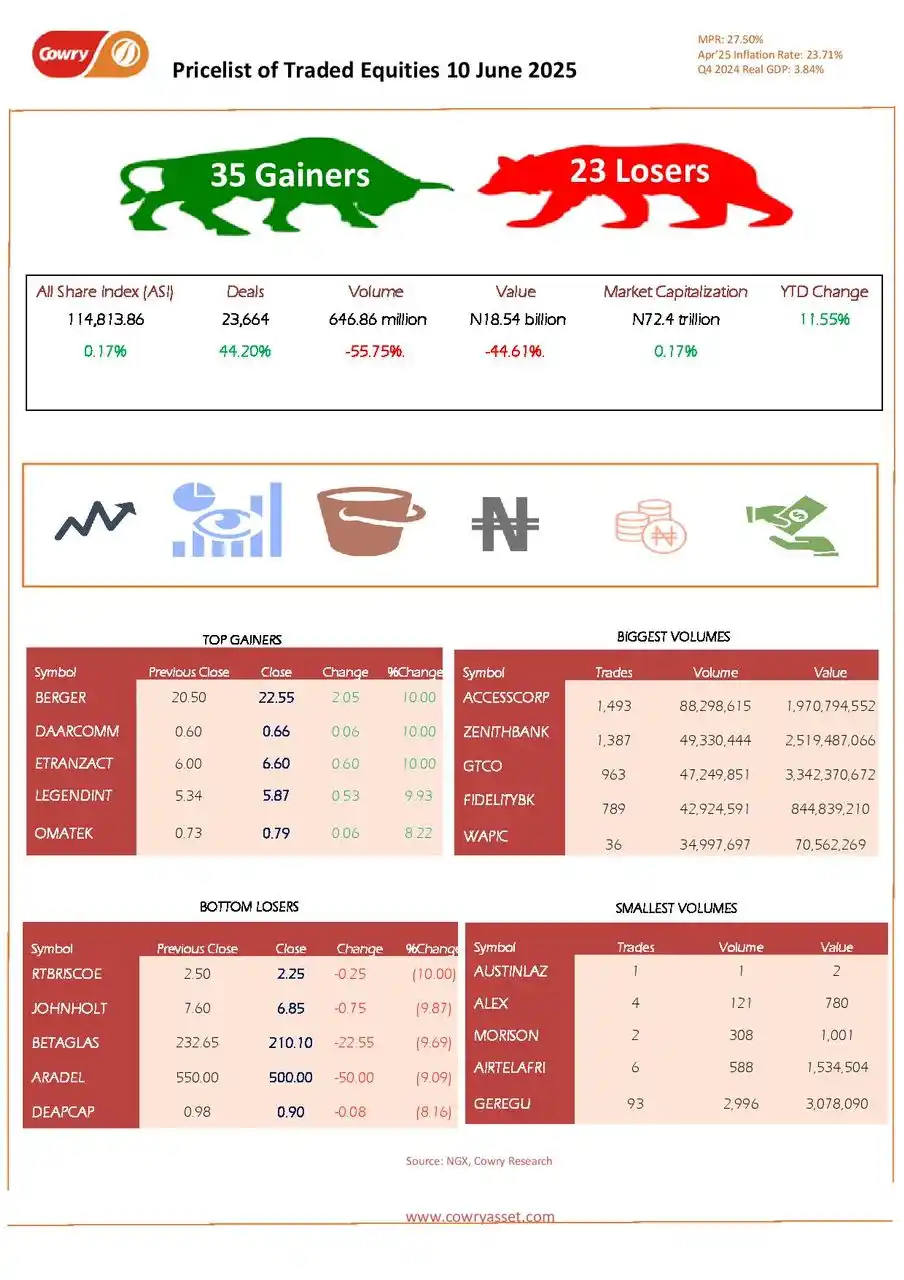

EQUITIES SUMMARY

The Nigerian equities market extended its bullish run on Monday, as the NGX ASI rose 0.17% to 114,813.86 points, adding ₦124.3 billion to market cap at ₦72.4 trillion. Market breadth was positive with 35 gainers led by Berger, Daarcomm, and Etranzact, while 23 stocks declined. Sector performance was mixed, with gains in Banking, Consumer Goods, and Oil & Gas, and losses in Insurance, Industrial Goods, and Commodities. Despite muted activity—volume and value down 55.75% and 44.61%—deal count rose 44.20% to 23,664.

NIBOR

NIBOR declined across all tenors except overnight (flat at 28.83%), while OPR was steady at 26.50% and OVN inched up 1bps to 26.95%, reflecting improved system liquidity.

NITTY

The NITTY curve rose across all tenors as sell-offs pushed average yield up by 11bps to 20.80%.

FGN BOND

The FGN bond market traded bearishly, with average yields inching up 2bps to 18.82%.

EUROBOND

The Nigerian Eurobond market rallied on strong demand—especially for NOV-25 bond—pushing average yields down 7bps to 9.17%.

FX MARKET

The naira gained 0.85% to ₦1,540/$ at NAFEM, while trading at ₦1,580/$ in the parallel market.