NTARE Spirit

32 subscribers

About NTARE Spirit

You're the best version of yourself.

Similar Channels

Swipe to see more

Posts

#NotrePainQuotidien Conduis-moi dans ta vérité, et instruis-moi; Car tu es le Dieu de mon salut, Tu es toujours mon espérance.

Set of Practical health tips to help prevent age-related diseases as you turn 40: 1. Get Regular Screenings Blood pressure (hypertension) Cholesterol levels Blood sugar (diabetes) Cancer screenings: breast, prostate, colon, skin, cervical (as appropriate) Eye and hearing exams Bone density scan (especially for women) 2. Adopt a Balanced Diet Prioritize vegetables, fruits, whole grains, lean proteins, and healthy fats. Limit sugar, salt, and processed foods. Ensure calcium and vitamin D intake for bone health. 3. Exercise Regularly Aim for 150 minutes/week of moderate aerobic activity. Include strength training 2–3 times per week. Incorporate stretching or yoga for flexibility and joint health. 4. Maintain a Healthy Weight Obesity increases the risk of heart disease, diabetes, and joint issues. Keep track of your BMI and waist circumference. 5. Sleep Well Get 7–9 hours of quality sleep per night. Treat sleep apnea, insomnia, or snoring early. 6. Manage Stress Use techniques like meditation, mindfulness, deep breathing, or counseling. Chronic stress is linked to heart disease, depression, and immune dysfunction. 7. Avoid Tobacco and Limit Alcohol Quit smoking completely. Limit alcohol to 1 drink/day for women, 2 for men (or less). 8. Protect Your Mental Health Stay socially connected. Keep your brain active through reading, learning new skills, or puzzles. Watch for signs of depression or anxiety. 9. Stay Hydrated Drink plenty of water daily. Limit caffeine and sugary beverages. 10. Vaccinations Stay up to date on vaccines, including: Influenza Tetanus booster Shingles and pneumococcal vaccines (after 50, or earlier if at risk)

"The 1994 Genocide Against the Tutsi in Rwanda: Key Consequences" We remember. Slide 2: Loss of Human Life Over 1 million people were killed in 100 days Families and entire communities destroyed Slide 3: Psychological Trauma PTSD, depression, and anxiety among survivors Thousands of orphans deeply traumatized Slide 4: Breakdown of Social Fabric Community trust shattered Deepened ethnic divisions Slide 5: Displacement and Refugee Crisis Millions internally and externally displaced Refugees fled to DRC, Uganda, Tanzania, Burundi Slide 6: Collapse of Institutions Government and justice systems collapsed Loss of professionals across sectors Slide 7: Economic Destruction Infrastructure ruined, agriculture and trade halted Poverty and GDP decline Slide 8: Health Crises Disease outbreaks in refugee camps Untreated injuries and consequences of sexual violence Slide 9: Widespread Sexual Violence Tens of thousands of women raped HIV/AIDS spread, stigma, long-term health impacts Slide 10: Justice and Reconciliation Justice system overwhelmed Gacaca courts and ICTR established Slide 11: Long-Term Rebuilding Focus on unity, reconciliation, education, and poverty reduction Fight against genocide ideology continues. Brief Summary 2: The 1994 Genocide against the Tutsi in Rwanda resulted in over one million deaths and left deep psychological, social, and economic scars. Communities were torn apart, institutions collapsed, and millions were displaced. Survivors endured trauma, disease, and widespread sexual violence. The justice system struggled under the weight of crimes, prompting innovative solutions like Gacaca courts. Despite these challenges, Rwanda has made significant strides in reconciliation, rebuilding infrastructure, reforming education, and promoting a unified national identity. End.

Don’t let social media trick you. The people showing off the most are often the ones with the least. Real wealth is quiet. Real peace is invisible.

