S&P Global Commodity Insights First Take

4.0K subscribers

About S&P Global Commodity Insights First Take

Fundamentals and price sentiment analysis on the impact of major events on physical oil markets delivered real time. Provision of this WhatsApp service is at the discretion of S&P Global Commodity Insights and access can be amended or rescinded at any time.

Similar Channels

Swipe to see more

Posts

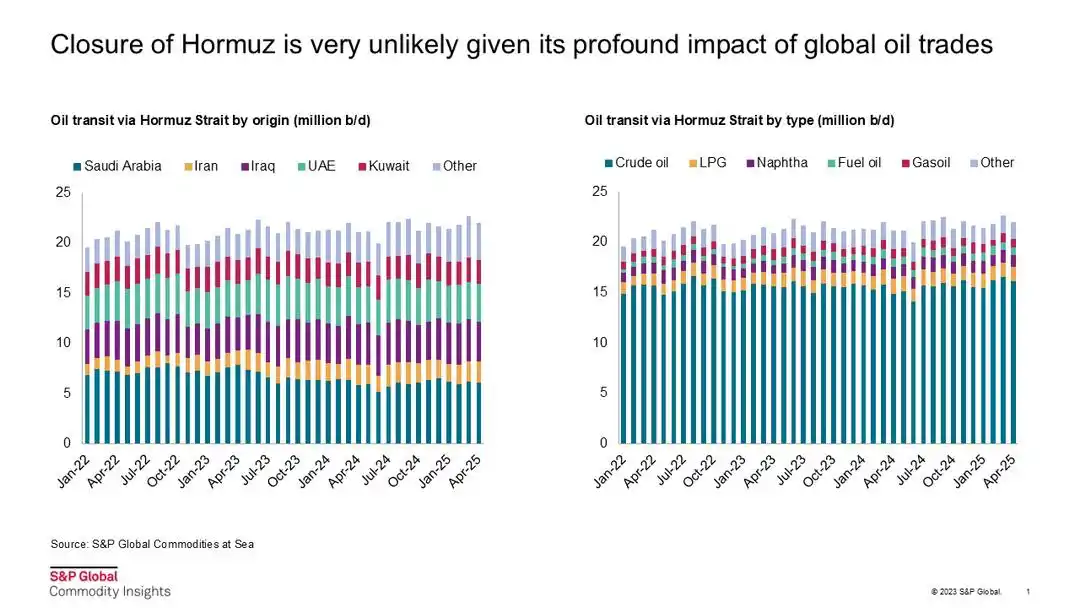

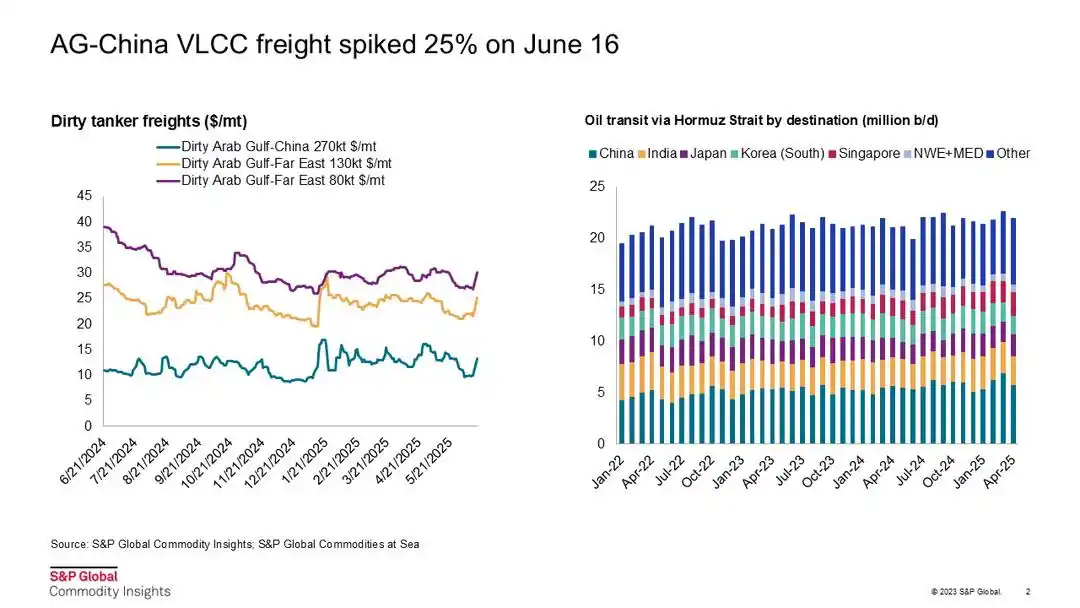

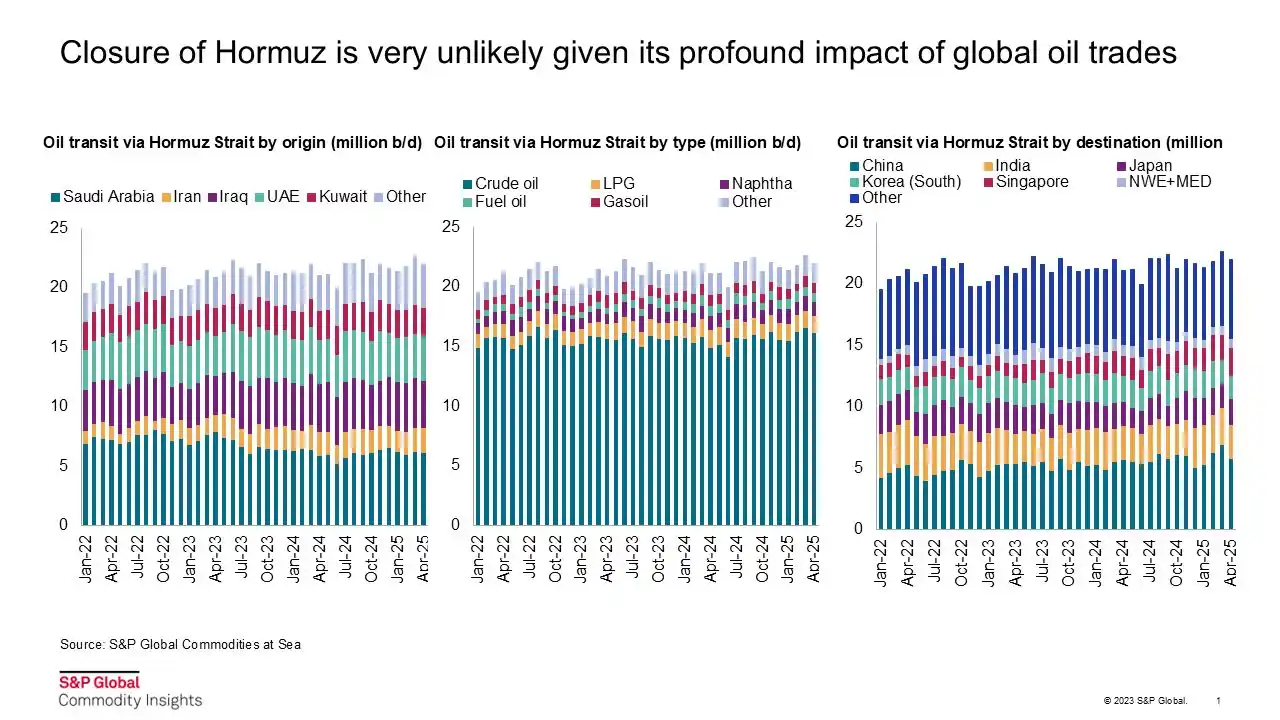

FIRST TAKE: Ship collision near Strait of Hormuz BULLISH for freight rates, NEUTRAL for oil and gas prices • Oil tanker incident near the UAE’s Khor Fakkan attributed to collision on ship signal jamming, unrelated to direct attacks • Dirty tanker freight rates surge as owners reluctant to navigate through Strait of Hormuz • Closure of strait highly improbable, though fewer tonnage may raise logistical costs The VLCC Front Eagle and Aframax tanker Adalynn have collided offshore Khor Fakkan in the UAE. We think this is NEUTRAL for oil and gas prices, as it is not associated with the direct attacks from Iran, but BULLISH for freight rates due to heightened risk premiums, as the collision is partly due to a jump in shipping signal jamming since June 13. Platts, part of S&P Global Commodity Insights, assessed the benchmark Persian Gulf-China route at w60 on June 16, marking a sharp w12 point gain, or a 25% increase from June 13. Shipowners are keeping their options open and reviewing