Tax Update With CA. Mohit Kumar

June 15, 2025 at 03:16 PM

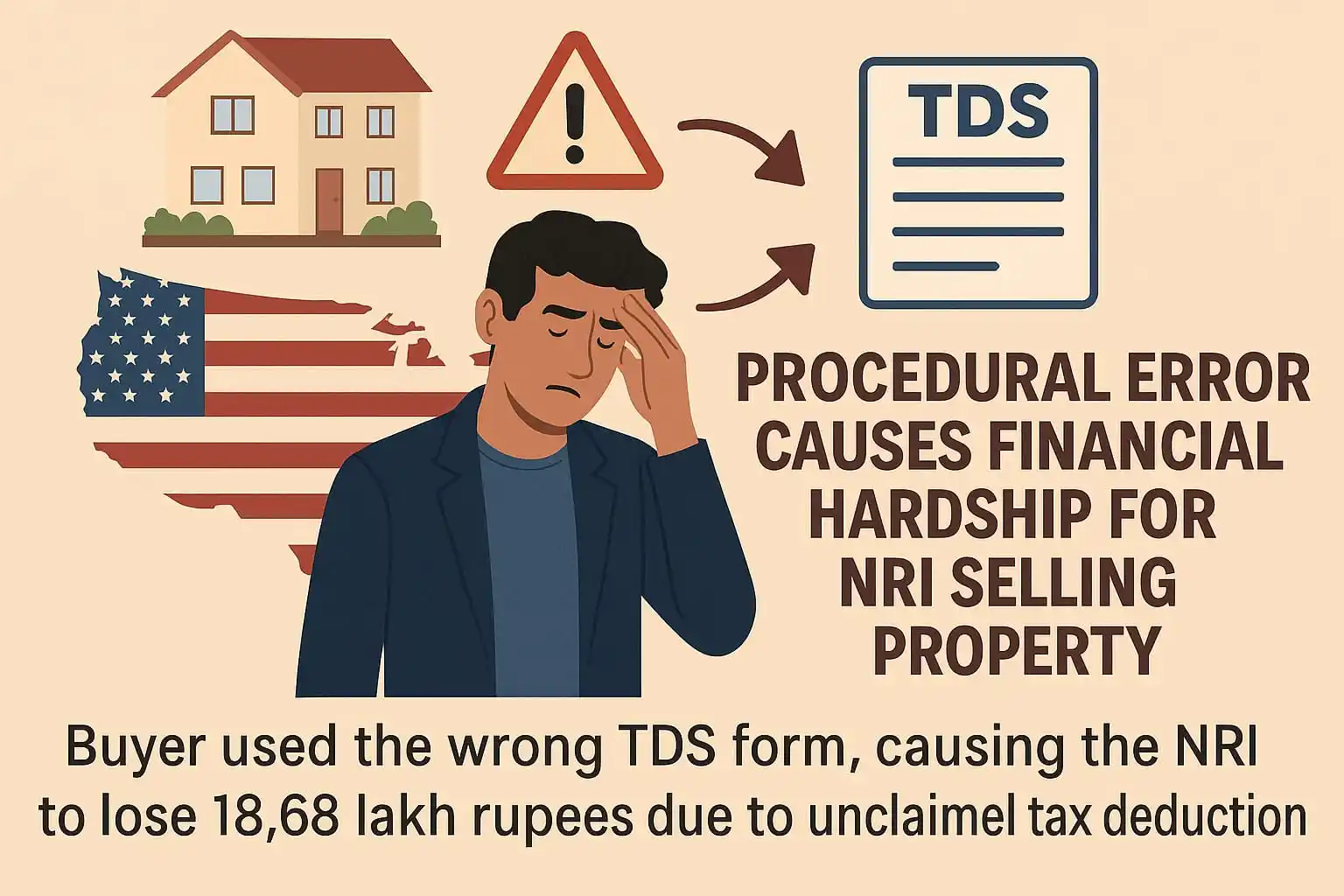

A US-based NRI sold his Pune property for ₹2 Cr. The buyer deducted 20% TDS but filed it using the wrong form meant for residents. Result? ₹18.68 lakh vanished from his AIS. Without AIS credit, he couldn’t claim refund in ITR. ❌

* TDS Requirement for NRI: As per Section 195 of the Income Tax Act, @ 20% TDS must be deducted on property sales involving NRIs (not Section 194-IA which is for resident sellers).

* Mistake by Buyer: Buyer wrongly deposited TDS using Form 26QB, which is meant for resident sellers under Section 194-IA, instead of Form 27Q, which is mandatory for payments to NRIs under Section 195

* Result: The TDS got deposited under the wrong section, and hence, did not reflect in the NRI seller’s AIS (Annual Information Statement).

* *Outcome*: NRI couldn't claim this TDS while filing ITR, leading to a *financial loss of ₹18.68 lakh*, unless rectified.

How did this case start?

According to the order of the Delhi High Court dated May 27, 2025, here is a timeline of events:

1998: A NRI person residing in the United States of America (USA) purchased a property in Pune.

March 18, 2015: A doctor expressed his interest in buying this Pune property from this NRI for a total sale consideration of Rs 2 crore.

The NRI accepted the offer.

September 5, 2015: The property buyer informed the NRI that he needs to deduct 20% TDS on this Rs 2 crore property sale. So the buyer will deduct Rs 18.68 lakh (18,68,177) and give the NRI Rs1.8 crore (1,81,31,823). The NRI agreed to this.

October 27, 2015: The NRI computed his income tax liability as Rs 1.9 lakh (1,91,780) and deposited the same as advance tax. He then repatriated the balance amount of property sale proceeds to the USA. He did not file an income tax return (ITR) for that year.

March 4, 2023: An Income tax officer issued a notice under Section 148(b) to this NRI on the basis of the information available that the NRI had sold a property, which according to the officer, suggested that the petitioner’s income had escaped assessment.

April 15, 2023: The NRI person furnished all details and even showed his advance tax receipt, but the tax officer did not accept the same. This officer then proceeded to pass an order under Section 148A(d) holding that it is a fit case for issuance of notice under Section 148.

October 30, 2024: The income tax officer issued another notice under Section 142 seeking furnishing of certain documents. The NRI person responded to the same and gave the details.

March 4, 2025: The income tax officer issued a proposed assessment order by accepting the ITR filed by the NRI in response to the earlier notice. The tax officer also issued a computation sheet reflecting a tax demand of Rs 46 lakh (46, 81, 013). He issued another notice showing this tax demand amount. The tax officer based on this notice also initiated penalty proceedings under Section 270A.

March 2025: The NRI filed a detailed reply pointing out that the entire tax liability had been discharged, but the credit of the same was not effected on account of TDS returns filed under Form 26QB instead of Form 27Q.

The NRI directly filed an appeal against this order in the Delhi High Court.

The Delhi High Court decisively protects NRI sellers by mandating that TDS credit be provided regardless of technical form errors. Sellers who followed due process and had TDS deducted must not be burdened with financial loss due to buyer-side filing mistakes.

*A 10-Year Nightmare Over a TDS Form Mistake*

It took nearly a decade — from 2015 to 2025 — for the NRI to get justice, simply because a buyer used the wrong TDS form.

😢

1