Market Mania

June 12, 2025 at 03:27 AM

President Trump’s announcement of unilateral tariff rates within two weeks has weakened Asian shares.

Consumer price inflation data due later today is expected to moderate further, but may not be of much cheer to bulls with more rate cuts unlikely near term.

Bond issuers turn wary as yields edge up

The bond markets’ initial excitement following the RBI’s liquidity bazooka last Friday has quickly faded. As yields nudged higher this week, two state-run giants — Indian Oil Corp. and Power Finance Corp. — canceled their issuances, opting to wait for yields to settle down. With the central bank signaling limited scope for further rate cuts, investors are showing little urgency to lock into longer-term debt.

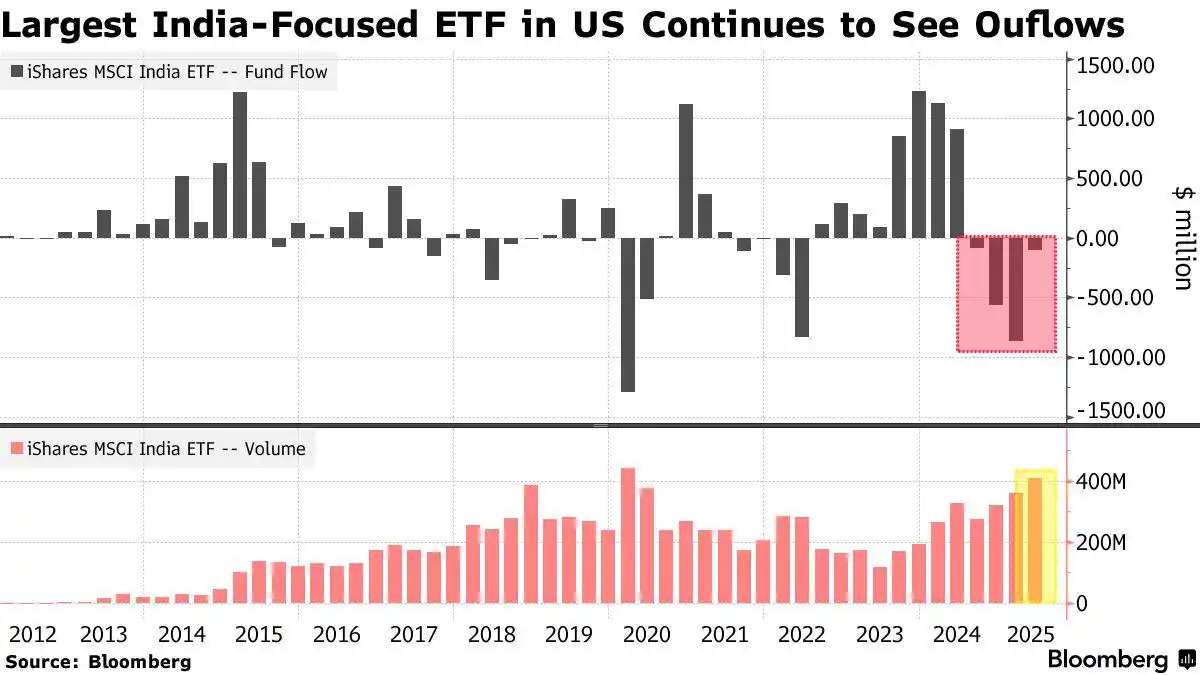

While global money managers have recovered their appetite for Indian equities this quarter with $3 billion of net purchases, some US-based funds appear wary. The largest ETF dedicated to Indian stocks in the US is on pace for a record fourth-straight quarter of withdrawals. The outflows were coupled with the highest quarterly volumes on the fund since March 2020.