JIPIN PRASAD

6.9K subscribers

About JIPIN PRASAD

Objective : FREE Knowledge & Education We are not SEBI registered Given stocks charts and stocks analysis is only for education purpose WhatsApp Number : 9633520697 No Buy/Sell Recommendations Premiums community more details https://wa.me/7012316830

Similar Channels

Swipe to see more

Posts

നിഫ്റ്റി വീണ്ടും വരും ദിവസങ്ങളിൽ കൂടുതൽ തിരുത്തലുകൾ നടത്തിയേക്കാം

Russia - ukraine war Ukraine strikes strategically & hit 4 air bases and severely damages russian strategic bombers causing losses over 2 billion dollars. What is important to note is style of attack is nothing less than movie script. Truck loaded with drones placed near Russian airbases. All these drones were less with AI technology and striked at stationed strategic bombers & aircrafts. This is real modern warfare. There were no hangers, interception of these drones which are very cheap in price but did severe damage to Russian airforce. once the operation is done truck carrying drones had timer bomb which blew itself up.Russian twitter handles & thinkers are demanding for nuclear strike. Looks like pearl harbour moment for Russia

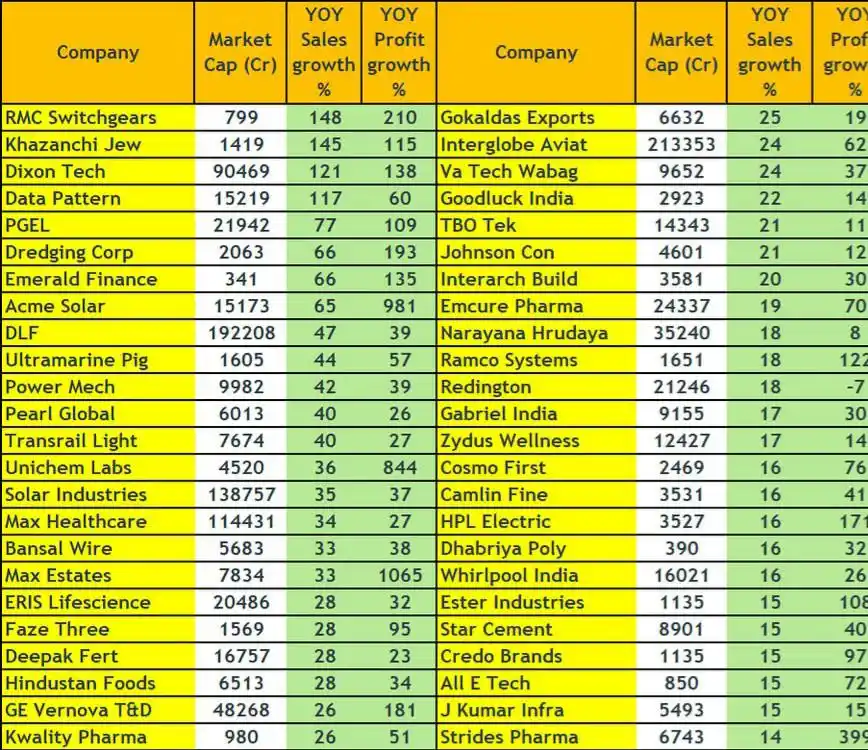

portfolio series ഒന്നായിരുന്നു ഇന്ന് ബോണസും സ്പ്ളിറ്റും കഴിഞ്ഞു നോക്കുമ്പോൾ 200% അധികം റിട്ടേൺ ഈ വളർച്ച തുടരും 🙏

ഇന്നത്തെ intrady മാർക്കറ്റ് ഒരു കറക്ഷൻ ലേക്ക് പോകും എന്ന് തോന്നിയപ്പോൾ നഷ്ടത്തിൽ അവസാനിപ്പിച്ചു എങ്കിൽ മാർക്കറ്റ് ക്ലോസ് ചെയ്തപ്പോൾ നമ്മുടെ tgt അടുത്ത് വരുകയും ചെയ്തു ലോസ്സ് മാർക്കറ്റിൽ ഉള്ളതാണ് sl ഹിറ്റ് ചെയ്യുന്നതും നല്ലതാണ് tgt. മാത്രം അല്ല sl പോസ്റ്റ് ചെയ്യും 🙏