the situation on a day-to-day basis. Asian crude oil buyers have started to seek dirty tankers available for early-July loading cycle this week. Tightened shipping tonnages will increase logistical costs and press refining margins. The likelihood of a closure of the Strait of Hormuz is low, with outbound crude flows averaging 14.7 million b/d and outbound refined products and chemicals exports, excluding LPG and other gas commodities, averaging 4.1 million b/d during the first five months of this year, according to S&P Global Commodities at Sea data. Asian LNG markets have been supported by the Israel-Iran conflict and Platts assessed the August JKM at $13.901/MMBtu on June 16, its highest since February. Gas markets are monitoring the conflict as Asia has the highest exposure to LNG exports from the Middle East, accounting for 87%-88% of LNG exports from the region. Asian importers and shipowners have said they have backup plans in case the Hormuz chokepoint is affected. Zhuwei Wang, Eric Yep Read on Platts Connect: https://tinyurl.com/mr4hxtsp

FIRST TAKE: EU draft legislation banning Russian gas NEUTRAL for TTF, NWE, JKM *The European Commission proposes legislation banning imports of Russian gas and LNG *Draft to ban Russian gas imports from 2028; earlier ban on short-term pipeline purchases was softened *The legislative language could be amended as the process continues into summer and early autumn The publication by the European Commission of draft legislation, following on the Road Map