Market Mania

May 30, 2025 at 03:50 AM

Riskier emerging-market bonds may continue to outperform their lower-yielding peers due to the dollar's slide, which softens the impact of rising Treasury yields on investor returns.

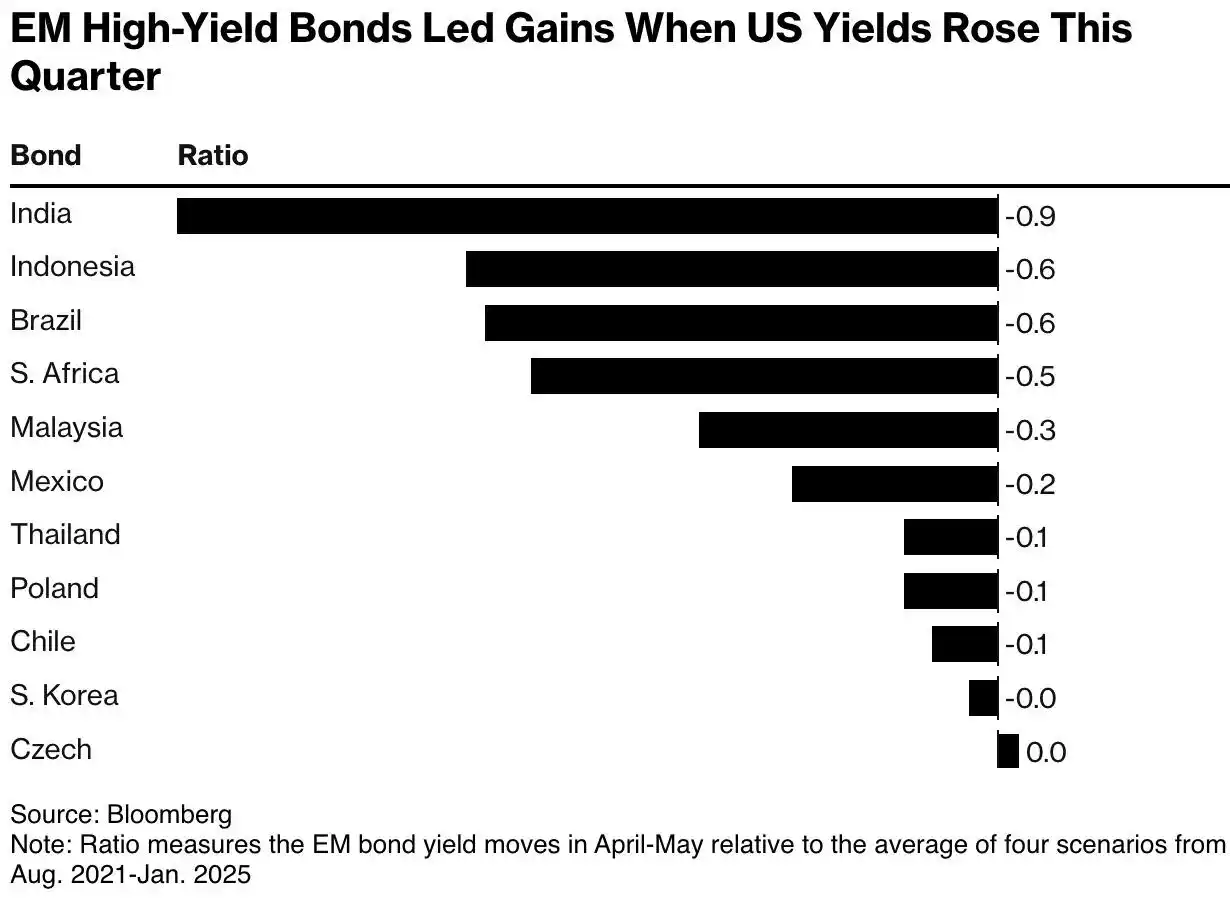

The dollar's fall allows currency returns to compensate for the impact of higher US yields, benefiting higher-yielding EM bonds, such as those from India, Indonesia, Brazil, and South Africa.

A weaker US dollar this year has benefited EM local markets, and a continuation of this trend could help cushion local bond performance.

The ratio of yield moves this quarter versus the historical average for India was minus 0.88, versus Indonesia, Brazil and South Africa at -0.57, -0.55 and -0.50 respectively. This means that India’s yields in the most recent scenario have declined the most relative to its historical mean. Peers which offer lower yields, such as the Czech Republic and South Korea, tend to be more affected by the surge in US yields due to the tighter spreads.

Life Insurance Corporation of India subscribed to the entire ₹5,000-crore non-convertible debenture (NCD) issue of Adani Ports and Special Economic Zone underscoring sustained efforts by India's largest private port operator to refinance short-term debt with longer-tenor borrowings at lower rates.