Taxtip

1.4K subscribers

About Taxtip

Welcome to Taxtip – Your trusted partner for professional tax consultancy, tax preparation, record-keeping, and accounting solutions. We also offer comprehensive accounting and taxation courses to help you grow your skills and career. Join us: 📺 YouTube Channel: www.youtube.com/@Tax-Consultant 📲 WhatsApp Channel: https://whatsapp.com/channel/0029VaD0QyRICVfkhMIVIB3i 👥 WhatsApp Group: https://chat.whatsapp.com/KZULxLhIhTo8LJHBSeqpMk Contact Hafiz Muhammad Kashif – Tax Consultant & Trainer 📞 WhatsApp: wa.me/+923417763776

Similar Channels

Swipe to see more

Posts

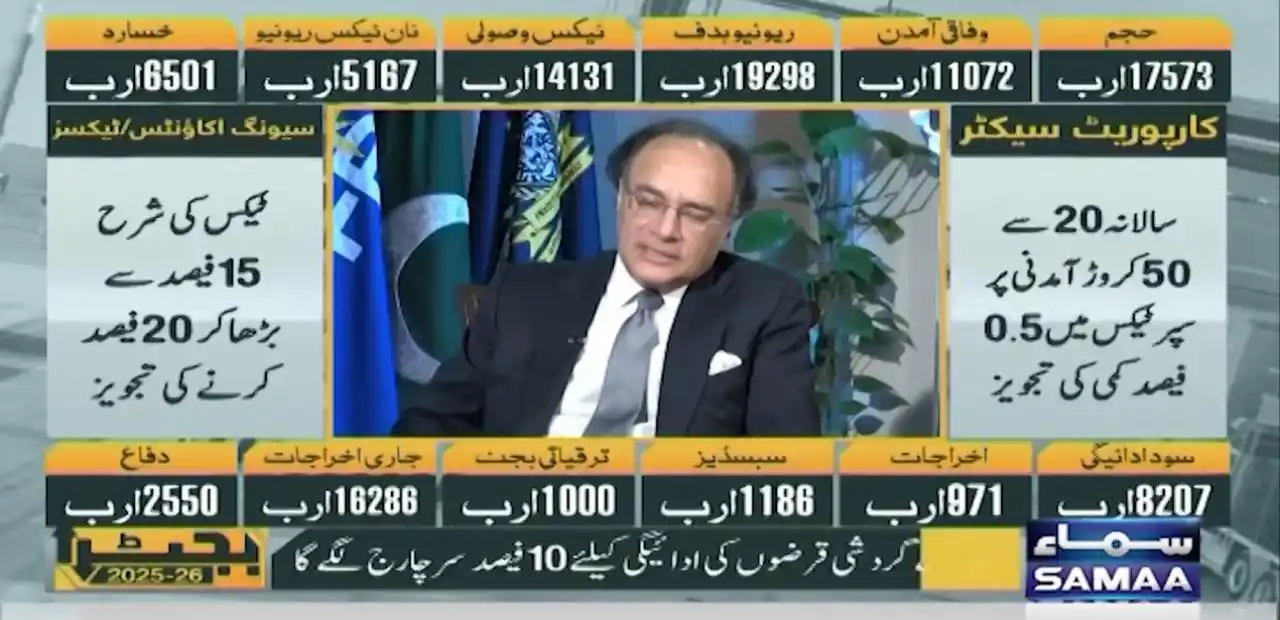