communication of May 6, contains no major surprises. The basic thrust remains the same, with all Russian gas imports into the EU – including LNG – banned from the start of 2028, and spot or short-term sales banned earlier. The draft language should be considered NEUTRAL for prices, but did trigger a quick 3% spike (mostly given up by close) on the ICE TTF month-ahead market. The text may have seemed bullish to any market participants who were sceptical that the EC would stick to its Road Map goal of an early phaseout of spot imports of Russian LNG. If the legislation is adopted, we estimate that as much as 6 MMTPA (8.2 Bcma) of Yamal LNG – about 7 cargoes per month – will start being diverted to non-EU markets starting in January 2026 (or slightly later in case some short-term contracts are in place), and backfilled with alternative Atlantic Basin cargoes. Hungary's MVM and Slovakia's SPP will be allowed to continue imports on both existing long-term and short-term contracts through 2028, but they did not receive any exemption from the January 2028 full phaseout. They will continue to fight for some flexibility on this point – and may succeed. The legal basis for banning Russian gas imports without sanctions (which require unanimity) – and allowing importing companies to declare force majeure – is the EU-level competence on trade (specifically TFEU Article 207). This is certain to be challenged in court once final legislation is adopted later this year. Read in PlattsConnect: https://tinyurl.com/ye26pjjs