Global Decline in Birth Rates: 1950-2024 1. 🇰🇷 South Korea: 88% 2. 🇨🇳 China: 83% 3. 🇹🇭 Thailand: 81% 4. 🇯🇵 Japan: 80% 5. 🇮🇷 Iran: 75% 6. 🇧🇷 Brazil: 74% 7. 🇨🇴 Colombia: 72% 8. 🇲🇽 Mexico: 72% 9. 🇵🇱 Poland: 71% 10. 🇹🇷 Turkey: 70% 11. 🇷🇺 Russia: 69% 12. 🇸🇦 Saudi Arabia: 69% 13. 🇲🇾 Malaysia: 68% 14. 🇲🇦 Morocco: 67% 15. 🇺🇦 Ukraine: 67% 16. 🇵🇹 Portugal: 66% 17. 🇮🇹 Italy: 66% 18. 🇨🇦 Canada: 65% 19. 🇮🇳 India: 65% 20. 🇵🇪 Peru: 65% 21. 🇧🇩 Bangladesh: 64% 22. 🇲🇲 Myanmar: 63% 23. 🇪🇸 Spain: 63% 24. 🇻🇳 Vietnam: 62% 25. 🇮🇩 Indonesia: 61% 26. 🇩🇿 Algeria: 60% 27. 🇪🇬 Egypt: 59% 28. 🇳🇵 Nepal: 59% 29. 🇵🇭 Philippines: 58% 30. 🇻🇪 Venezuela: 57% 31. 🇿🇦 South Africa: 54% 32. 🇺🇸 United States: 54% 33. 🇦🇺 Australia: 53% 34. 🇫🇮 Finland: 52% 35. 🇸🇪 Sweden: 51% 36. 🇫🇷 France: 51% 37. 🇳🇱 Netherlands: 50% 38. 🇮🇸 Iceland: 50% 39. 🇦🇷 Argentina: 49% 40. 🇳🇴 Norway: 49% 41. 🇳🇿 New Zealand: 48% 42. 🇩🇰 Denmark: 48% 43. 🇧🇪 Belgium: 47% 44. 🇦🇹 Austria: 46% 45. 🇰🇪 Kenya: 46% 46. 🇩🇪 Germany: 45% 47. 🇨🇭 Switzerland: 45% 48. 🇱🇺 Luxembourg: 44% 49. 🇾🇪 Yemen: 44% 50. 🇮🇪 Ireland: 43% 51. 🇬🇭 Ghana: 43% 52. 🇺🇿 Uzbekistan: 42% 53. 🇮🇶 Iraq: 41% 54. 🇪🇪 Estonia: 41% 55. 🇬🇧 United Kingdom: 40% 56. 🇱🇻 Latvia: 40% 57. 🇱🇹 Lithuania: 39% 58. 🇨🇿 Czech Republic: 38% 59. 🇵🇰 Pakistan: 38% 60. 🇸🇰 Slovakia: 37% 61. 🇭🇺 Hungary: 36% 62. 🇸🇮 Slovenia: 35% 63. 🇭🇷 Croatia: 34% 64. 🇧🇦 Bosnia & Herzegovina: 33% 65. 🇷🇸 Serbia: 32% 66. 🇲🇪 Montenegro: 31% 67. 🇲🇰 North Macedonia: 30% 68. 🇦🇱 Albania: 29% 69. 🇧🇬 Bulgaria: 28% 70. 🇷🇴 Romania: 27% 71. 🇲🇩 Moldova: 26% 72. 🇬🇷 Greece: 25% 73. 🇨🇾 Cyprus: 24% 74. 🇮🇱 Israel: 23% 75. 🇯🇴 Jordan: 22% 76. 🇳🇬 Nigeria: 21% 77. 🇱🇧 Lebanon: 21% 78. 🇸🇾 Syria: 20% 79. 🇯🇲 Jamaica: 19% 80. 🇨🇩 DRC: 10% Source:United Nations Population Division (UNPD)