/9j/4AAQSkZJRgABAQAAAQABAAD/2wBDABsSFBcUERsXFhceHBsgKEIrKCUlKFE6PTBCYFVlZF9VXVtqeJmBanGQc1tdhbWGkJ6jq62rZ4C8ybqmx5moq6T/2wBDARweHigjKE4rK06kbl1upKSkpKSkpKSkpKSkpKSkpKSkpKSkpKSkpKSkpKSkpKSkpKSkpKSkpKSkpKSkpKSkpKT/wgARCABHAEgDASIAAhEBAxEB/8QAGQAAAwEBAQAAAAAAAAAAAAAAAAIDAQQF/8QAFQEBAQAAAAAAAAAAAAAAAAAAAAH/2gAMAwEAAhADEAAAAPeJ0sGysqLYJFQmOHJSWWXflZeh+UOo5Q6jlBsoExpjroIzukigaa0s3VwxlNNBBxJsCgBugMgGAH//xAAZEQADAQEBAAAAAAAAAAAAAAAAAREhIED/2gAIAQIBAT8Aaa5e6QhCeD//xAAZEQACAwEAAAAAAAAAAAAAAAABIQARIDD/2gAIAQMBAT8ABvIXZwLP/8QAKRAAAgICAQMCBQUAAAAAAAAAAQIAERIhAxMxUkFREEJhcZEEIiOBof/aAAgBAQABPwDqcvun5gflqyV+kXlf5itQHmIv9sPVx0Bcv9R7LL592Fl8/ssXq5DKqnFzcPK1BD9zD0a7jUvhr5YpBUFe03Nzc3Ca7mcPEvGV/lsLMU2ch+IqITsqf6g1oOKhvEjPcVgAAWszIe4mQ9xMlPqI2KCzqZoK3M08opDC1NypXxPaFA3cXOmviJ018RAFGhQ+BYA0dQhScrMU33Wo2lJqWDPsIwPYd4ODHd2Zg3pc6N7aLxKv1lRhqAKRY/yYsfXUqmom4FEqVKlRtKbiKQKU6mLX3jcRJyvcCkau5RhRru+8UEa9JuEBhRGpx8fKqgF7MKPenmL+cxfzgVq20UEDZv4FX9GmL+c///4AAwD/2Q==