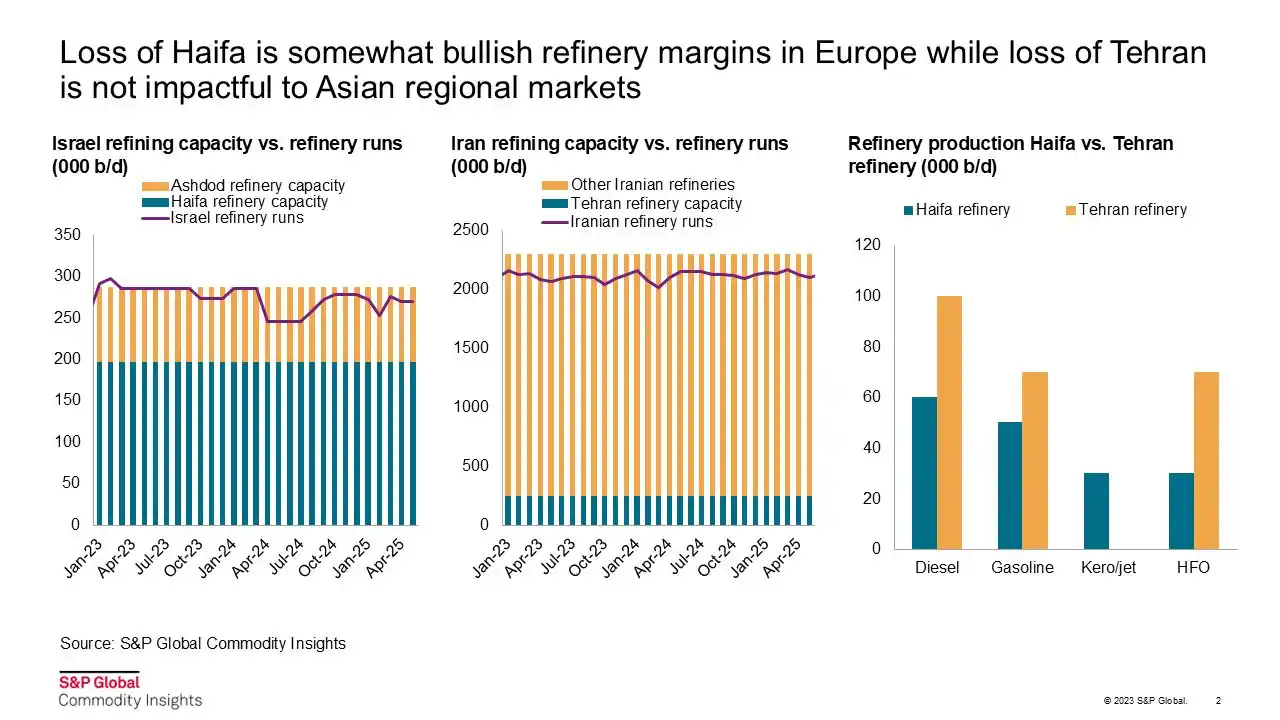

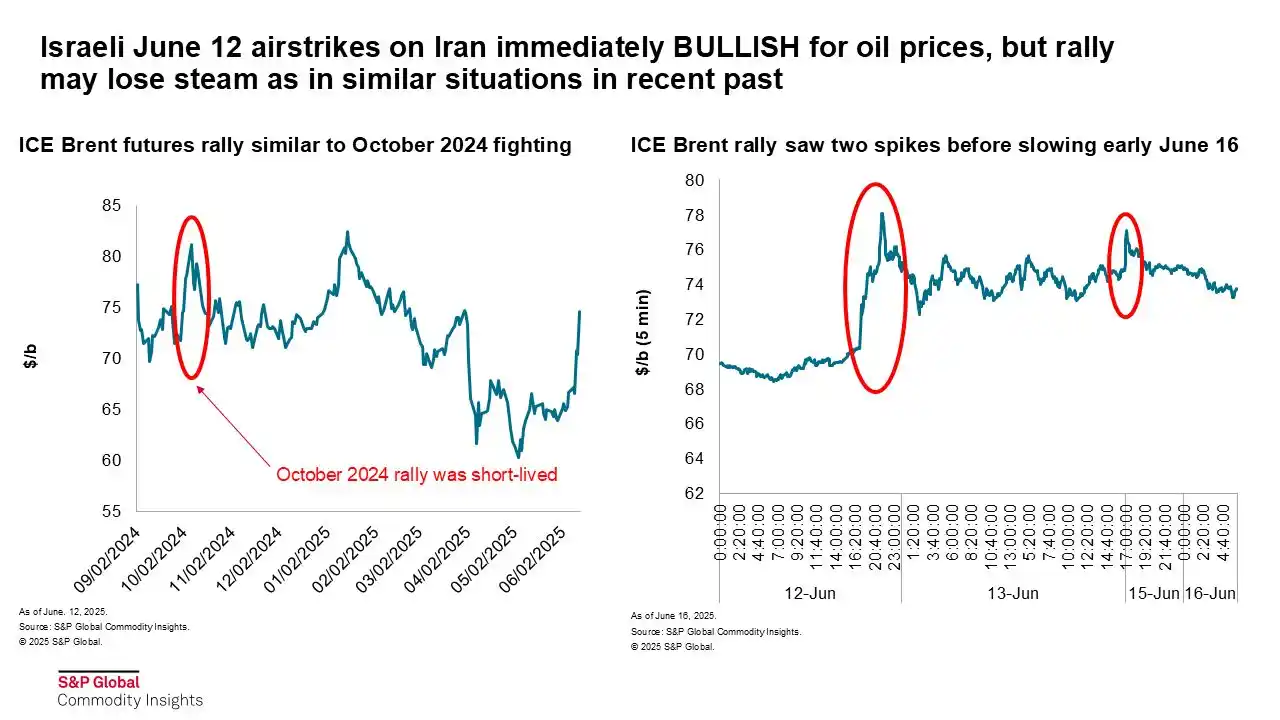

FIRST TAKE: Softening signals out of Iran BEARISH for near-term oil price sentiment

FIRST TAKE: Softening signals out of Iran BEARISH for near-term oil price sentiment * ICE Brent rally slows significantly; prompt contract down early June 16 * Fundamentals still bearish with expected crude build Q3-Q4 (split between stocks afloat, China and elsewhere). * Iranian oil export capacity remains mostly unaffected, with the possible exception of South Pars condensate (~75,000-80,000 b/d). Asian condensate differentials to Dated Brent down slightly June 16. News reports that Iran is signaling a desire to end the fighting with Israel early June 16 are BEARISH for near-term oil price sentiment. Prompt ICE Brent was trading almost $3/b lower, effectively erasing much of the market rally late last week. It is too soon to say for certain, however, as fighting has already moved beyond simple tit-for-tat measures. Iran has signaled it would like to reopen negotiations on its nuclear capabilities in a bid to halt Israel’s attacks and to keep the US from joining the conflict, and the oil market appears to be responding to this news. Israel has repeatedly said it would continue attacks until Iran’s nuclear capabilities are destroyed. So far, only limited damage to Iranian and Israeli oil infrastructure has been seen. Strikes near the Tehran and Haifa refineries do not appear to have damaged the process units. Larger risks to supply – a potential closure of the Strait of Hormuz, attacks on Iran’s Kharg Island export capacity, or wider Iranian attacks on neighboring Gulf infrastructure – remain very unlikely at this point. James Bambino, Richard Joswick, Zhuwei Wang Read on Platts Connect: https://tinyurl.com/4kbnwkbj