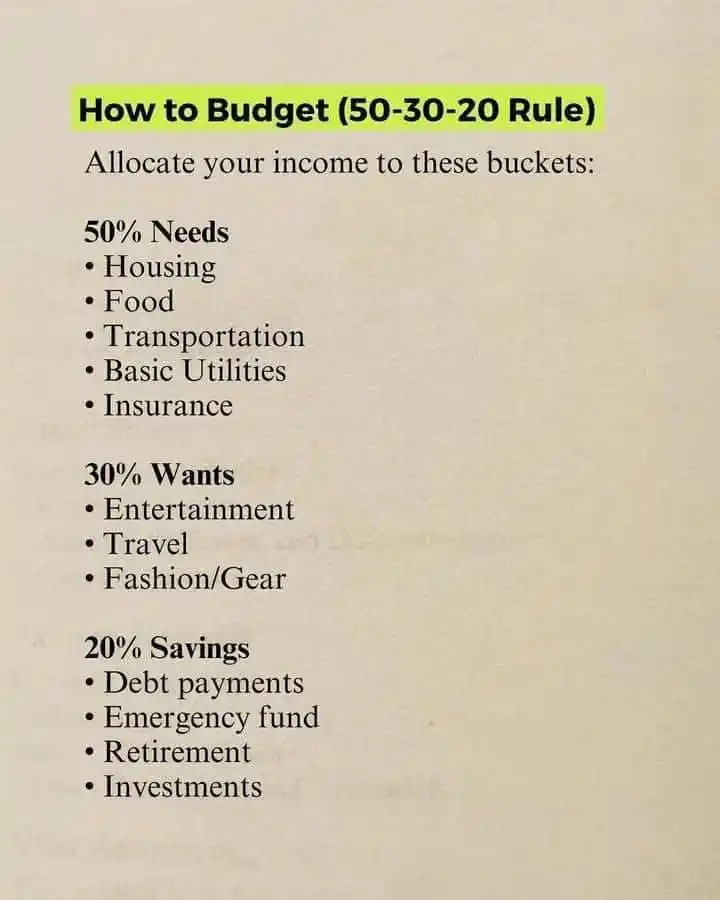

🪙 Here are some budget hacks to help you save money: 1. Track Your Expenses Keeping track of where your money is going is crucial to saving. Write down every purchase, no matter how small, in a notebook or use an app like Mint. 2. Create a Budget Plan Make a budget plan that accounts for all your necessary expenses, such as rent, utilities, and groceries. You can then identify areas where you can cut back. 3. Cut Back on Subscriptions Review your subscriptions, such as streaming services, gym memberships, and magazine subscriptions. Cancel any that you don't use regularly. 4. Cook at Home Eating out can be expensive. Cooking at home can save you around $5-10 per meal. Try meal planning and batch cooking to make the most of your groceries. 5. Avoid Impulse Buys Make a shopping list and stick to it. Avoid buying things on impulse, especially if they're not on sale. 6. Shop Secondhand Consider shopping at thrift stores, garage sales, or online marketplaces for secondhand items. You can often find great deals on gently used items. 7. Use Cashback Apps Use cashback apps like Ibotta, Fetch Rewards, or Rakuten to earn money back on your purchases. 8. Save Your Change Save your loose change in a jar or piggy bank. It may not seem like much, but it can add up over time. 9. Use the 50/30/20 Rule Allocate 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. 10. Avoid Fees Be mindful of fees associated with bank accounts, credit cards, and other services. Avoid them whenever possible to save money. 11. Shop During Sales Plan your shopping trips during sales periods, especially for non-perishable items. Stock up on items you use regularly. 12. Use Energy-Efficient Appliances Using energy-efficient appliances can help reduce your utility bills. Look for appliances with the ENERGY STAR label. 13. Cancel Credit Card Interest If you have credit card debt, consider consolidating it to a lower-interest card or balance transfer offer. 14. Use Public Transportation Using public transportation, walking, or biking can save you money on fuel, parking, and vehicle maintenance. 15. Save on Entertainment Look for free or low-cost entertainment options, such as hiking, game nights, or streaming movies instead of going to the theater. By implementing these budget hacks, you can save money and achieve your financial goals. 🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹 The 50-30-20 rule is a simple yet powerful budgeting framework that helps you allocate your after-tax income across three main categories: Needs (50%), Wants (30%), and Savings/Debt Repayment (20%). Let's break this down in much greater detail with practical examples. Understanding Your After-Tax Income First, you need to calculate your monthly take-home pay (after taxes and deductions). For example: If your gross salary is $5,000/month After 20% in taxes and deductions ($1,000) Your take-home pay is $4,000 This $4,000 would then be divided according to the 50-30-20 rule. 50% for Needs ($2,000 in our example) Needs are expenses you must pay to live and function in society. These are non-negotiable essentials: Housing (30-35% of Needs) Rent or mortgage payments Property taxes Homeowners/Renters insurance Basic maintenance Example: $1,000/month for rent (25% of take-home pay) Food (15-20% of Needs) Groceries Basic household supplies Example: $400/month for groceries and household items Transportation (10-15% of Needs) Car payments (if necessary for work) Gas Public transit costs Basic maintenance/repairs Example: $300/month for car payment, gas, and insurance Utilities (10% of Needs) Electricity Water Gas Internet (basic plan) Cell phone (basic plan) Example: $200/month for all utilities Insurance (5-10% of Needs) Health insurance Auto insurance Disability insurance Example: $100/month for health insurance premiums Total Needs: $2,000 (50% of $4,000 take-home pay) 30% for Wants ($1,200 in our example) Wants are discretionary expenses that enhance your lifestyle but aren't