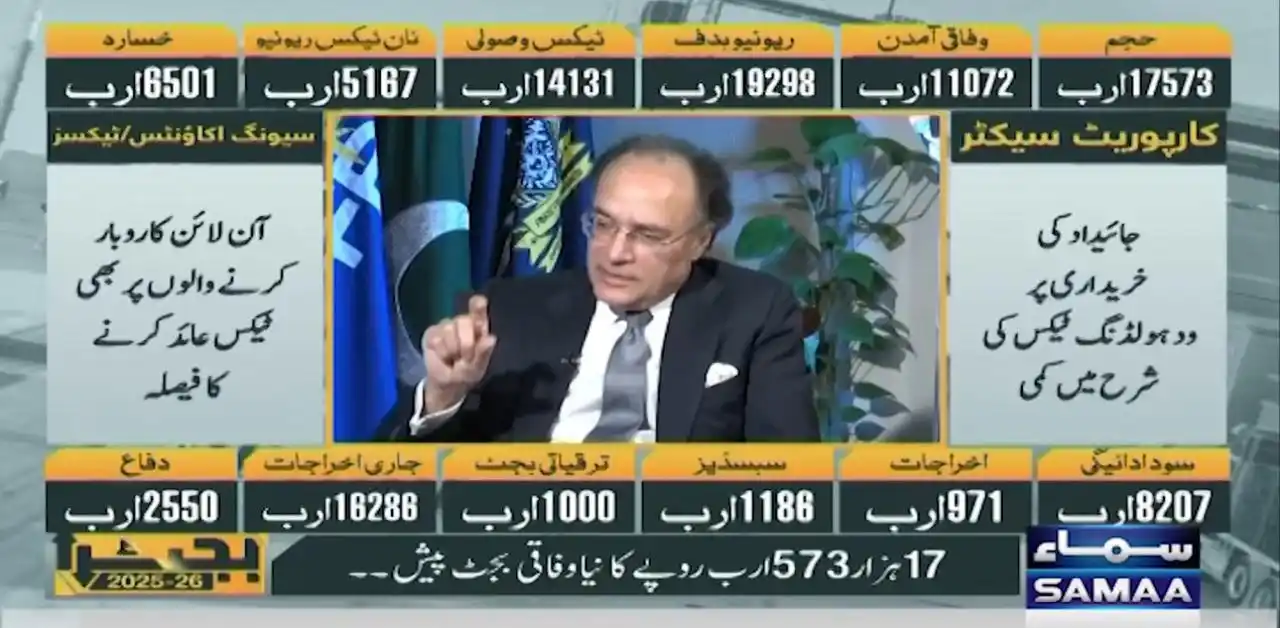

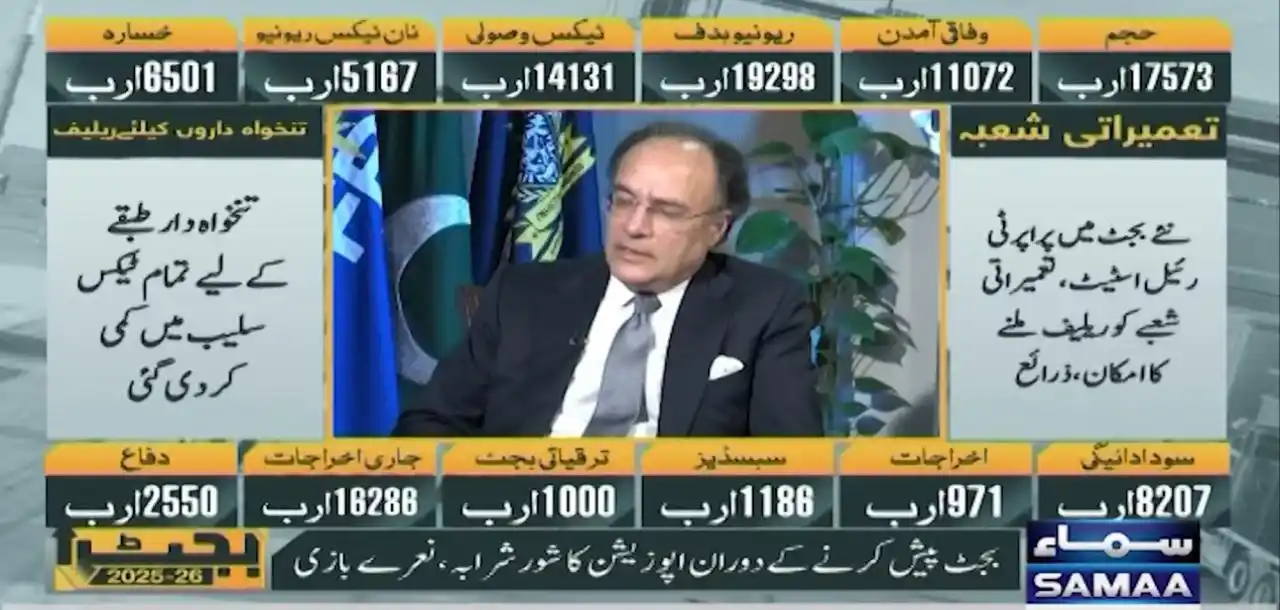

*بجٹ 2025-26 میں سرکاری ملازمین* ماہانہ 83 ہزار تک تنخواہ لینے والوں کو ٹیکس فری کرنے کی تجویز 1 لاکھ تک تنخواہ لینے والوں کے لیے ٹیکس میں 2.5 فیصد کمی کی تجویز 1 لاکھ 83 ہزار روپے تنخواہ پر انکم ٹیکس 15 فیصد سے کم کرکے 12.5 فیصد کرنے کی تجویز 2 لاکھ 67 ہزار ماہانہ تنخواہ پر انکم ٹیکس 25 فیصد سے کم ہو کر 22.5 فیصد کرنے کی تجویز 3 لاکھ 33 ہزار ماہانہ تنخواہ پر ٹیکس 30 فیصد کم کر کے 27.5 فیصد کرنے کی تجویز 3 لاکھ سے 33 ہزار سے زائد تنخواہ پر ٹیکس کی شرح 32.5 فیصد مقرر کرنے کی تجویز

Bonding check karain Mashallah jora haj karnay aya h dono wheel chair use kartay hain