Market Mania

June 20, 2025 at 03:22 AM

Across Asia, markets are trading in a narrow range as investors keep an eye on geopolitical tensions in the Middle East. A dip in oil prices and a slightly softer dollar could offer some support to the broader Indian market that’s still on track for a modest weekly gain.

After a stellar eight-year rally, Varun Beverages shares have slumped 30% so far this year. A rebound looks unlikely in the near term, with mounting competition from Mukesh Ambani’s conglomerate. According to recent reports, Reliance’s consumer unit is looking to pump nearly $1 billion into its soft drink business, which has so far targeted rural markets while steering clear of confrontation with PepsiCo and Coca-Cola in urban centers. Adding to Varun’s woes is the erratic weather — this year’s summer was shorter and less harsh, weighing on demand.

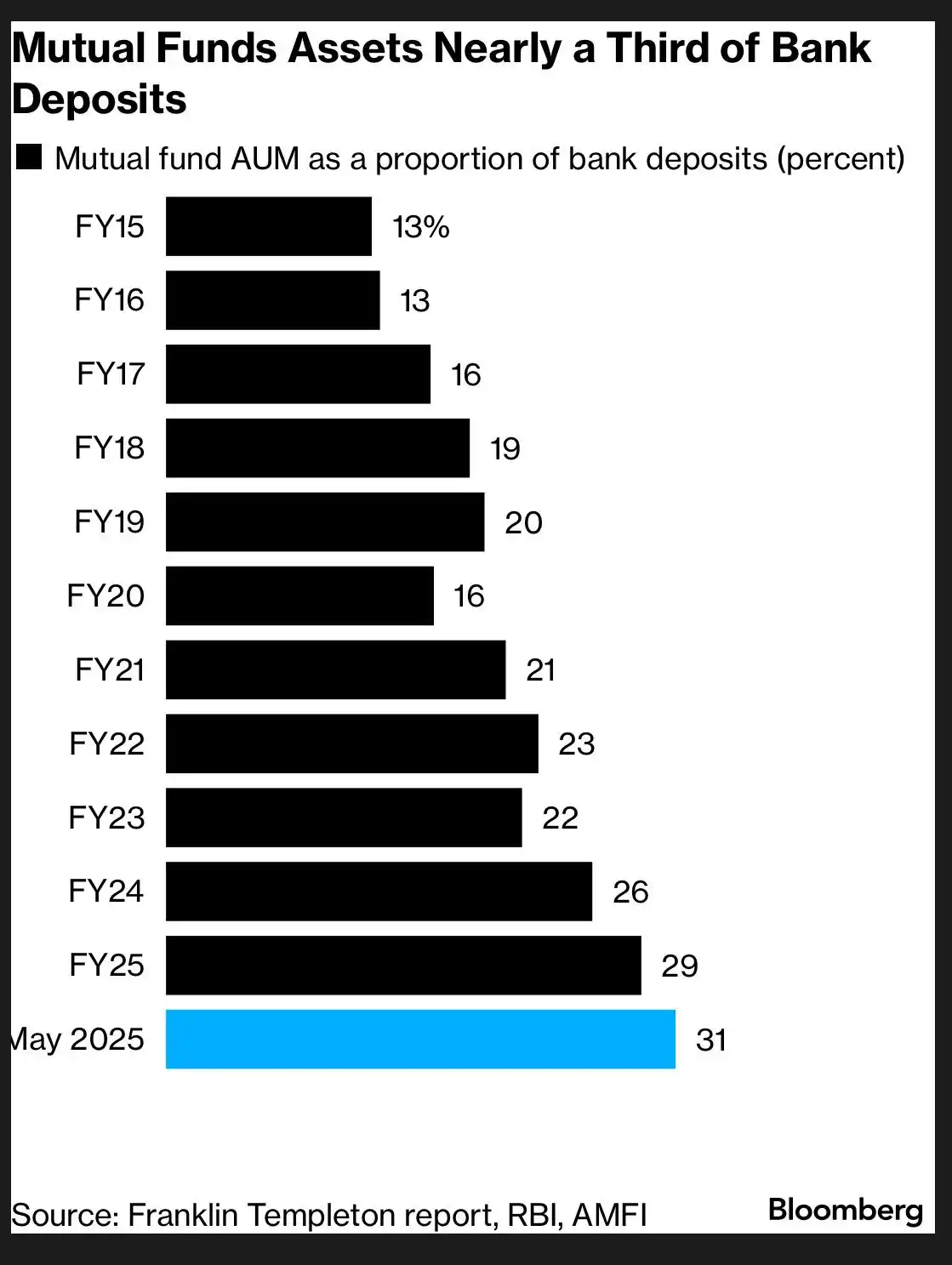

Assets managed by Indian mutual funds have grown at a compounded annual rate of 24% over the past five years. As of May, they reached a record high of over 72 trillion ($832 billion). For context, that is equivalent to over 30% of total bank deposits. This marks a significant shift in the savings preferences of Indian households. The trend has been accelerating since the pandemic, driven by several factors — the rise of discount brokers, a bull market in equities, and sustained investor education efforts by the industry.