8 രൂപ മുതൽ 43 വരെ പറഞ്ഞ stock Suzlon FY25 Results: PAT Up 190%, Eyes 60% Growth in FY26 Backed by 5.5 GW firm orders and a growing EPC pipeline, Suzlon must deliver flawlessly—rich valuations demand execution, margin stability, and timely CODs. What Changed Between FY21–25 3× Revenue Growth: Scale-up across WTG, OMS, and SE Forge. Platform Evolution: S144 matured to industrial scale with 5+ GW orders. Capacity Ramp-Up: Expanded nacelle, blade, and tower plants to 4.5 GW capacity. Customer Base Shift: Now includes PSU majors like NTPC, Torrent, BPCL. Cash Conversion: ₹1,943 Cr net cash in FY25 vs ₹110 Cr in FY24; DTA recognition aids equity base. Service Model Deepening: OMS AUM >15.1 GW (Suzlon) + 3 GW (Renom), annuity cash flows. Export & Digital Readiness: Azure OpenAI-led digital infra; export interest from EU OEMs. Business Model Evolution: From asset-light supplier to vertically integrated solution partner. Execution Breakout: Record quarterly deliveries (573 MW), with robust commissioning visibility across PSU and C&I orders. Operating Leverage Playbook: Higher scale and factory utilization improved cost absorption and margin lift. One-Time Boost: ₹600 Cr deferred tax asset recognition pushed PAT to record high—supporting equity base restoration. Platform Dominance: S144 turbine now over 90% of order mix, driving better pricing and tech alignment for FDRE projects. ROCE improved in FY25, driven by stronger execution, higher contribution margins, and improved working capital after full ramp-up of 4.5 GW capacity. ROE rise, supported by ₹2,072 Cr PAT and a stronger equity base. The FY23 spike (262.7%) was a low-base anomaly; FY25 reflects normalized returns. Valuation Analysis – Suzlon Energy FY26E P/E is calculated by assuming a 60% growth on FY25 PAT excluding DTA Trailing valuations are elevated, reflecting Suzlon’s turnaround year in FY25 with record revenue, 118% growth in deliveries, and normalized PAT doubling YoY. At current levels, valuation implies a full price for flawless execution. With Suzlon guiding for 60% growth in FY26, the stock trades at ~42× forward earnings — still rich relative to industrial peers. Valuation rerating depends on execution certainty, especially on commissioning (COD), order-to-cash cycles, and margin maintenance. While balance sheet strength (₹1,943 Cr net cash) supports confidence, working capital pressures and project timing remain key watchpoints. No room for multiple expansion unless FY26 outperforms guidance both P/E and EV/EBITDA are already near upper decile of renewables/infra comparables. Valuation compression is possible, especially if delivery execution lags or margins dip. The Street may model a derating from 47× → 35–38× as normalized PAT scales in FY26. Despite a clean balance sheet and leadership in India’s wind OEM market, Suzlon’s margin of safety is low at current valuations. The stock prices in a strong FY26 already, and any slip in execution, margin, or cash conversion could trigger a derating. Valuation Risk Factors: Market expectations: Premium multiples demand PAT > ₹2,200 Cr and margin stability above 17% Execution dependency: FY26 depends on timely EPC conversions and CODs Supporting Positives: S144 turbine scaled across 5.6 GW+ order book Visibility into FY26–27 revenue through backlog

എന്റെ പേരിൽ ഫ്രണ്ട് റിക്വസ്റ്റ് ഫേക്ക് id നിന്നും വരുന്നുണ്ട് ആർക്കെങ്കിലും വന്നിട്ടുണ്ട് എങ്കിൽ റിപ്പോർട്ട് അടിച്ചു സഹായിക്കണം