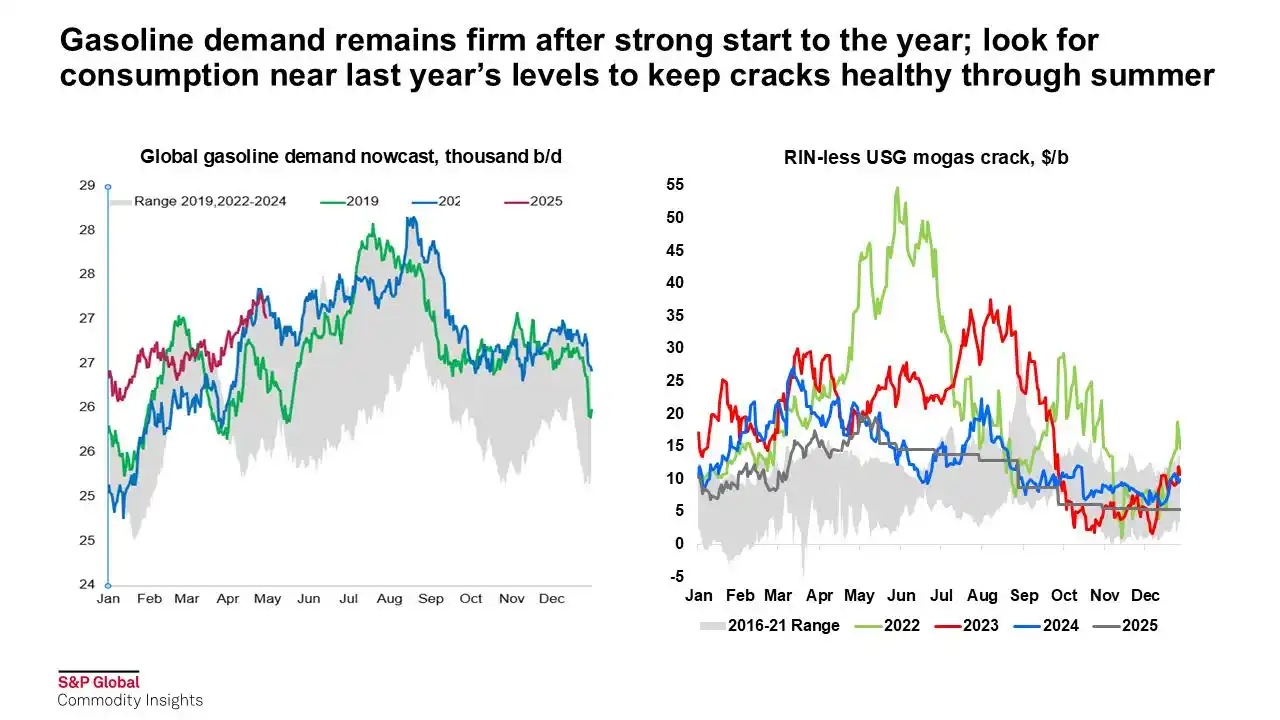

FIRST TAKE: Potential 50% US tariff on EU imports BEARISH for Dated Brent price * Trump expresses frustration over lack of negotiating progress with EU and calls for tariffs beginning June 1 * Carve-out for oil-related imports would be likely, but any tariff that included gasoline would be BULLISH for PADD 1 gasoline cracks * Demand outlook remains BEARISH amid tariff uncertainty, but summer gasoline demand will broadly support gasoline cracks US President Donald Trump’s May 23 Truth Social post announcing a potential 50% tariff on US imports from the European Union starting June 1 is BEARISH for global oil demand and thus prices. However, markets have so far taken it in stride with prompt ICE Brent up around 17 cents at $64.61/b in mid-morning US trading. As with other recent tariff announcements, this should be seen as both a directional indication of policy intent and as a negotiating tactic. Given that the EU is the largest trading partner with the US, such a large tariff would probably be unsustainable. But some level of higher tariffs is likely. Although summer gasoline demand will be supportive for the summer, our oil demand outlook remains bearish amid the general macroeconomic uncertainty surrounding tariffs. The 90-day reprieve on tariffs on imports from China should expire around Aug. 11.Weak consumer confidence and downgrades to global GDP outlooks will only be partly offset by lower prices. James Bambino, Richard Joswick Read on Platts Connect: https://tinyurl.com/mr2mb53k