essential for survival: Entertainment (25% of Wants) Streaming services Dining out Movies/concerts Hobbies Example: $300/month (Netflix $15, dining out $200, hobbies $85) Travel (20% of Wants) Weekend getaways Vacation savings Example: $240/month set aside for annual vacation fund Fashion/Gear (15% of Wants) Clothing beyond basics Electronics Home decor Example: $180/month for occasional clothing purchases Personal Care (10% of Wants) Salon visits Spa treatments Gym memberships Example: $120/month for gym and occasional haircuts Other Luxuries (30% of Wants) Premium groceries Upgraded tech Gifts Charity Example: $360/month flexible spending Total Wants: $1,200 (30% of take-home pay) 20% for Savings/Debt Repayment ($800 in our example) This category builds your financial security: Debt Payments (40% of Savings) Credit card debt Student loans Personal loans Example: $320/month extra on student loans beyond minimums Emergency Fund (30% of Savings) Savings account for unexpected expenses Example: $240/month until reaching 3-6 months of expenses Retirement (20% of Savings) 401(k) beyond any employer match IRA contributions Example: $160/month into Roth IRA Investments (10% of Savings) Brokerage accounts Other investments Example: $80/month into index funds Total Savings: $800 (20% of take-home pay) Adjusting the Percentages While 50-30-20 is a good starting point, you may need to adjust based on: High cost-of-living areas: May require 60% to Needs Aggressive debt payoff: Might do 50-20-30 temporarily High earners: Could save more than 20% Tracking Your Budget Use tools like: Budgeting apps (Mint, YNAB) Spreadsheets The envelope system (cash for categories) Remember, the key is consistency. Even if you don't hit perfect percentages every month, using this framework will help you maintain balance between living today and securing your financial future. 🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹 HOW TO MAKE AND SAVE MONEY Financial Discipline: Key Principles for Stability and Growth Financial discipline is the ability to manage money wisely by controlling spending, saving consistently, and making informed financial decisions. It plays a crucial role in achieving long-term financial stability and independence. 1. Budgeting and Planning Create a monthly budget to track income and expenses. Prioritize needs over wants to avoid unnecessary spending. Set financial goals (short-term and long-term) to guide decisions. 2. Controlling Expenses Avoid impulsive buying by following a spending plan. Differentiate between essential expenses (food, rent, utilities) and luxuries. Use the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings/investments. 3. Saving Consistently Follow the pay-yourself-first rule by saving before spending. Maintain an emergency fund (3–6 months' expenses) for unexpected situations. Use automatic transfers to savings accounts for consistency. 4. Managing Debt Wisely Avoid unnecessary debt and prioritize paying off high-interest loans first. Use credit cards responsibly, paying off balances in full each month. Consider the debt snowball or avalanche method to clear debts effectively. 5. Smart Investments Invest in assets that grow over time (stocks, mutual funds, real estate). Diversify investments to reduce financial risk. Understand the power of compound interest and start investing early. 6. Avoiding Financial Traps Steer clear of get-rich-quick schemes and risky investments. Beware of lifestyle inflation—increasing expenses as income grows. Be mindful of peer pressure spending and focus on personal financial goals. 7. Continuous Learning and Adaptation Educate yourself about personal finance, investments, and money management. Adjust financial strategies based on life changes and economic conditions. Seek professional advice when making major financial decisions. Final Thought Financial discipline is a habit that leads to financial freedom. By making small, smart choices daily, you build wealth, reduce stress, and secure a stable future.