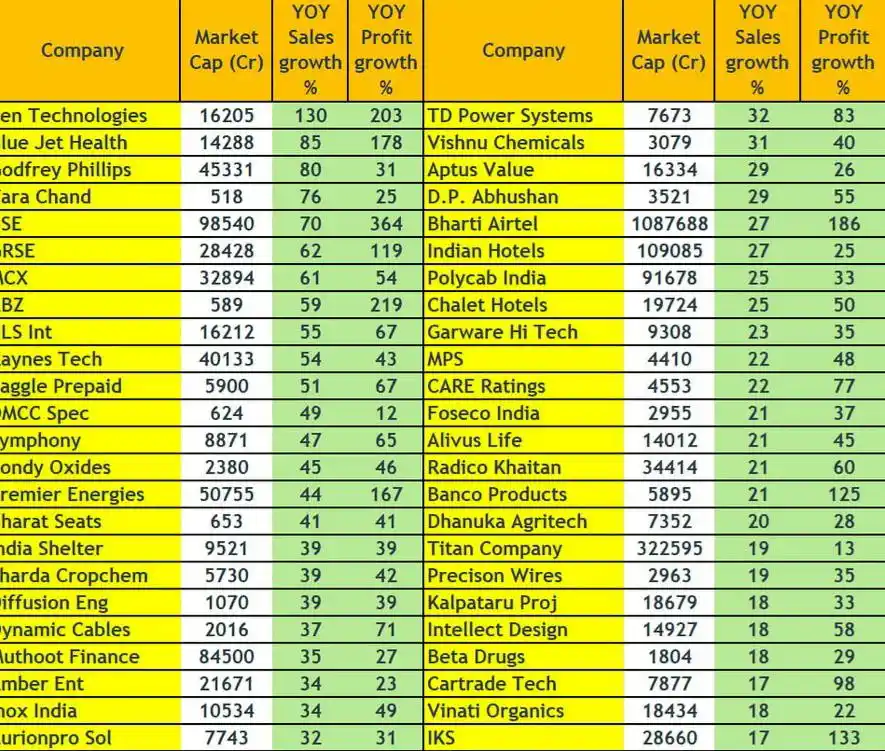

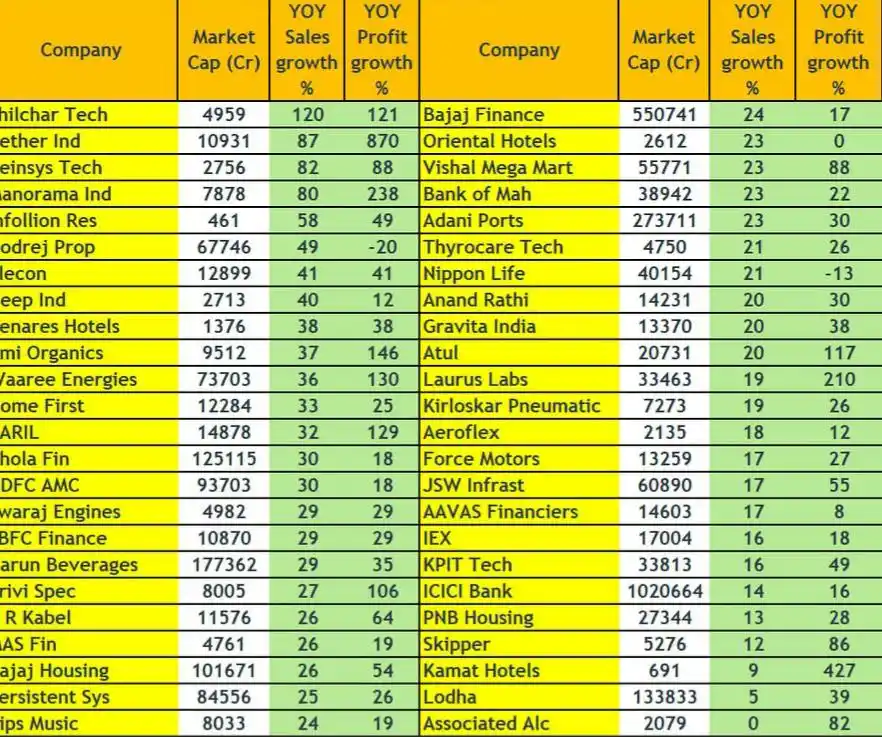

Earnings Season Sectoral Summary #Q4FY25 Lot of companies delivered blockbuster earnings🔥 Lot of Action in Mid/SmallCap💹 Strong Results: - Financials - Housing Finance, Select NBFC's - Few Auto Ancillaries (Lumax, Lumax Auto, Gabriel, Fiem...) - Pharma - CRDMO, API - Capital Markets (Exchanges, MFD, Asset & Wealth M) - Recycling & few in Water Treatment (Va Tech, Enviro Infra..) - Capital Goods (PEB, Turbines & Generator, Industrial Gears & Equipment's, Compressors etc) - Real Estate, Co Working - EMS - B2B Jewellery, Jewellery & Value Retailers - Renewables, EPC (Cashflow concerns) - Power - T&D , W&C, Transformer - Consumer Durables - Packaging Films (Margin Expansion) - Select Agro Chemicals/Chemicals - Defence - Aviation & Hotels - Telecom - Hospitals - Life Insurance - Sugar - Alcoholic Beverages Weak/Mixed Results: - Textiles - Banks (NIM's compression) - Dairy - Cement - Building Materials - LargeCap IT, Midcap IT (Ex Persistent, Coforge) - Paints - QSR (Muted SSSG) - Paper - FMCG (Muted Growth)

![thousands_CORE [🇺🇸1000$CORE🔸🇺🇸] WhatsApp Channel](https://cdn1.wapeek.io/whatsapp/2025/02/27/12/thousands-core-us1000-dollar-coreus-cover_63e7cda40cb087184b8acd73929db8f6.webp)